Table of Content

Improvements

Version 6.5.0 introduces a revised authentication method onboarding flow, Peppol invoice receiving support, Swift Messaging API connectivity, and expanded signature requirement coverage.

Authentication Method Onboarding Flow

To use LuxTrust or the LYNKS mobile app for authentication and signature, users will have to go through an onboarding process to confirm that they are legitimately using that account. We have now revised the onboarding process to better support the user.

When an administrator enables an authentication method, the user receives an email with instructions to onboard their account to the application, followed by a second email including a one-time password or a verification link. The authentication method only becomes active once the user enters the code or follows the link and completes the verification process.

Peppol Invoice Receiving

The platform now supports receiving electronic invoices through the Peppol network. Incoming invoices are routed using the configured Peppol identifiers and are made available through the API, LYNKSDrive, and SFTP.

This extends LYNKS invoicing capabilities to cover the full Peppol receive workflow, enabling organisations to accept standardised e-invoices from counterparties registered on the Peppol network without manual file handling in accordance with Directive 2014/55/EU of the European Parliament on e-invoicing.

Swift Messaging API Migration

Bank connectivity for SWIFT-connected banks has been upgraded to the Swift Messaging API from the legacy file-based system, improving communication with the SWIFT network and enabling both Interact and FinPlus services for direct, synchronous communication following ISO20022 standards.

This migration eliminates file parsing overhead and establishes a direct API connection for banks that support Swift Interact, improving reliability and reducing processing steps for payment submission and statement retrieval.

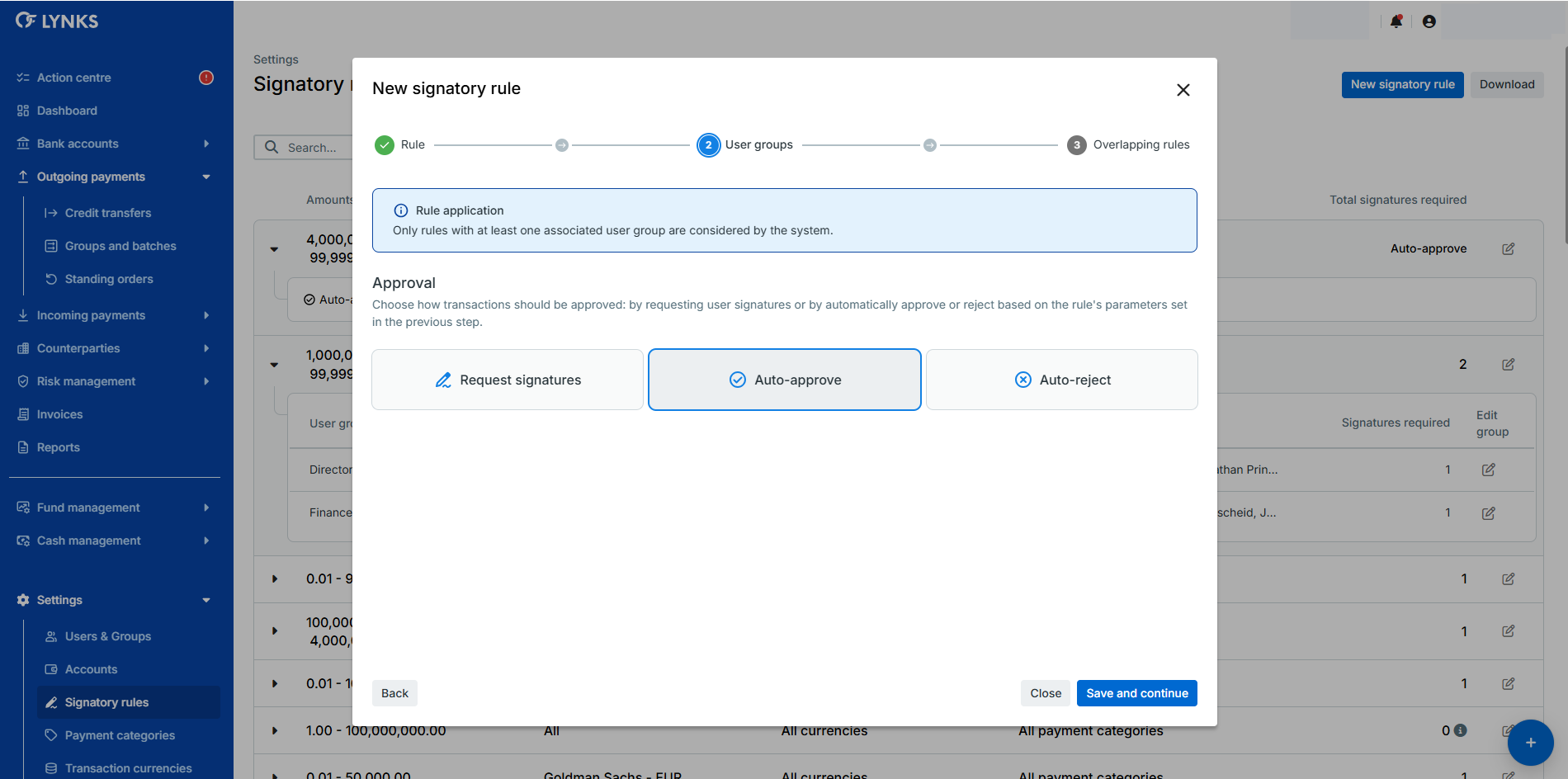

Default Signature Requirements

Signature requirements now apply by default to cover gaps in signatory rule configurations. Where no specific signatory rule is defined for a payment or operation, the platform enforces a default signature requirement to ensure authorisation controls remain in place.

This prevents scenarios where payments or operations could proceed without the appropriate number of signatures or be automatically rejected due to missing rule coverage, strengthening the overall authorisation framework across all payment types.