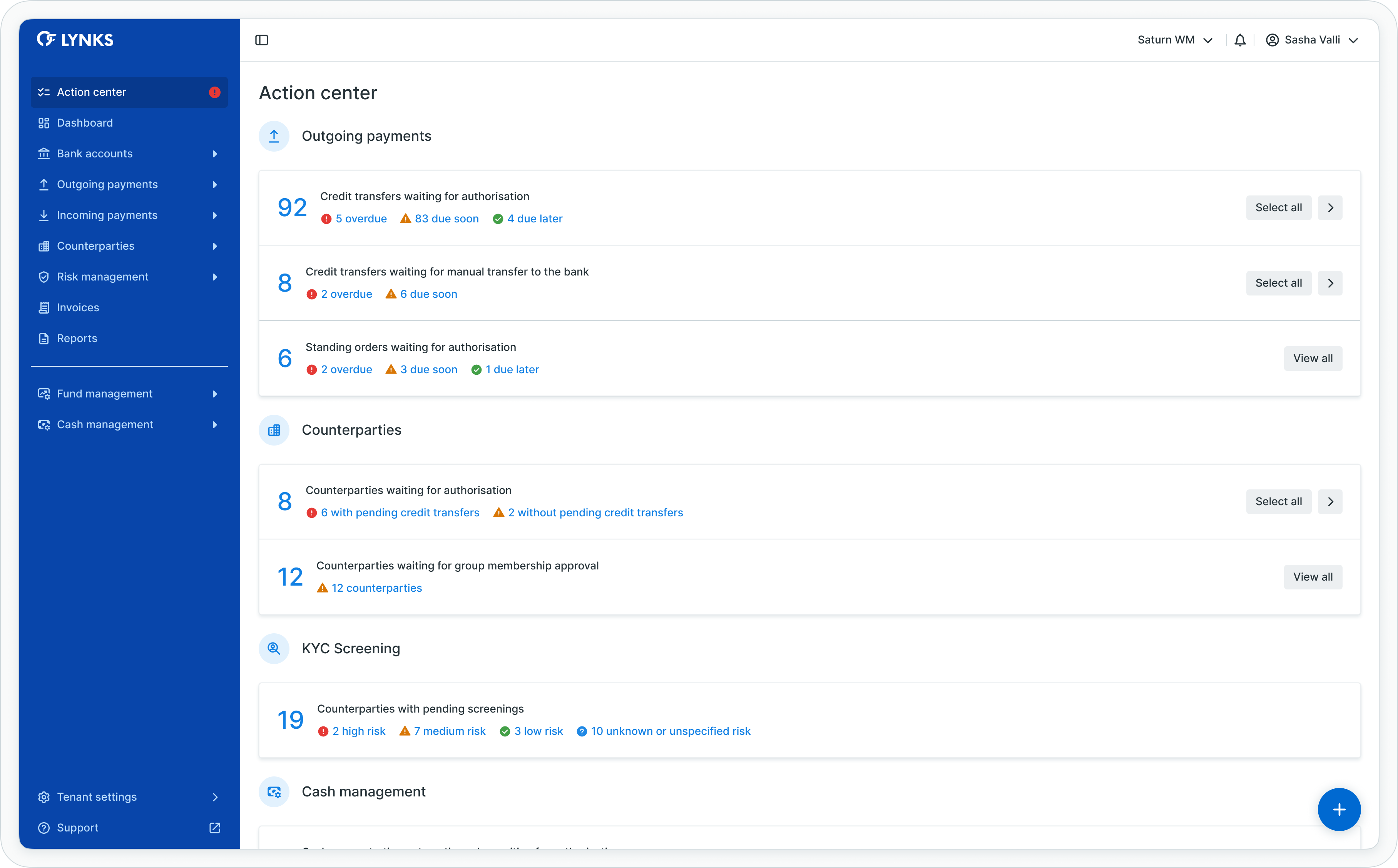

Action centre

The LYNKS Action centre consolidates all actions that require manual interaction from the user and forecast what actions will be required soon and later. Divided in specific sections, the interface displays pending actions to the user. By expanding the sections, the user can see more details on the objects that require his attention.

Selecting an object or a counter will result in a redirection to a pre-filtered table view page, where the user can see more details and choose to act on the objects.

Action centre

The identified actions are split into sections by type and inside into status (for action) & the urgency. The sections are divided into: Payments, Counterparties and KYC screenings.

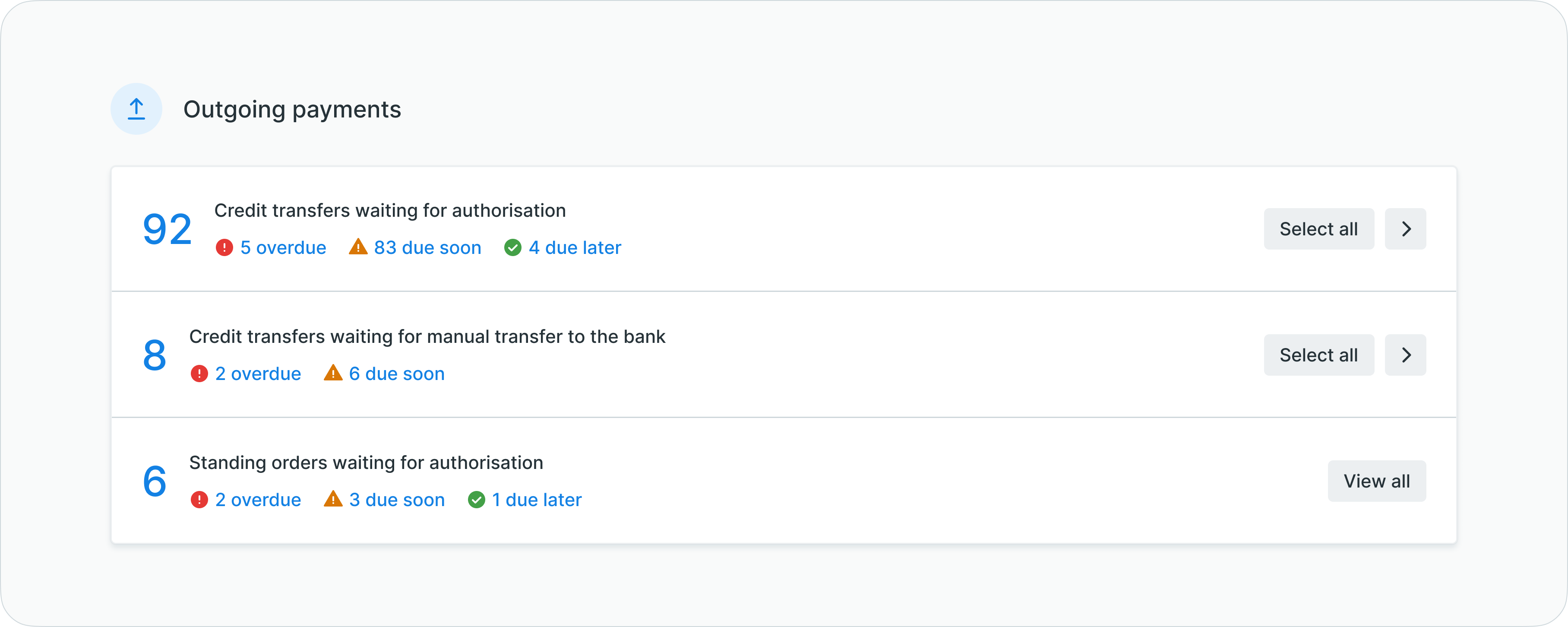

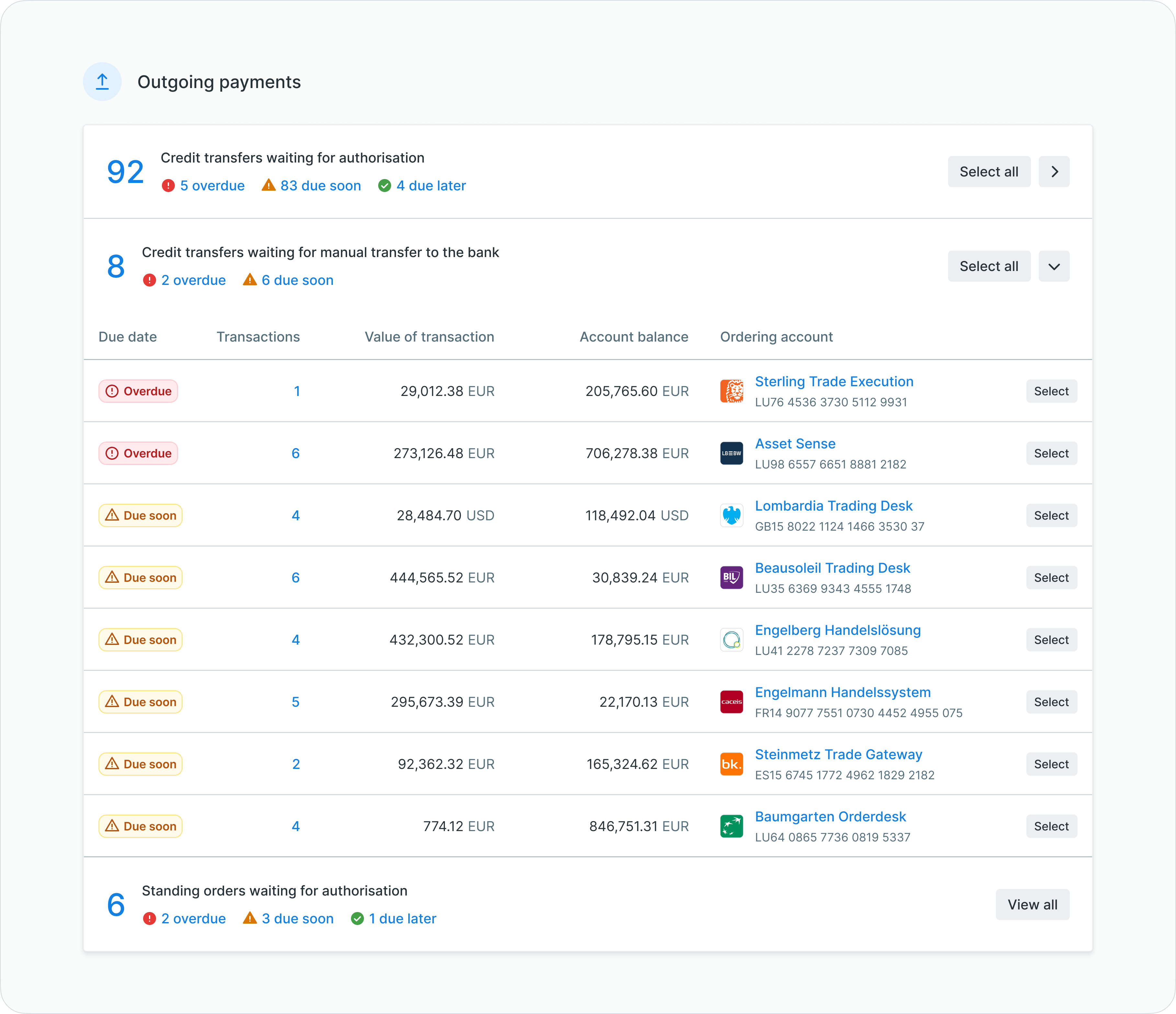

Payments

- Credit transfers waiting for authorisation

- Credit transfers waiting for manual transfer to the bank

- Standing orders waiting for authorisation

- Split into: urgency

- Overdue

Requested authorisation date = past - Due soon

Requested authorisation date from today to today + 7days - Due later

Requested authorisation date from today + 8days

- Overdue

Payment section

Payment section - expanded details

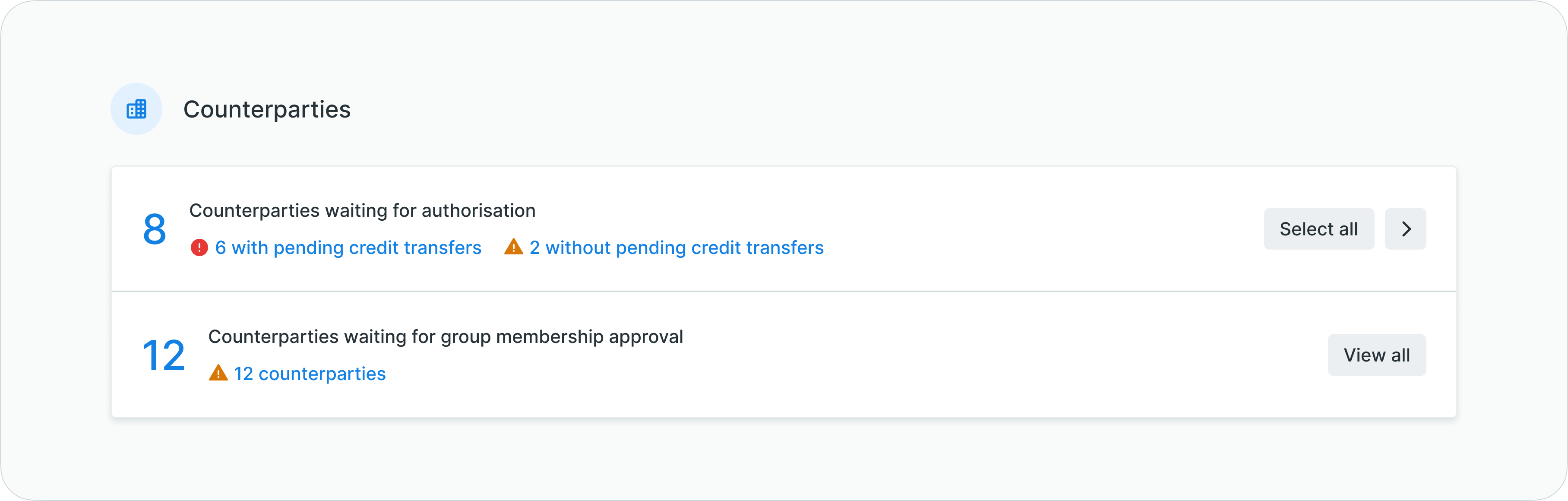

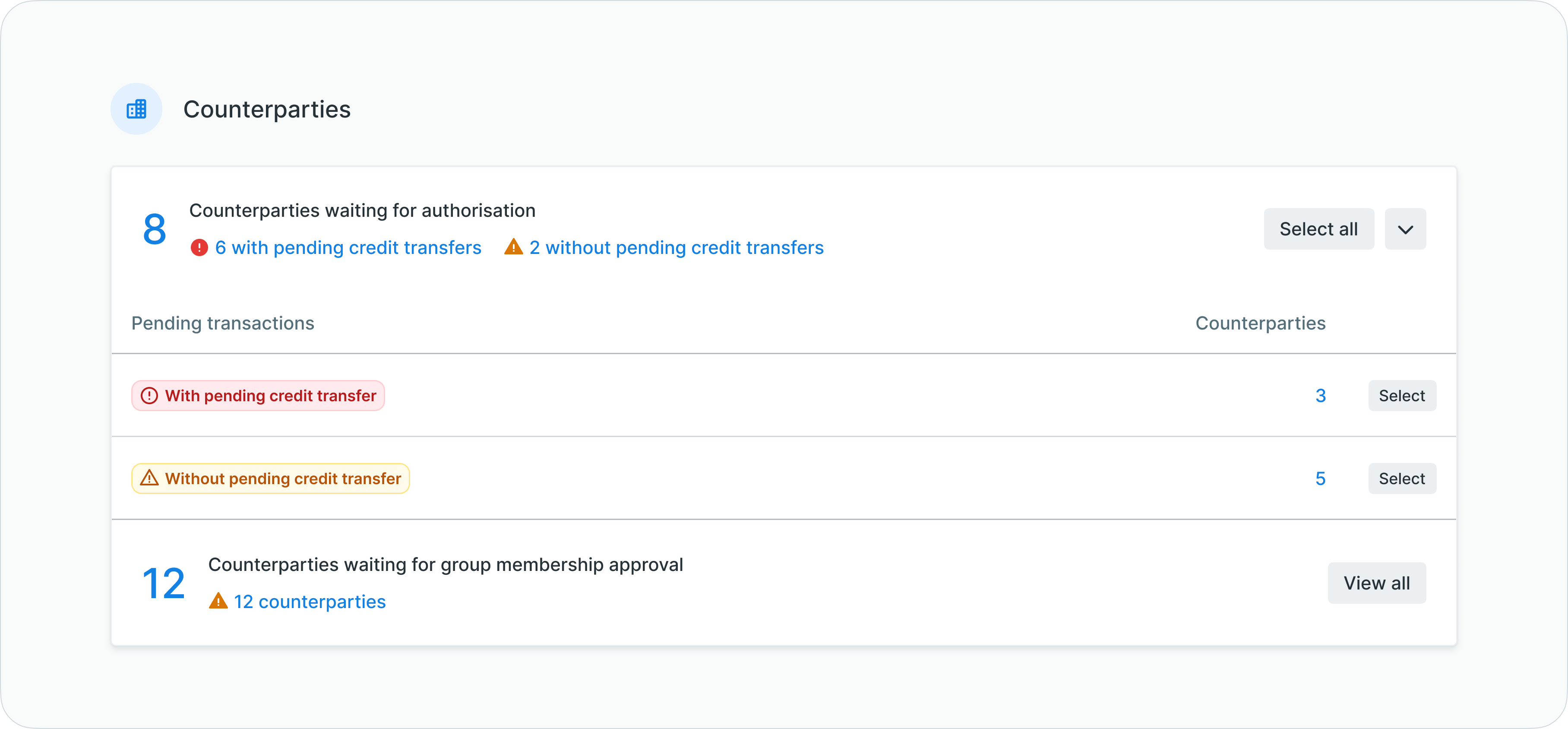

Counterparties

- Counterparties waiting for authorisation

- Split into:

- With pending credit transfers

Counterparty status PENDING, created by other user, pending payments =yes - Without pending credit transfers

Counterparty status PENDING, created by other user, pending payments =no

- With pending credit transfers

Counterparties section

Counterparties section - expanded details

KYC screenings

- Counterparties with pending screenings

- Split into: risk

- High risk

Screening status: pending review, Risk level: High - Medium risk

Screening status: pending review, Risk level: Medium - Low risk

Screening status: pending review, Risk level: Low - Unknown or unspecified risk

Screening status: pending review, Risk level: undefined & unknown

- High risk

KYC screenings section

Updated 5 months ago