KYC screenings

Screen counterparties against sanctions lists, PEP databases, and adverse media sources, classify results, and manage compliance cases

Introduction

The KYC Screenings feature enables users to conduct Know Your Customer (KYC) compliance checks by screening individuals and organizations against sanctions lists, politically exposed persons (PEP) databases, and adverse media sources. Within the Screenings section, users can check the status of their ongoing screening processes and manage compliance cases.

This functionality supports financial sector professionals in meeting their Anti-Money Laundering (AML) and Counter-Terrorist Financing (CFT) obligations. Users can perform screenings, save results as cases for ongoing management, classify hits, and link cases to counterparties for complete compliance tracking.

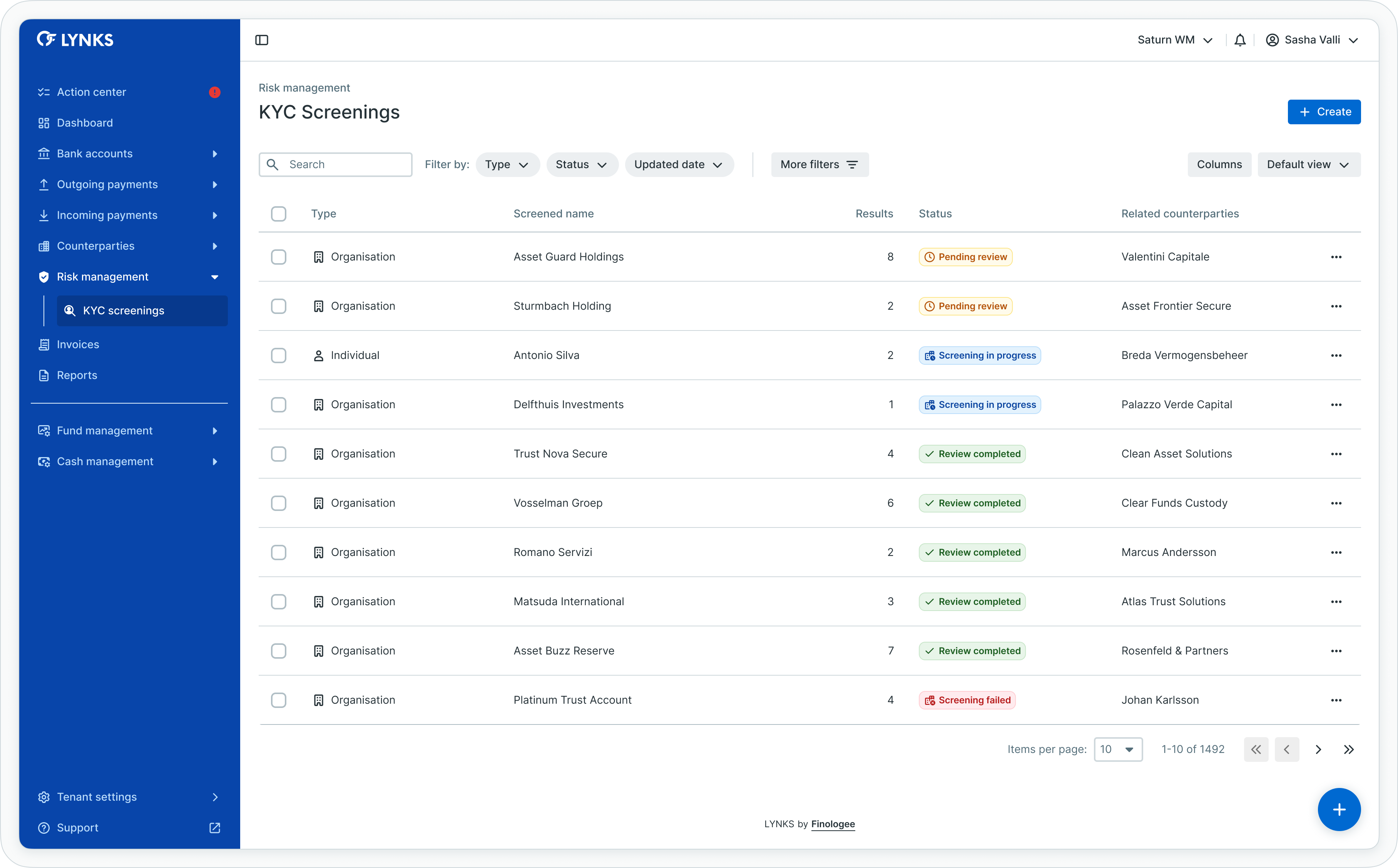

KYC screenings list

Prerequisites

Users must have the appropriate permissions to access KYC screening functionality. The KYC Screenings feature requires tenant-level feature flags to be enabled.

Permissions

| Permission | Description |

|---|---|

KYC_SCREENING_READ | View the list of KYC screenings and case details without the ability to resolve results |

KYC_SCREENING_WRITE | Conduct screenings, save cases, resolve hits, and access related parties during counterparty creation |

KYC_RISK_LOG_READ | View KYC risk details including comments, links, documents, and risk log history |

KYC_RISK_LOG_WRITE | Update risk levels for counterparties and provide supporting evidence |

COUNTERPARTY_ACCOUNT_READ | Required to access the counterparty filter on the KYC screening page |

Feature flags

Feature flag requiredKYC screening functionality requires the KYC_SCREENING tenant flag to be enabled. Additionally, KYC_RISK enables risk level management, and KYC_MONITORING enables automated ongoing monitoring. Contact [email protected] to enable these features for your tenant.

KYC screenings overview

The KYC Screenings section provides a centralized interface for managing all compliance screening activities. Users can view screening cases, access case details, and track the resolution status of screening results across the organization.

Key capabilities

KYC screenings in LYNKS support the following compliance workflows:

- Name screening against sanctions lists, PEP databases, and adverse media sources

- Case management for organizing and tracking screening results

- Hit classification to categorize results as positive, false-positive, or requiring further review

- Counterparty linking to associate screening cases with counterparty records

- Risk level assignment to define counterparty risk classifications

- Export functionality for compliance reporting and audit purposes

- Audit trail for complete traceability of all screening actions

Screenings list

The screenings list provides an overview of all screening cases. Users can see the name of the screened party, the number of results associated with that party, and the current status.

Information displayed

The screenings list includes:

- Screened party name

- Client type (Individual/Organisation)

- Number of screening results

- Case status

- Linked counterparty (if applicable)

- Creation date

- Last modified date

Creating a new screening

To start a new screening, click the New Screening button in the top right corner of the screen. This opens the screening creation form where users can enter the party details to screen.

Table functionality

The KYC screenings list supports standard table features for case management. For detailed information about table features, filtering, and view customization, see Platform Navigation - Detailed guide to the head-up display, table views, filters, and search functionality.

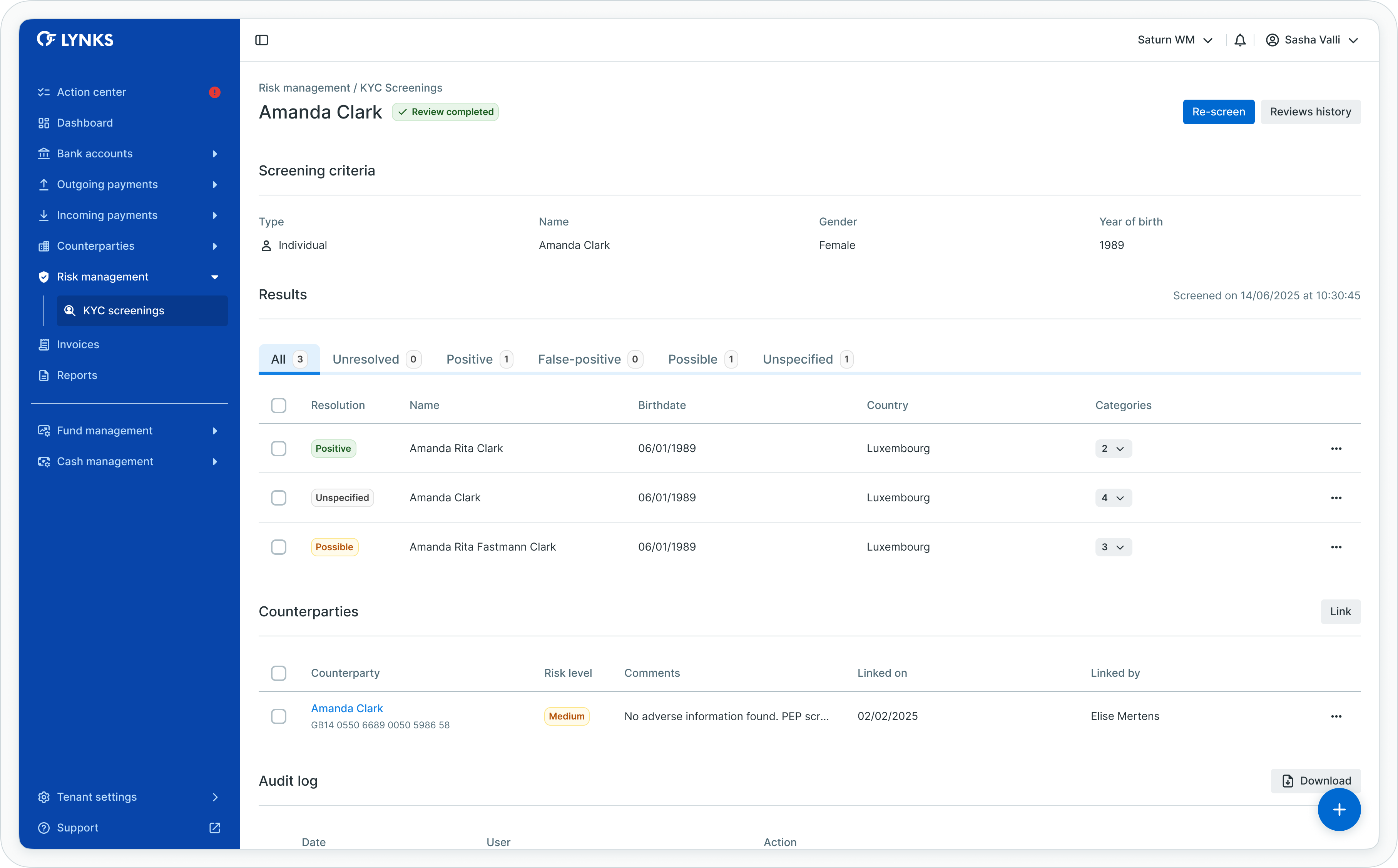

Screening details

Each screening has its own dedicated page where additional details are displayed and compliance officers can manage the results after a successful screening.

Screening details view

Screening summary

At the top of the details page, a summary displays the information entered when initiating the first screening for a party. This includes the screened name, client type, and any additional parameters submitted.

Results section

Below the summary, the results section displays either:

- No results found - When the screening returned no matches

- Results table - Displaying all matches from the screening provider

When results are found, they are initially stored in the Unresolved tab. The compliance department can then categorize these findings by marking them as Positive, False Positive, Possible, or leaving them as Unresolved.

Linked counterparties

Below the results section is an area where counterparties can be linked to the screening. A list of linked counterparties is displayed, enabling users to maintain the connection between screening cases and counterparty records.

Audit log

As with other LYNKS features, the last section of the details page features the audit log, which tracks and logs every action and change made by a user. This provides complete traceability for compliance and audit purposes.

Managing screening results

When a screening returns results, users must review and classify each hit to determine its relevance to the screened subject.

Classifying results

Users must classify each screening hit to indicate its relevance:

| Classification | Description | Use case |

|---|---|---|

| Positive | Confirmed match to the screened subject | The hit genuinely relates to the counterparty being screened |

| False positive | Not a match to the screened subject | Different person or entity with similar name |

| Possible | Requires further investigation | Insufficient information to determine match status |

| Unresolved | No classification applied yet | Default state before review |

To classify a result:

- Select the result from the results table

- Choose the appropriate classification action

- For positive hits, assign a risk level

- Optionally add comments or supporting documentation

- The result moves to the corresponding category tab

Risk level assignment

When classifying a hit as positive, users can assign a risk level that impacts the counterparty's ongoing monitoring frequency:

| Risk level | Description |

|---|---|

| High | Significant compliance concerns requiring enhanced due diligence |

| Medium | Moderate risk requiring standard monitoring |

| Low | Minimal risk with basic monitoring requirements |

Result details

By selecting a result, each one can be examined closer by reviewing its details. The result details panel provides comprehensive information about the match, enabling users to make informed classification decisions.

Screening result details

Result detail information

The result details include:

- Name - Full name as recorded in the screening database

- Client type - Individual or Organisation

- Category - Classification in screening database (sanctions, PEP, adverse media)

- Gender - For individual screenings

- Date of birth - For individual screenings

- Nationality - For individual screenings

- Country location - Associated countries

- Status - Current classification status

- Risk level - Assigned risk level for positive hits

Counterparty integration

KYC screenings integrate with counterparty management to support compliance workflows. According to the features enabled for the environment, risk assessment and KYC screenings can be managed from inside a counterparty details page.

Risk level display

Counterparty risk levels assigned through KYC screenings appear throughout LYNKS:

- Counterparty list - Risk level and screening columns

- Counterparty details - Risk assessment section with full history

- Payment creation - Risk level indicator for counterparties

Linking screenings to counterparties

From the screening details page, users can link counterparties to maintain the connection between compliance screening and counterparty records. This ensures complete documentation for regulatory requirements.

For detailed counterparty management information, see Counterparties - Investor and beneficiary management.

Ongoing counterparty monitoring

LYNKS supports automated ongoing monitoring of counterparties based on their assigned risk levels. This feature conducts regular screenings to ensure continued compliance throughout the business relationship.

Feature flag requiredOngoing monitoring requires the KYC_MONITORING tenant flag. For monitoring configuration options, see Counterparty Monitoring - Configure ongoing monitoring.

Automatic screening schedule

In the Counterparty Monitoring settings, administrators can define specific monitoring rules for each counterparty based on their risk level. This feature enables administrators to set customized parameters that determine the frequency of monitoring for each counterparty.

Each risk level can be configured to have monitoring recurrences, which results in scheduled automatic rescreening. By automating the screening process, counterparties are consistently evaluated and assessed in accordance with their assigned risk level.

For monitoring configuration details, see Counterparty Monitoring - Configure ongoing monitoring.

Status definitions

KYC screening cases and results progress through defined statuses reflecting their position in the compliance workflow.

Result classification statuses

| Status | Definition |

|---|---|

| Unresolved | Result not yet reviewed or classified |

| Positive | Confirmed match requiring compliance action |

| False positive | Not a match to the screened subject |

| Possible | Requires further investigation before classification |

Best practices

Follow these recommendations to maximize the effectiveness of KYC screening workflows:

- Screen before onboarding - Conduct screenings before establishing business relationships with new counterparties

- Document classifications - Add comments explaining the rationale for positive and false-positive classifications

- Review regularly - Monitor the Action Center for counterparties with pending screenings requiring attention

- Maintain risk levels - Update counterparty risk levels when new information becomes available

- Link all cases - Connect screening cases to counterparty records for complete compliance history

- Configure monitoring - Enable automated monitoring appropriate to your risk appetite and regulatory requirements

Related documentation

Explore related sections for more information:

- Platform Navigation - Detailed guide to the head-up display, table views, filters, and search functionality - Tables, filters, search, and view customization

- Permissions - Comprehensive explanation of access control and role-based permissions - Understanding KYC-related permissions

- Action Center - Centralized task and approval management - Pending KYC screenings and counterparty alerts

- Counterparties - Investor and beneficiary management - Counterparty management and risk levels

- Counterparty Monitoring - Configure ongoing monitoring - Configuring automated monitoring rules

- Compliance & Audit - Security features, audit trails, and regulatory compliance - Audit trails and compliance features

Support

For assistance with KYC screenings or questions about compliance features, contact [email protected].

Updated about 1 month ago