Reports

Generate and export transaction history, account statements, non-executed transactions, and account balances in multiple formats

Introduction

The LYNKS Reports feature enables users to generate and export financial data for analysis, reconciliation, and compliance purposes. Designed for accountants, auditors, and compliance teams, Reports provides flexible data extraction with customizable parameters and multiple output formats.

Users can generate four types of reports: transaction history covering all incoming and outgoing transactions, account statements in standardized banking formats, non-executed transactions for tracking failed or pending payments, and account balances for position monitoring. Each report type supports filtering by ordering party accounts and date ranges, with output options tailored to specific use cases.

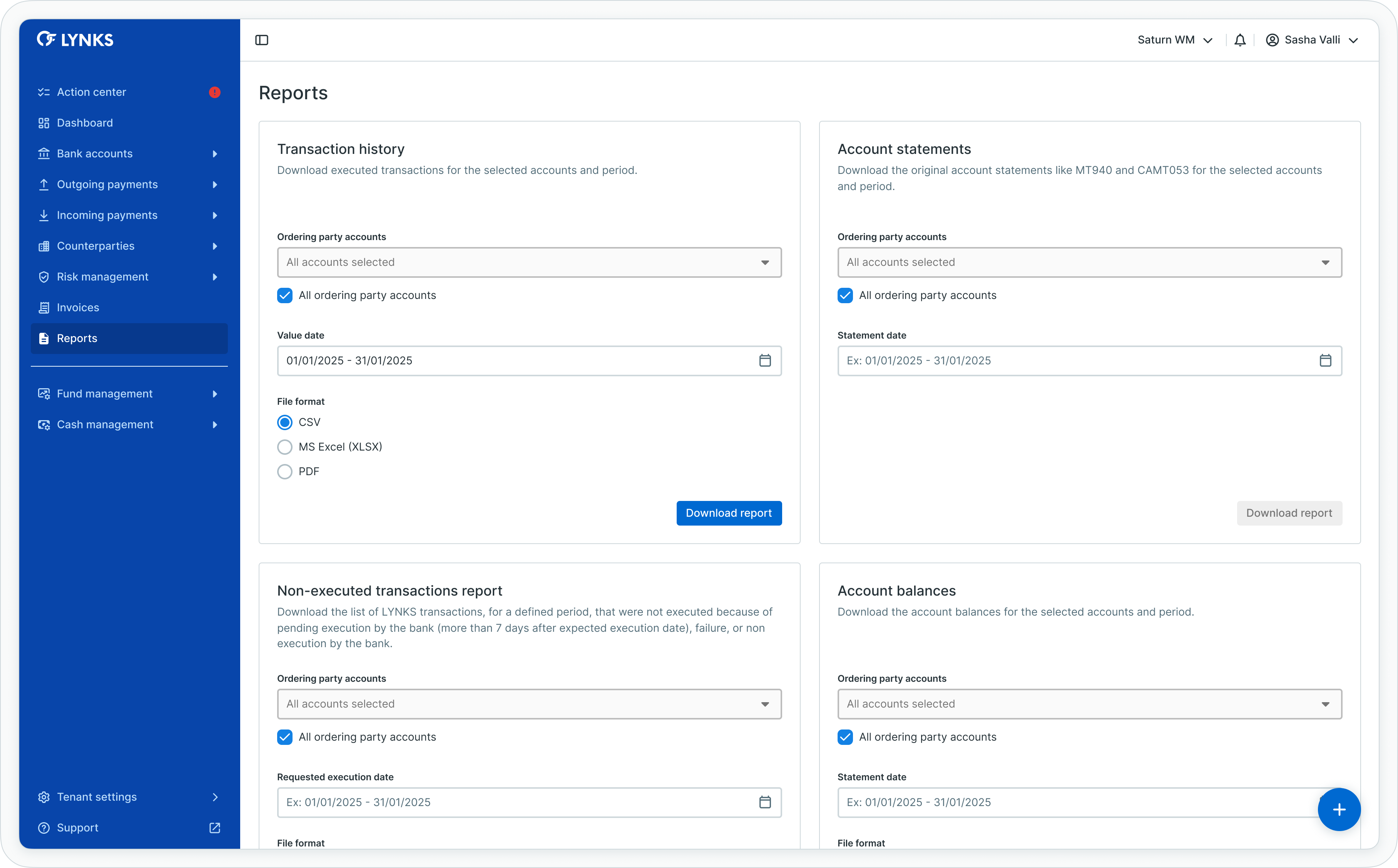

Reports interface

Prerequisites

Users must have the appropriate permissions to access the Reports feature and view data for specific accounts.

Permissions

| Permission | Description |

|---|---|

PAYMENT_REPORT_READ | Access the Reports section and generate reports |

ORDERING_PARTY_BALANCE_READ | View account balance data in reports |

ORDERING_PARTY_STATEMENT_READ | View transaction history and account statement reports |

PAYMENT_READ | View non-executed transaction reports |

Account scopingReports display only data for ordering party accounts that you have permission to access. If you cannot see expected accounts in the report filters, verify your account permissions with your administrator.

Reports overview

The Reports section provides a centralized interface for generating financial exports. All reports follow a consistent workflow: select the report type, configure parameters including accounts and date ranges, choose an output format, and generate the download.

Available report types

| Report type | Description | Output formats |

|---|---|---|

| Transaction history | All incoming and outgoing transactions known to LYNKS | CSV, Excel, PDF |

| Account statements | Bank statement files received from connected banks | MT940, CAMT.053 |

| Non-executed transactions | Payments that failed, were rejected, or remain pending | CSV, Excel, PDF |

| Account balances | Balance positions for ordering party accounts | CSV, Excel |

Generating reports

All report types follow a similar generation workflow with parameters specific to each report's purpose.

Common parameters

Each report requires the following selections:

| Parameter | Description |

|---|---|

| Ordering party account(s) | Select one or multiple accounts to include in the report |

| Date range | Define the start and end dates for the data period |

| Output format | Choose the file format for the exported report |

Generation workflow

To generate any report:

- Navigate to Reports from the main navigation menu

- Select the report type you want to generate

- Choose the ordering party account(s) to include

- Set the value date range using the date picker controls

- Select your desired output format from the available options

- Click Generate to create and download the report

The system processes the request and initiates a file download once the report is ready.

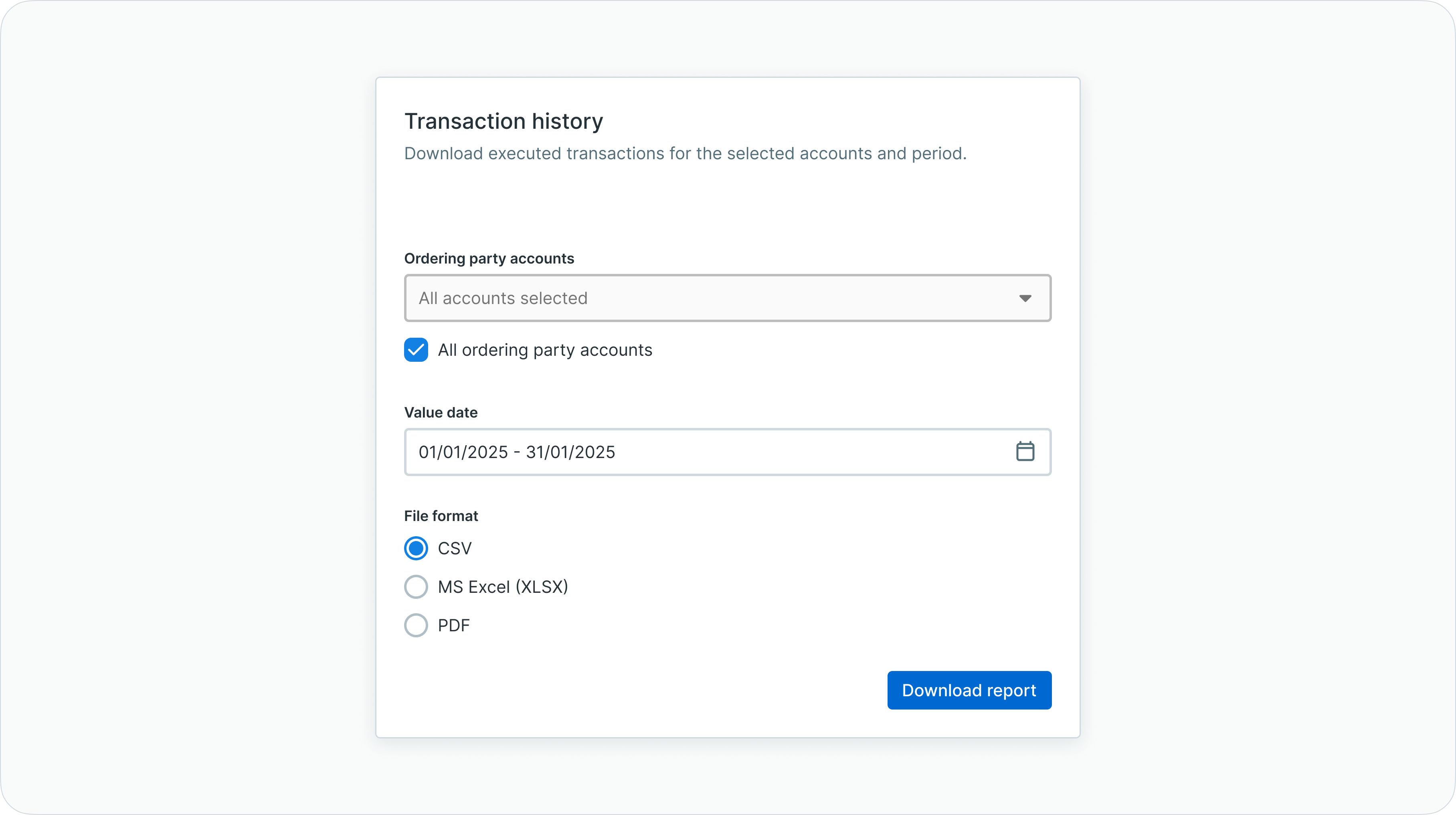

Transaction history report

The transaction history report generates a listing of all incoming and outgoing transactions known to LYNKS for the selected accounts and date range. This includes transactions initiated within LYNKS as well as external transactions received through bank statement files.

Transaction history report generation

Report contents

The transaction history report includes:

- Transaction reference and identifiers

- Value date and booking date

- Ordering party account details

- Counterparty information

- Amount and currency

- Transaction type (credit or debit)

- Remittance information and communication

- Transaction status

Output formats

| Format | Use case |

|---|---|

| CSV | Data import into spreadsheet applications or databases |

| Excel (.xlsx) | Analysis and manipulation in Microsoft Excel with formatting preserved |

| Printable reports for meetings, audits, or archival purposes |

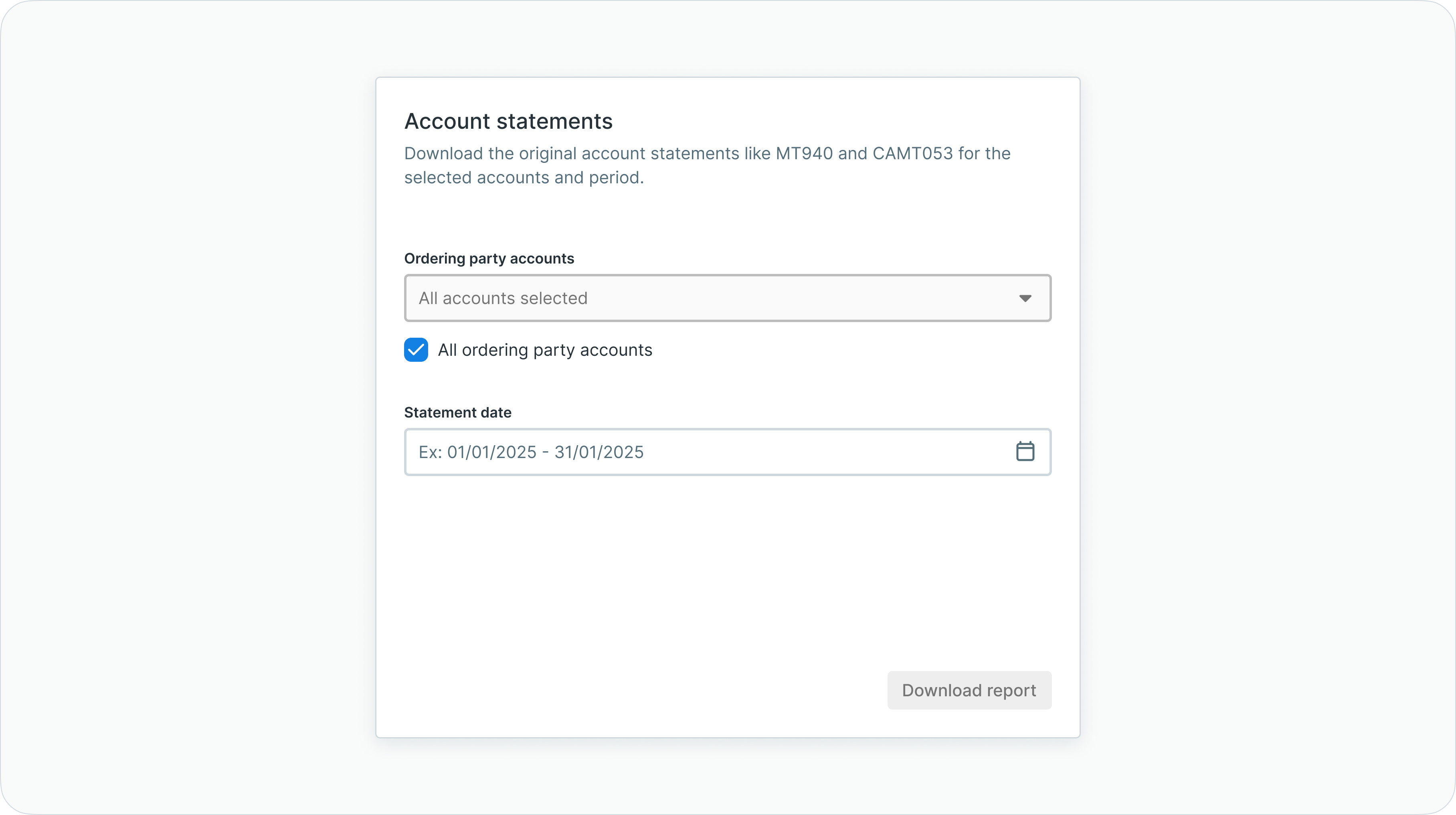

Account statements report

The account statements report provides access to bank statement files received from connected banks. LYNKS standardizes statements across all banks, allowing you to download files in consistent formats regardless of the originating institution.

Account statements report generation

Report contents

Account statements contain the complete bank statement data as received from the bank, including:

- Opening and closing balances

- All booked transactions for the statement period

- Transaction references and bank codes

- Remittance information

Output formats

| Format | Standard | Description |

|---|---|---|

| MT940 | SWIFT | End-of-day customer statement message in SWIFT format |

| CAMT.053 | ISO 20022 | Bank-to-customer statement in XML format |

ERP integrationMT940 and CAMT.053 formats are designed for automated processing by ERP and accounting systems. These standardized formats enable direct import for reconciliation workflows.

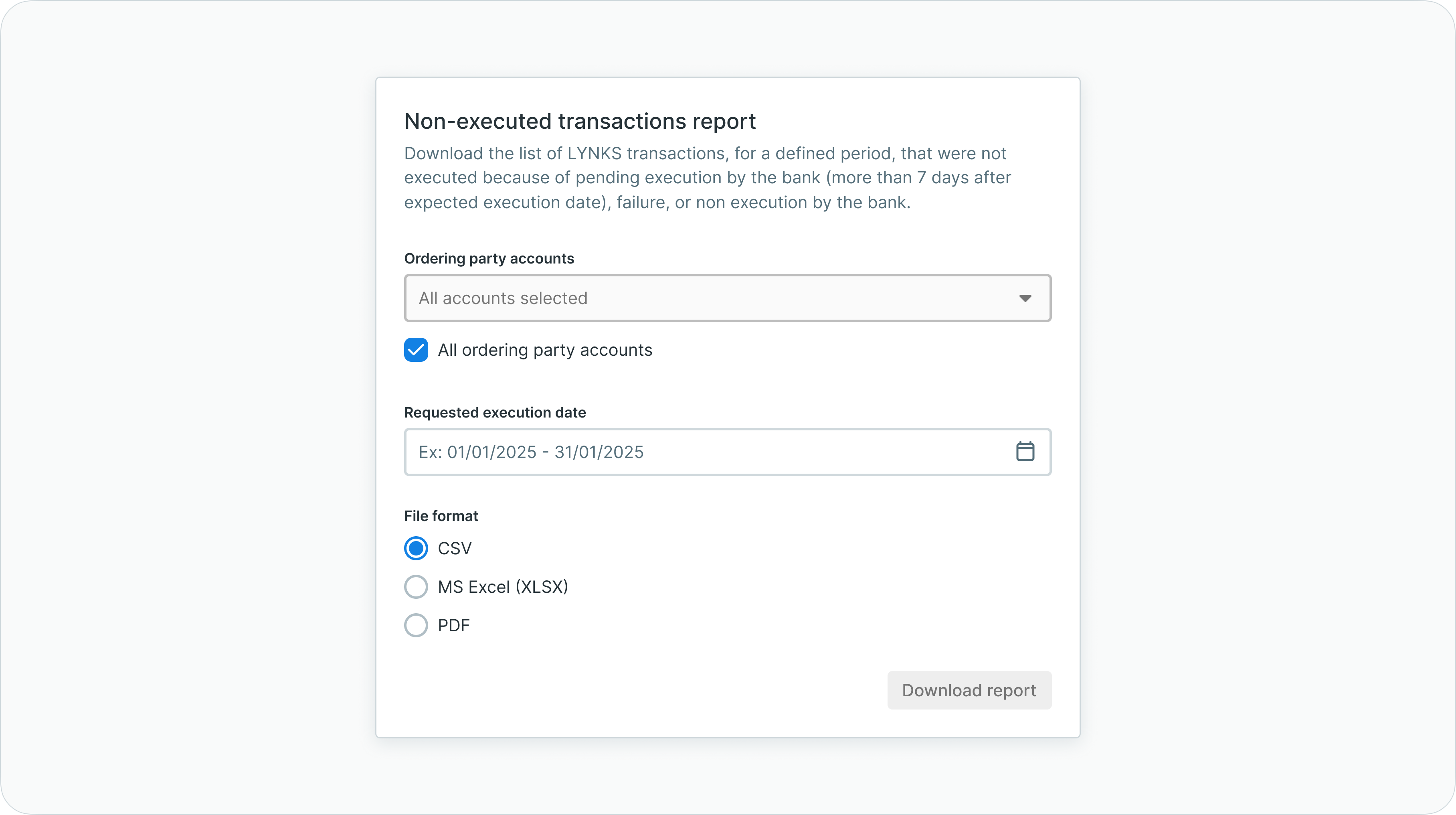

Non-executed transactions report

The non-executed transactions report identifies LYNKS payments that did not reach successful execution. This includes payments pending execution by the bank for extended periods, failed transactions, and bank rejections.

Non-executed transactions report generation

Report criteria

The report includes transactions matching the following conditions:

| Status | Description |

|---|---|

| Pending execution by bank | Payments awaiting bank processing for more than 7 days without feedback |

| Failed | Transactions that encountered processing errors |

| Rejected by bank | Payments rejected by the bank with rejection reason codes |

Report contents

Each non-executed transaction includes:

- Transaction reference and creation date

- Ordering party account

- Counterparty details

- Amount and currency

- Requested execution date

- Current status and reason codes where available

Output formats

| Format | Use case |

|---|---|

| CSV | Data analysis and exception tracking in spreadsheets |

| Excel (.xlsx) | Detailed review with filtering and sorting capabilities |

| Documentation for escalation and audit purposes |

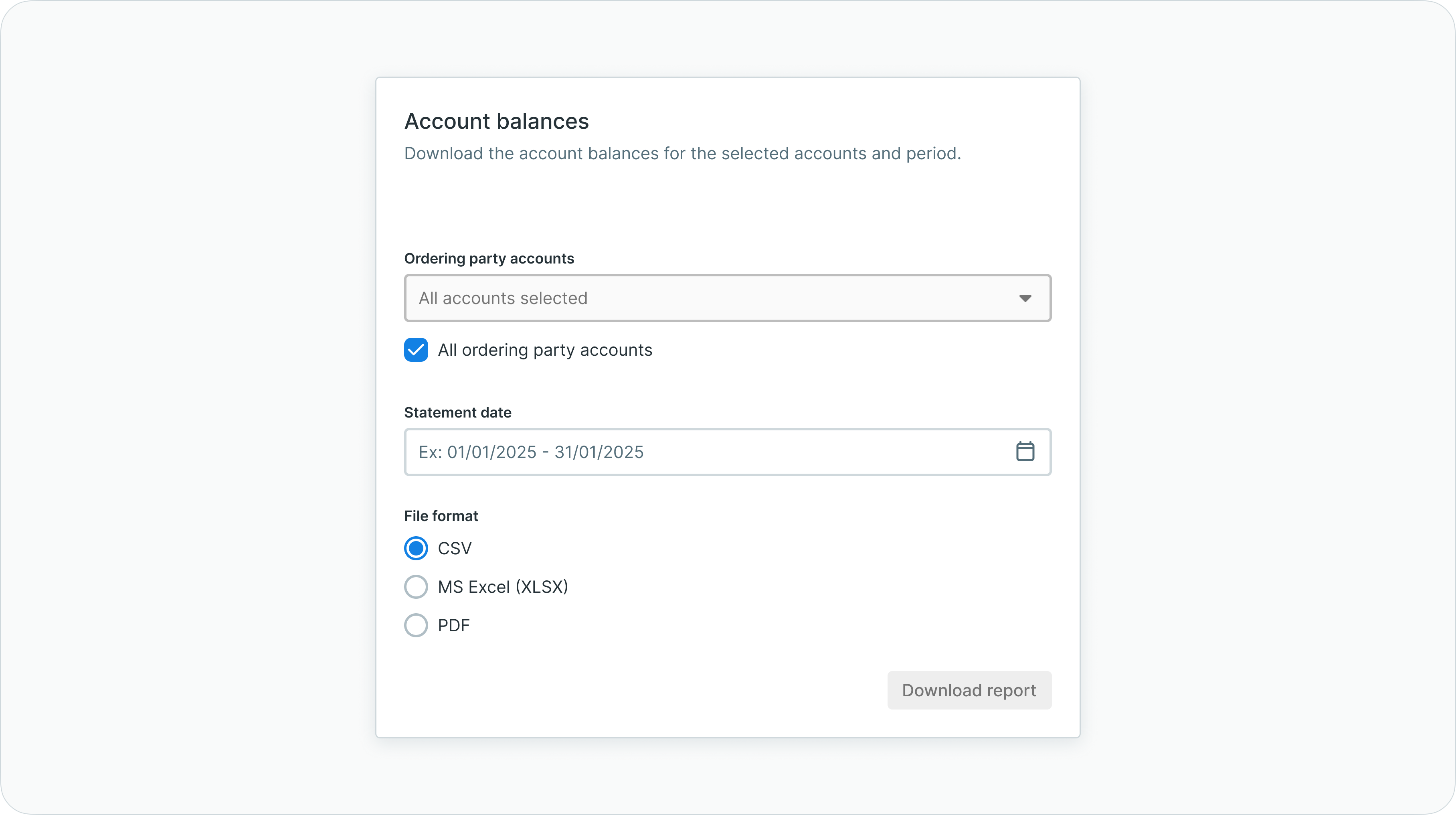

Account balances report

The account balances report generates balance positions for selected ordering party accounts over a specified time range, supporting liquidity monitoring and position reconciliation.

Account balances report generation

Report contents

The account balances report includes:

- Ordering party account identifiers (IBAN, alias)

- Bank and account currency

- Opening balance

- Closing balance

- Balance dates

Output formats

| Format | Use case |

|---|---|

| CSV | Import into treasury management systems or data analysis tools |

| Excel (.xlsx) | Position analysis with built-in spreadsheet functionality |

File format specifications

LYNKS supports industry-standard file formats for report exports, ensuring compatibility with external systems and compliance requirements.

Spreadsheet formats

| Format | Encoding | Description |

|---|---|---|

| CSV | UTF-8 | Comma-separated values for universal compatibility |

| Excel (.xlsx) | Native | Microsoft Excel format with formatting and data types preserved |

Document formats

| Format | Description |

|---|---|

| Portable Document Format for printable, archivable reports |

Bank statement formats

| Format | Standard | Version | Description |

|---|---|---|---|

| MT940 | SWIFT | — | End-of-day customer statement message |

| CAMT.053 | ISO 20022 | — | Bank-to-customer statement (XML) |

Character encodingCSV and Excel exports use UTF-8 encoding to ensure proper handling of special characters and international text. If you encounter encoding issues when opening CSV files, verify your application's import settings specify UTF-8.

Best practices

Follow these recommendations to maximize the value of LYNKS Reports:

- Schedule regular exports — Establish routines for generating transaction history and balance reports to maintain consistent records for reconciliation

- Use appropriate formats — Select CSV or Excel for data analysis and system imports; use PDF for documentation and audit trails

- Filter by account groups — When generating reports for specific business units, select only relevant ordering party accounts to produce focused outputs

- Retain MT940/CAMT.053 files — Archive bank statement downloads for compliance and long-term record retention

- Monitor non-executed transactions — Generate the non-executed transactions report regularly to identify and address payment issues before they impact operations

- Verify date ranges — Confirm the selected date range covers the intended period, particularly when generating reports across month or year boundaries

Related documentation

Explore related sections for more information:

- Platform Navigation - Detailed guide to the head-up display, table views, filters, and search functionality - Tables, filters, and view customization

- Permissions - Comprehensive explanation of access control and role-based permissions - Understanding access control and data scoping

- Bank Accounts - Account management, balance monitoring, and transaction history - Account balances and transaction history views

- Transaction History - Review incoming payment details - Interactive transaction browsing and search

- Outgoing Payments - Creating and managing credit transfers and standing orders - Payment statuses referenced in non-executed reports

Support

For assistance with report generation, file format questions, or data export issues, contact [email protected].

Updated 3 months ago