Signatory rules

Configure multi-level approval workflows, signature requirements, and automated approval or rejection rules for payment authorization

Introduction

Signatory rules define the authorization requirements for every payment in LYNKS. Each payment must be covered by a signatory rule to be processed and sent to the bank. These rules determine who can approve payments and how many signatures are required based on specific transaction parameters.

The signatory rules system serves two primary purposes: validating payment creation according to configured parameters, and determining which users are eligible to approve payments. Administrators can create, edit, and delete rules through the Settings interface, enabling organizations to implement approval workflows that match their internal policies and regulatory requirements.

Prerequisites

Before configuring signatory rules, ensure you have the appropriate administrative permissions and understand the impact of rule changes on payment workflows.

Permissions

| Permission | Description |

|---|---|

TENANT_SETTINGS_READ | View signatory rules, overlaps, gaps, and audit logs |

TENANT_SETTINGS_WRITE | Create, edit, and delete signatory rules |

Feature flags

Tenant Settings ApprovalIf the Tenant settings approval feature is enabled for your tenant, changes to signatory rules require approval before taking effect. See Pending Changes - Configuration change management for details on the configuration change approval workflow.

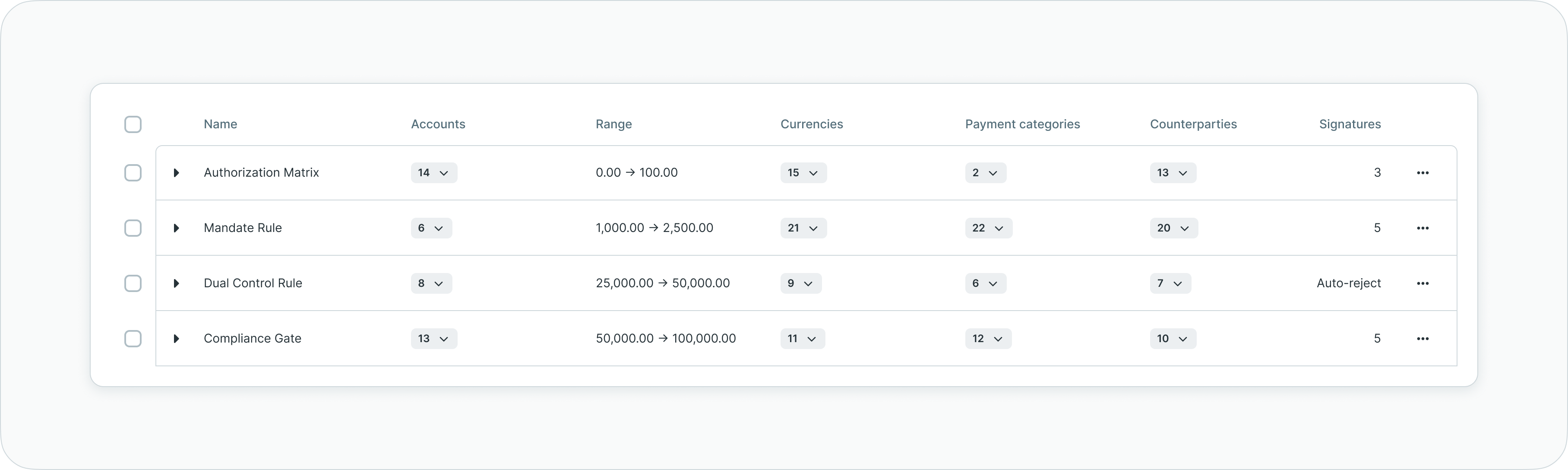

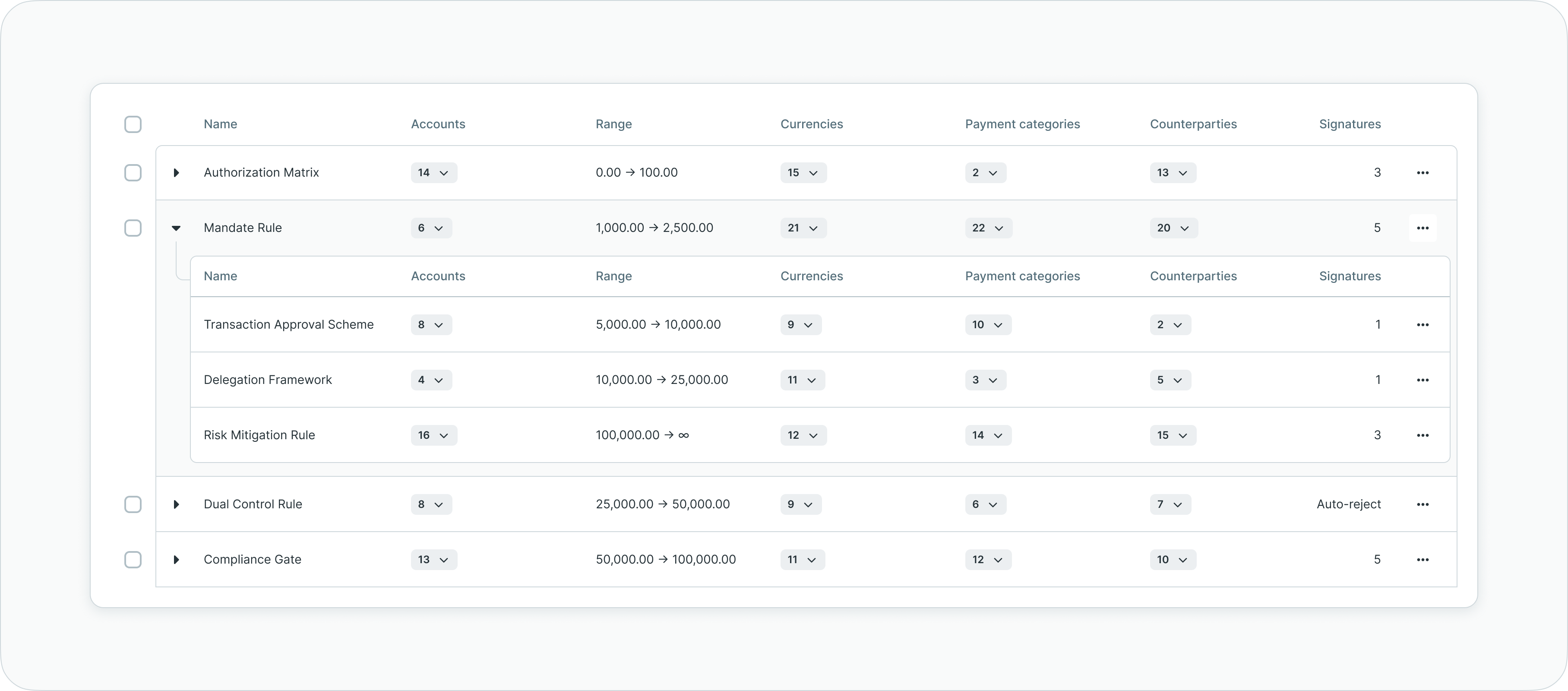

Signatory rules overview

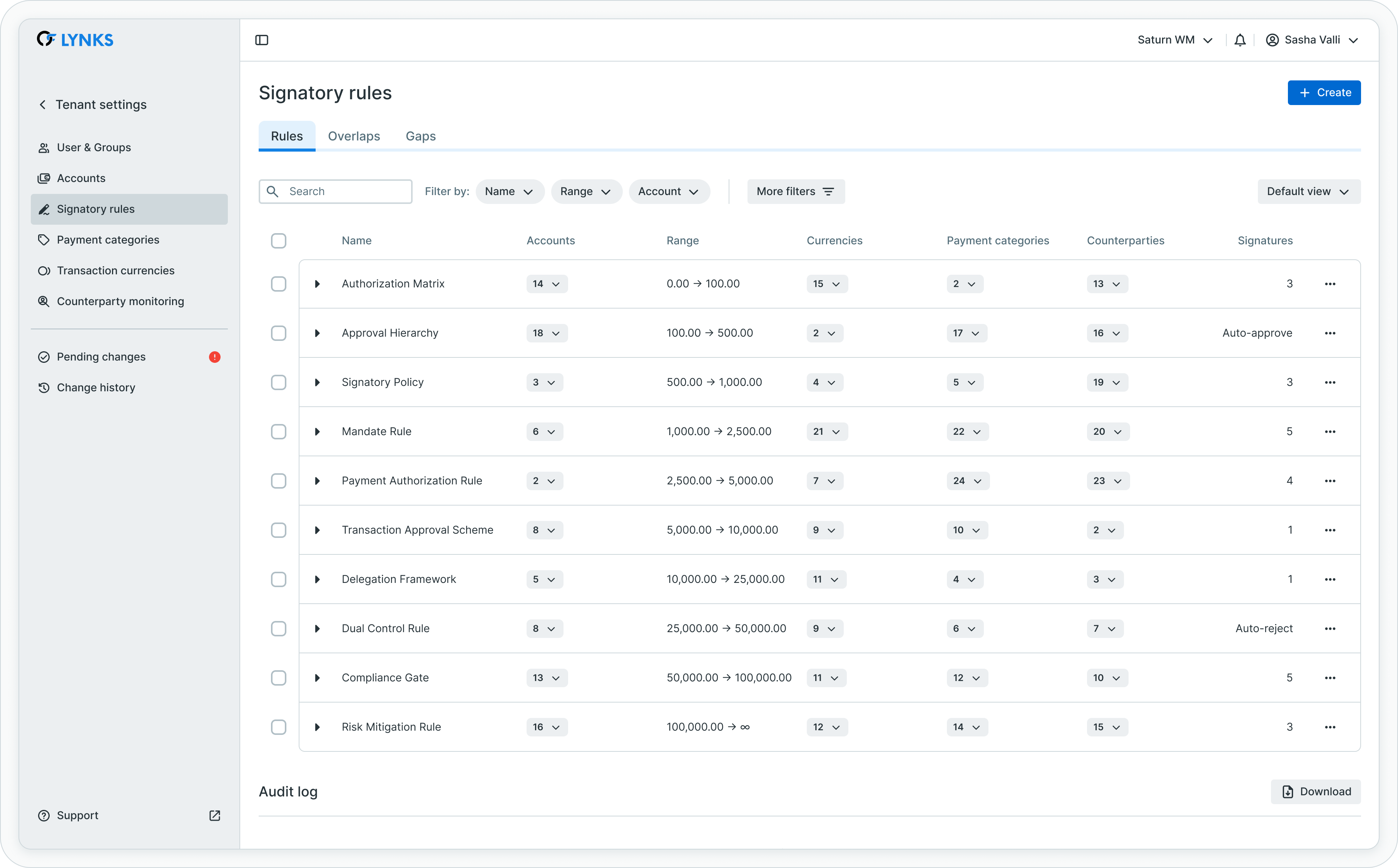

The signatory rules interface provides a comprehensive view for managing all aspects of payment approval configuration. Administrators can overview existing rules, consult their parameters, edit configurations, and audit changes from a centralized location.

Signatory rules management interface

Key components

The signatory rules management consists of three main sections: the rules list displaying all configured signatory rules, the overlaps section identifying potential conflicts between rules, and the gaps section highlighting parameter combinations not covered by any rule.

Rule parameters

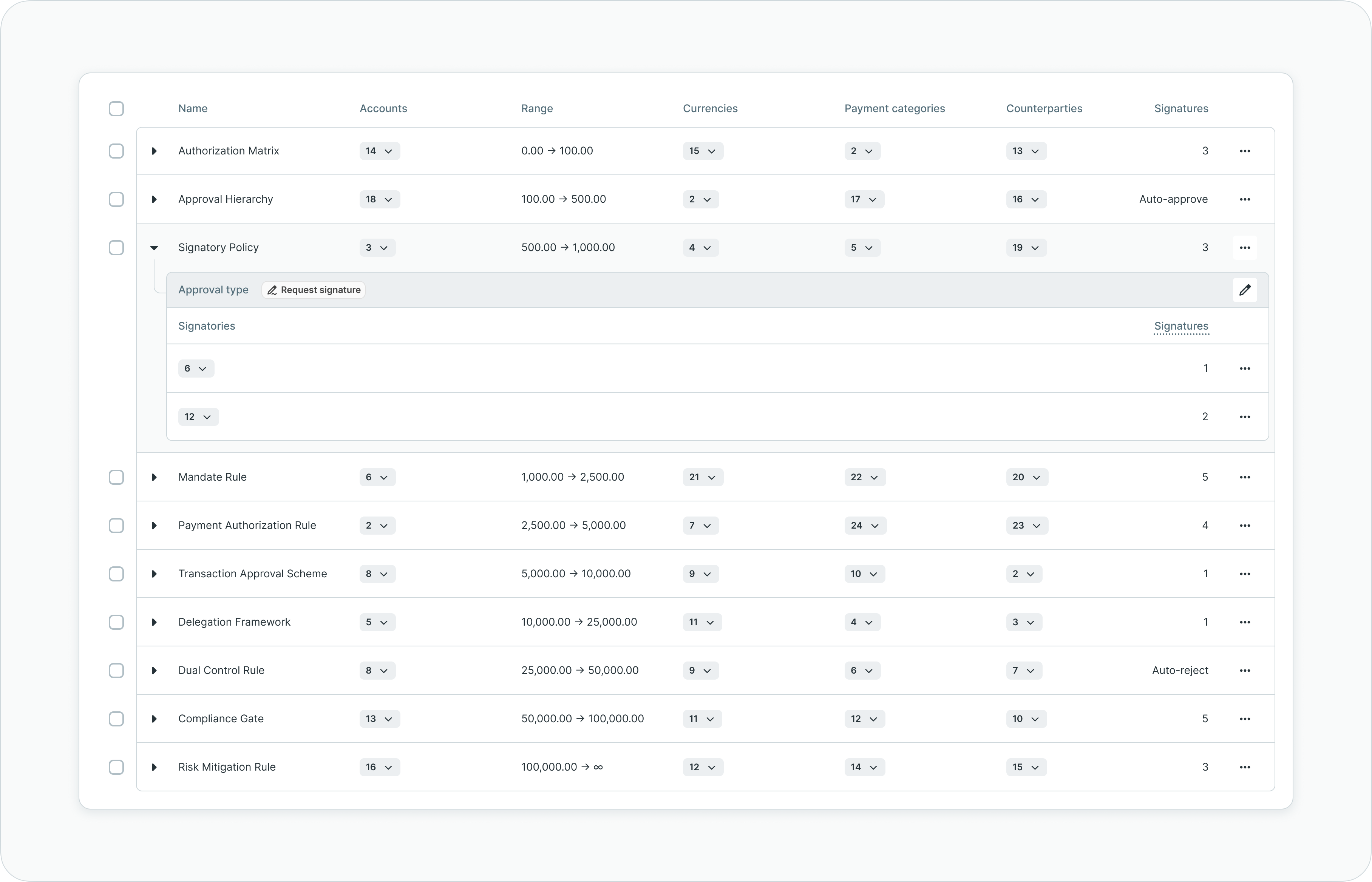

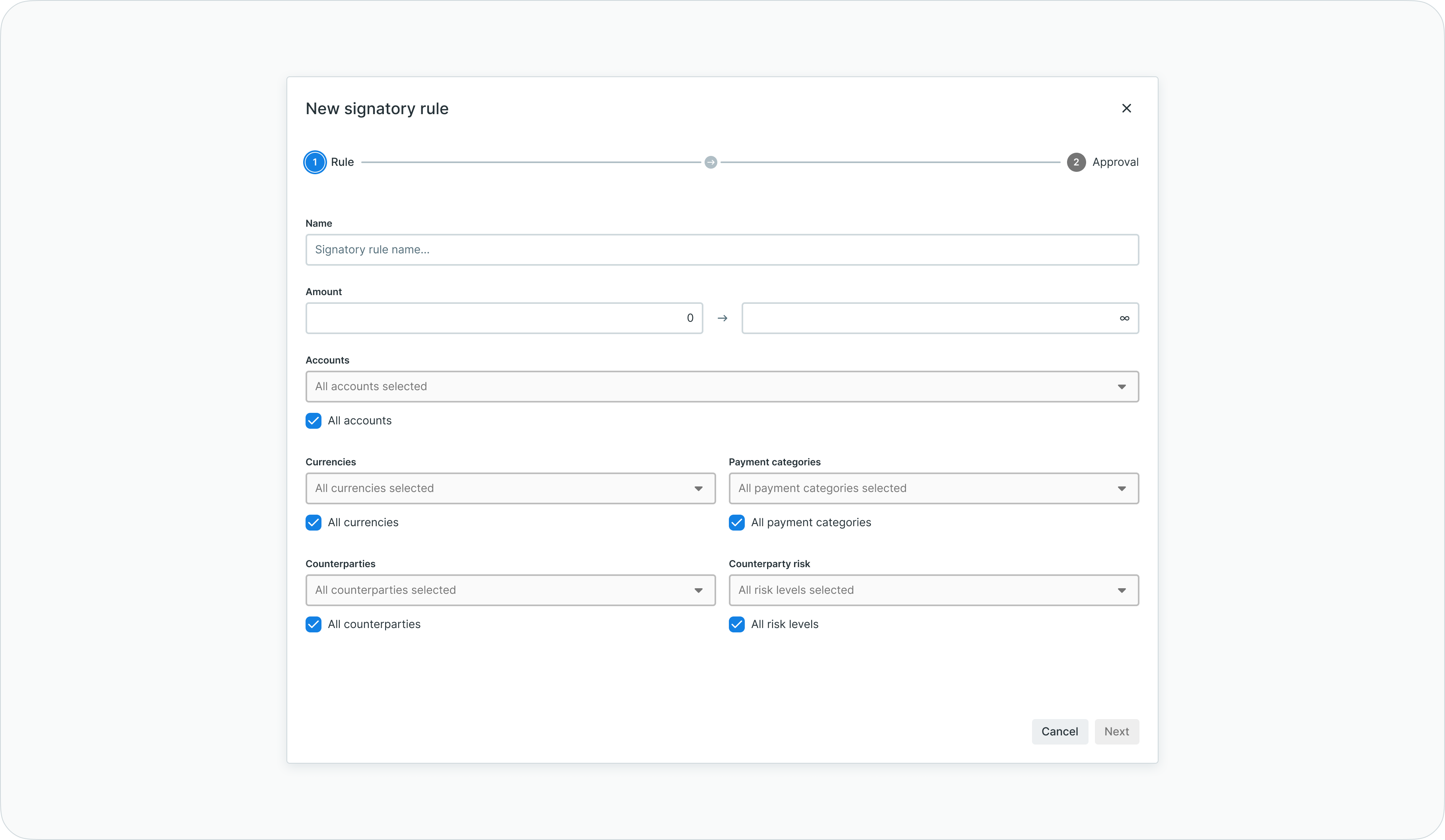

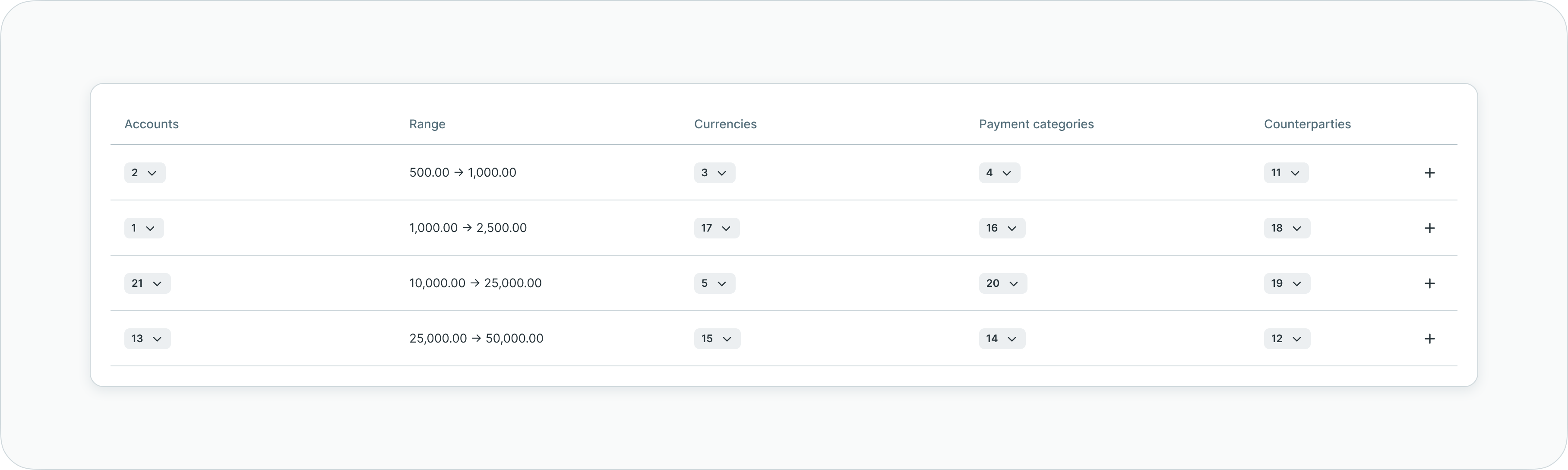

Each signatory rule defines its scope through a combination of parameters. When a user creates a payment, the platform validates whether the selected values match an existing signatory rule. The rule that applies to a transaction determines which users can approve it and how many signatures are required.

Expanded signatory rule showing configured parameters

Available parameters

| Parameter | Description |

|---|---|

| Accounts | Ordering party accounts or account groups to which the rule applies |

| Amount range | Minimum and maximum transaction amounts covered by the rule |

| Currency | Transaction currencies included in the rule |

| Payment category | Payment categories covered by the rule |

| Counterparties | Counterparty groups to which the rule applies (payments to counterparties in these groups follow this rule) |

| Signature method | Defines whether payments require manual signatures, auto-approval, or auto-rejection |

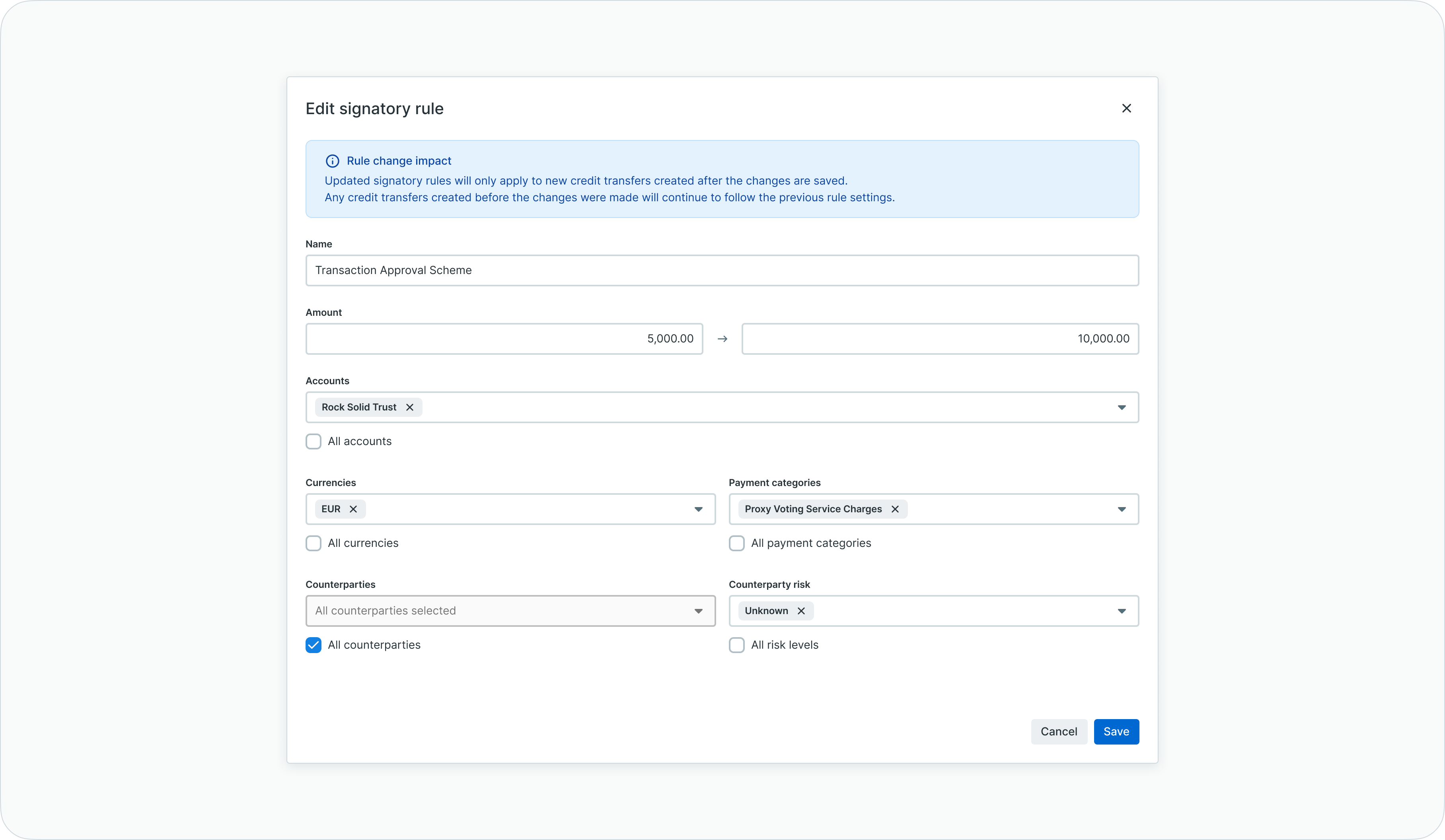

When creating or editing a rule, administrators can select individual items or choose "All" for accounts, currencies, and payment categories. Only active options appear in the selection lists, though deactivated items already assigned to a rule remain visible and can be saved.

Rule creation - defining parameters

When editing an existing rule, the same parameter configuration interface allows administrators to modify the rule scope and adjust parameter selections.

Rule editing - modifying rule parameters

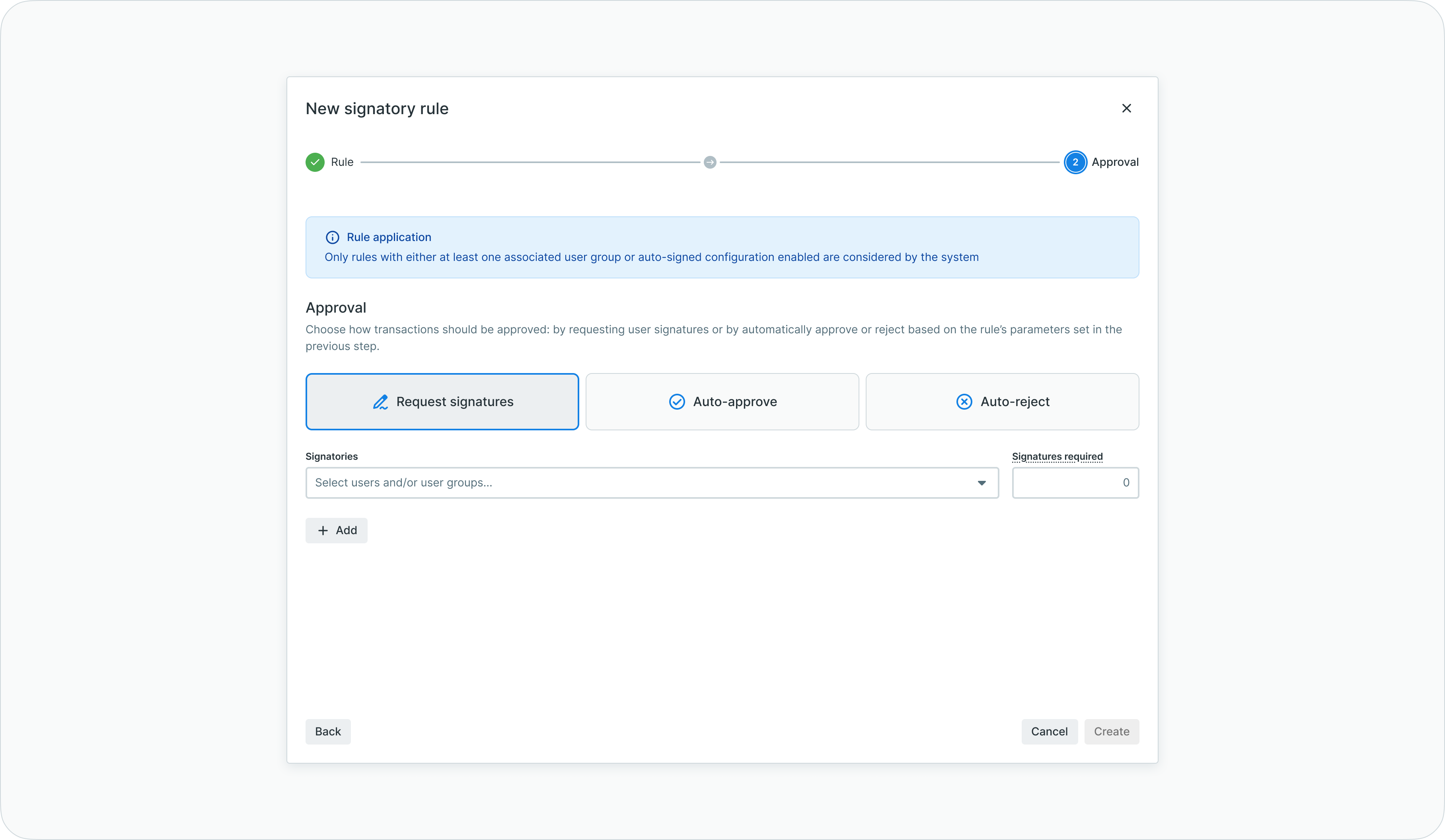

Approval options

The signature method determines how payments falling under a rule are processed. Administrators can choose between requiring manual signatures from designated users, or automating the approval or rejection process.

Define signatories

This option requires designated users to manually approve payments. Administrators define signatory groups and specify how many signatures are required from each group. The signature requirements can combine multiple groups, with different signature counts per group. When a payment requires approval, eligible signatories from the specified groups receive notification and can sign the transaction.

Rule creation - defining signature requirements

Auto-approve

Payments matching rules with auto-approve are automatically approved and sent to the bank without requiring manual signatures. This option is useful for low-value payments or scenarios where the cost of manual approval exceeds the transaction value. The auto-approval is reflected in the payment status and audit logs.

Auto-reject

Payments matching rules with auto-reject are automatically rejected and not sent to the bank. This option helps enforce risk management policies by blocking transactions that do not meet defined criteria. Rejected payments can be re-triggered after addressing the rejection reason.

Critical ConfigurationAuto-approve and auto-reject rules automate the approval process without human intervention. Configure these options carefully to ensure they align with your organization's risk management and compliance requirements.

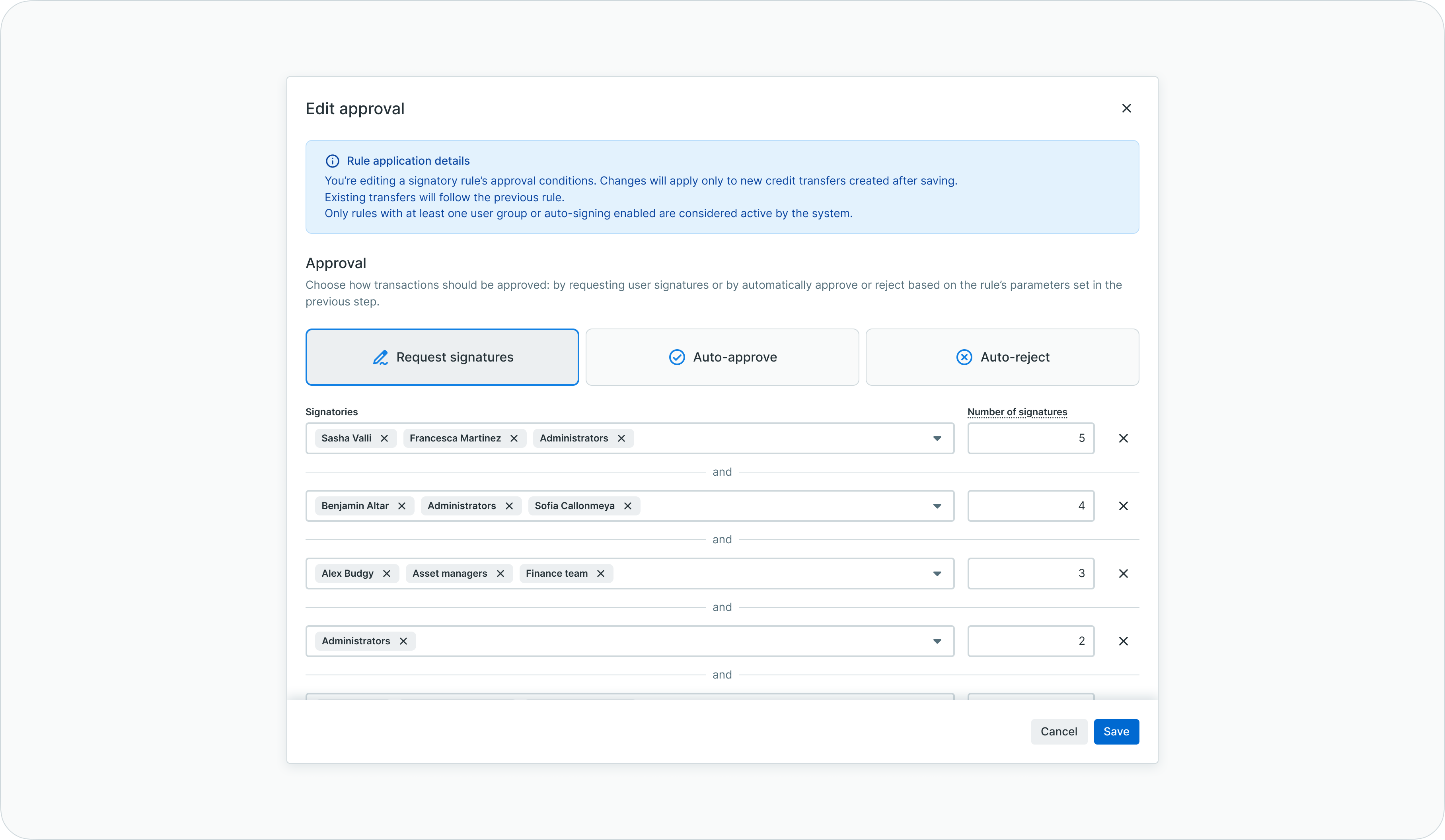

Signatory groups and signatures

When configuring manual signature requirements, administrators select signatory groups and specify the number of required signatures from each group. A signatory group is a collection of users who are authorized to approve certain types of payments.

Configuring signature requirements

The signature configuration allows combining multiple signatory groups with different signature counts. For example, a rule might require one signature from the "Treasury" group and two signatures from the "Management" group. Users in each group receive signature requests when a payment matching the rule is created.

Editing signature requirements for an existing rule

Key considerations for signature configuration include: a single user can only sign a payment once regardless of how many groups they belong to, the maximum number of signatures cannot exceed the number of signatories in a group, and signature requirements only apply to fully configured rules with specified groups and signature counts.

Managing signatories

Signatories can be added to or removed from groups in two ways: through the User & Groups management section (see User & Groups - User management and access configuration), or directly within the signatory rules configuration. Changes to signatory rules apply only to payments created after the modification. Existing payments continue to use the rules that were in effect at the time of their creation.

Overlaps and gaps

The signatory rules system includes validation features to help administrators identify and resolve configuration issues. Understanding overlaps and gaps ensures complete and consistent coverage of all possible payment scenarios.

Overlaps

Overlaps occur when more than one rule covers the same parameter combination. Payments falling within an overlap accumulate the signature requirements from all applicable rules, potentially creating approval bottlenecks.

Overlaps section showing conflicting rules

The overlaps section displays an informative table of all identified conflicts, calculated based on amounts, ordering party accounts, currencies, and payment categories. Expandable rows show which rules are overlapping, helping administrators understand the conflict and decide how to resolve it.

Expanded overlap showing conflicting rule details

When rules with different approval options overlap (such as one with auto-approve and another requiring signatures), the signature requirements take precedence over automatic approval or rejection.

Rule Overlap ImpactEditing signatory rules to remove overlaps is a critical intervention that affects platform behavior. Review the implications carefully before modifying overlapping rules.

Gaps

Gaps are parameter combinations not covered by any signatory rule. A payment that falls into a gap is automatically rejected because all payments require coverage by a signatory rule to be processed.

Gaps section showing uncovered parameter combinations

The gaps section calculates and displays all identified coverage gaps. Administrators can create a new rule directly from a gap by clicking the plus button, which opens the creation modal pre-populated with the gap's parameter values.

Gap BehaviorPayments not covered by any signatory rule are automatically rejected. Regularly review the gaps section to ensure complete coverage for all intended payment scenarios.

Signatory matrix download

The download button in the top right corner of the signatory rules screen generates an Excel file containing a consolidated overview of the current configuration. This export supports documentation, compliance review, and audit purposes.

The exported file contains two sheets. The first sheet provides a recap of user permissions based on their assigned roles. The second sheet lists all configured signatory rules with their parameters and eligible signatories, presenting the complete signatory matrix in a format suitable for external review.

Rule testing and validation

When creating or editing a signatory rule, the system automatically calculates potential overlaps with existing rules. This calculation may take a moment to complete, and the interface displays a loading indicator during processing.

The overlap preview shown during rule creation helps administrators understand the impact of their configuration before saving. If the new rule would create overlaps with existing rules, the conflicting rules are displayed, allowing administrators to adjust parameters before finalizing the configuration.

Changes to signatory rules affect only payments created after the modification. Existing payments in progress continue to follow the rules that were in effect at their creation time.

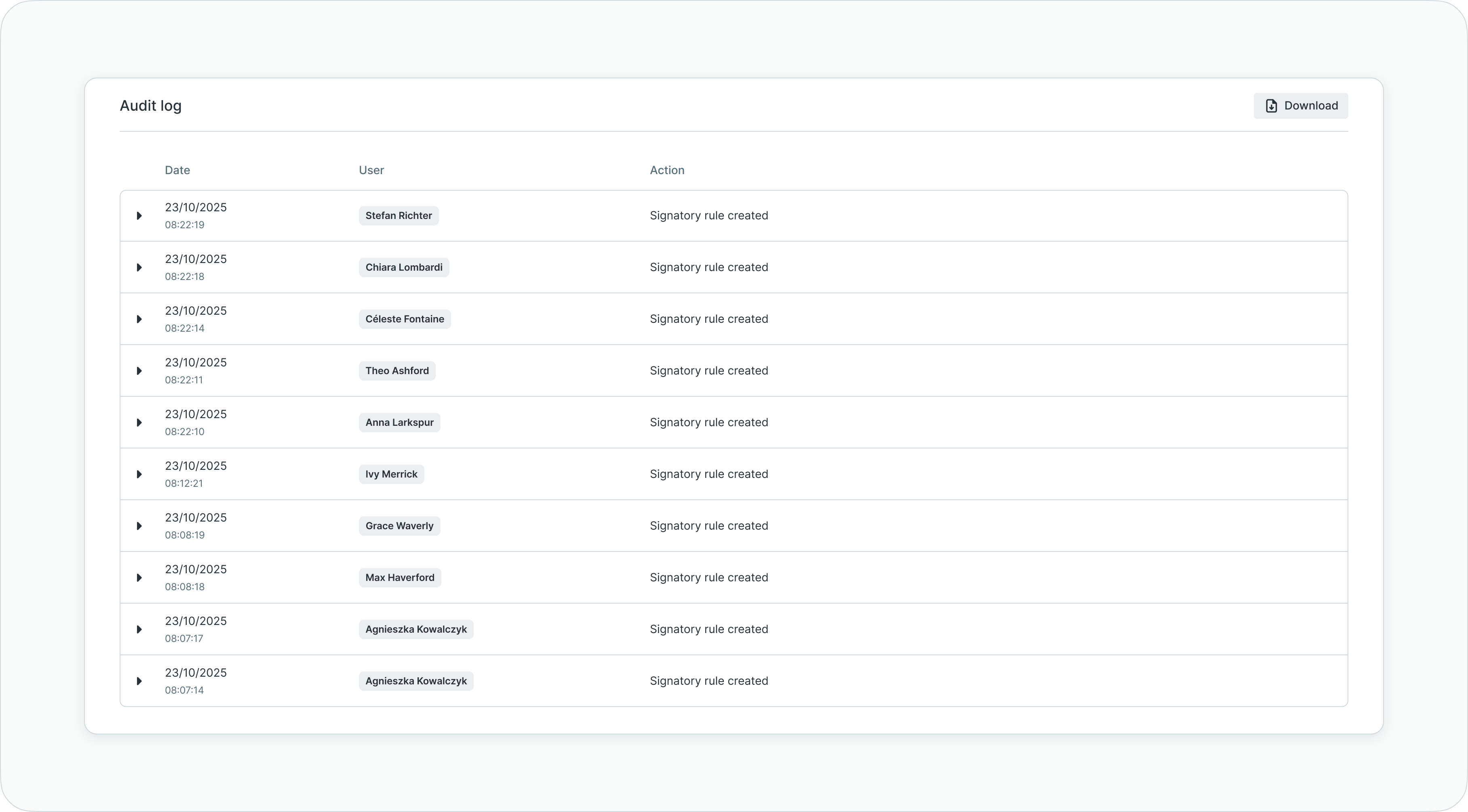

Audit log

The audit log maintains a complete trail of all changes to signatory rules. Each entry records the date of modification, the user who made the change, and the specific modification performed.

Signatory rules audit log

Tracked changes include updates to signature requirements, modifications to rule parameters, creation of new rules, and deletion of existing rules. This comprehensive logging supports compliance requirements and enables troubleshooting of approval workflow issues.

Best practices

Following these guidelines helps ensure effective signatory rule configuration and smooth payment approval workflows.

Design rules with clear, non-overlapping parameter ranges to avoid cumulative signature requirements. Use amount ranges strategically to apply different approval levels for low-value versus high-value payments. Regularly review the gaps section to ensure all intended payment scenarios have coverage. Document the business rationale for each rule configuration, especially for auto-approve and auto-reject rules. Test new rules with sample payment scenarios before relying on them for production transactions. Coordinate rule changes with affected signatories to ensure they understand their approval responsibilities. Use the matrix download feature periodically to maintain external documentation of your approval configuration.

Related documentation

Explore related sections for more information:

- Approvals - How approval workflows and signature processes function - Understanding approval concepts and workflows

- User & Groups - User management and access configuration - Managing users and signatory groups

- Payment Categories - Payment classification setup - Configuring payment categories for rule scoping

- Pending Changes - Configuration change management - Configuration change approval workflow

- Digital Signatures - Transaction signing methods and legal validity - Signature methods and authentication

Support

For assistance with signatory rule configuration or training on approval workflow setup, contact [email protected].

Training RecommendationSignatory rules are critical for platform functionality. Request guidance or training from the support team before making significant modifications to ensure proper configuration.

Updated 2 months ago