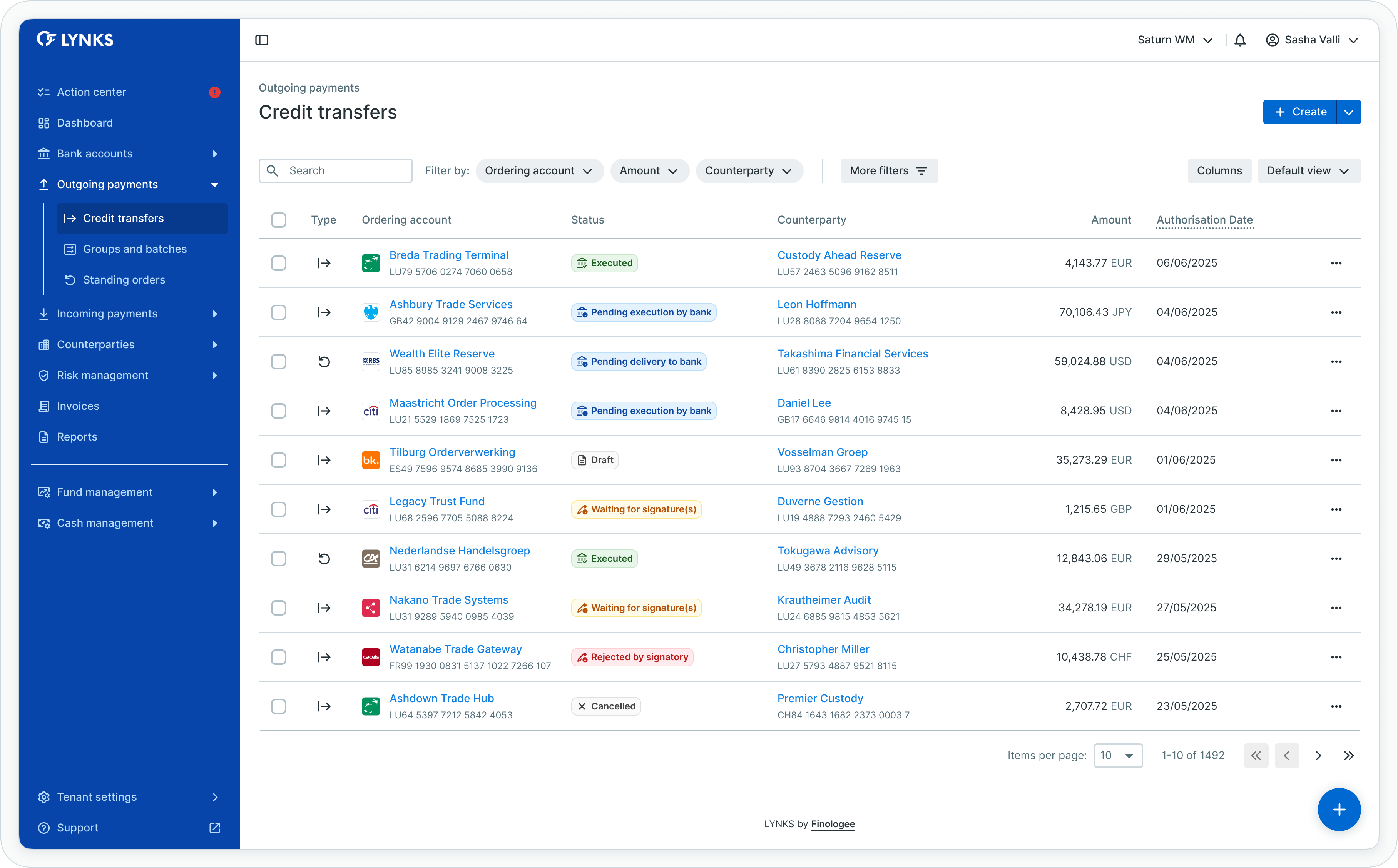

Credit transfers

This feature allows users to easily navigate through all their credit transfers initiated. Users can view and track the details of each transfer, such as the counterparty, amount, and transaction status.

This option provides a comprehensive overview of their transfer history, enabling users to monitor and manage their payment activities efficiently.

The management and handling of credit transfers will described in the how to section.

Credit transfers list

By adapting the columns that should be displayed, the user is able to have all the details in the credit transfers list in one sight.

Credit transfers list

In case additional details are needed for a specific payment, LYNKS offers a detailed view of each payment inside the interface.

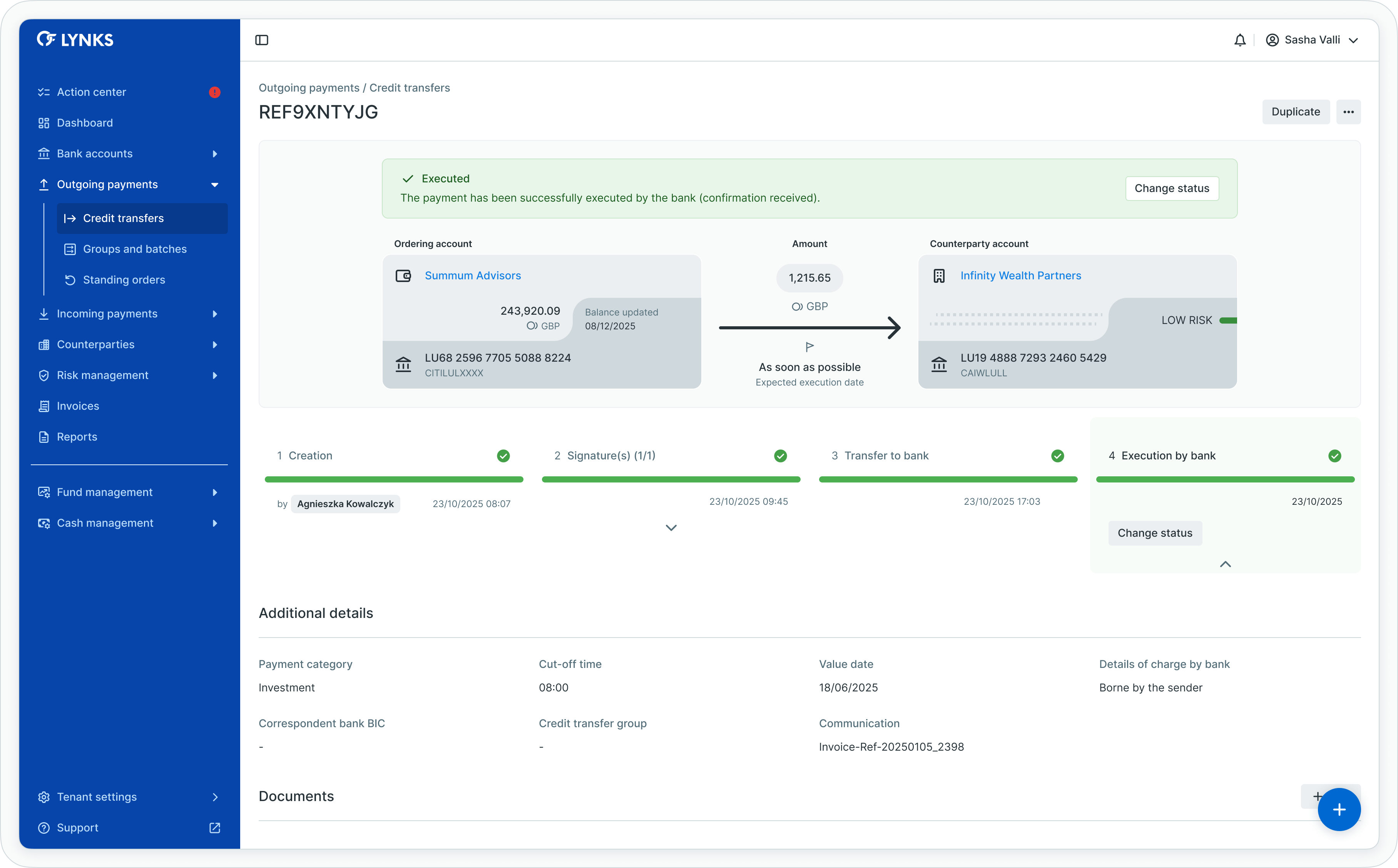

Credit transfers details

The credit transfers details screen shows all the related information to a payment on one single page. The page is split into several sections:

- Payment information and status

- Timeline

- Additional details

- Documents

- Audit log

Credit transfer - details part1

Credit transfer - details part2

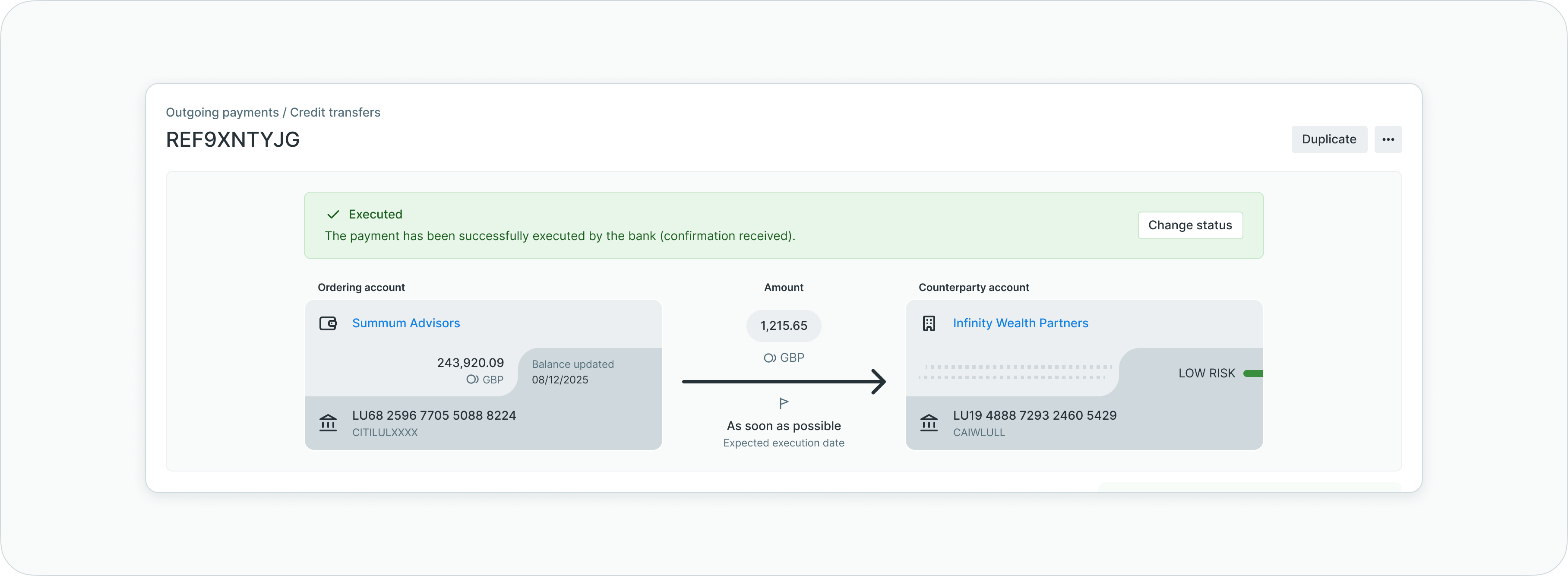

Payment information and status

According to the status of the payment the information displayed may vary.

The top section displays the most crucial information about the selected and displayed payment.

LYNKS discloses the transaction reference on the top left corner, and the buttons on the management on the opposite side.

As first attention point, the interface informs about the user about the status of the payment with a short description using the highlight colour of the status.

Below the alert box, LYNKS discloses the ordering party account (IBAN, BIC, balance) the amount, urgency and currency of the transaction and the receiving counterparty account (name, IBAN, BIC, Risk level).

Credit transfer - details - payment information and status

Timeline

The transaction timeline shows the evolution and transition in a step-by-step approach of a transaction. Split into 4 major steps, the timeline aims to provide a history and evolution the transitions to the new states by capturing some important information like the creator and creation date, possible signatories and received signatures, delivery to bank until finally the execution. Goal is to have a effective overview of the precise state of the payments.

In case of negative states (failed, cancelled) the timeline shows where the process stopped and shows the latest performed action.

Transition steps on the timeline:

- First the creation -either in draft status or immediately sent for authorization- is noted.

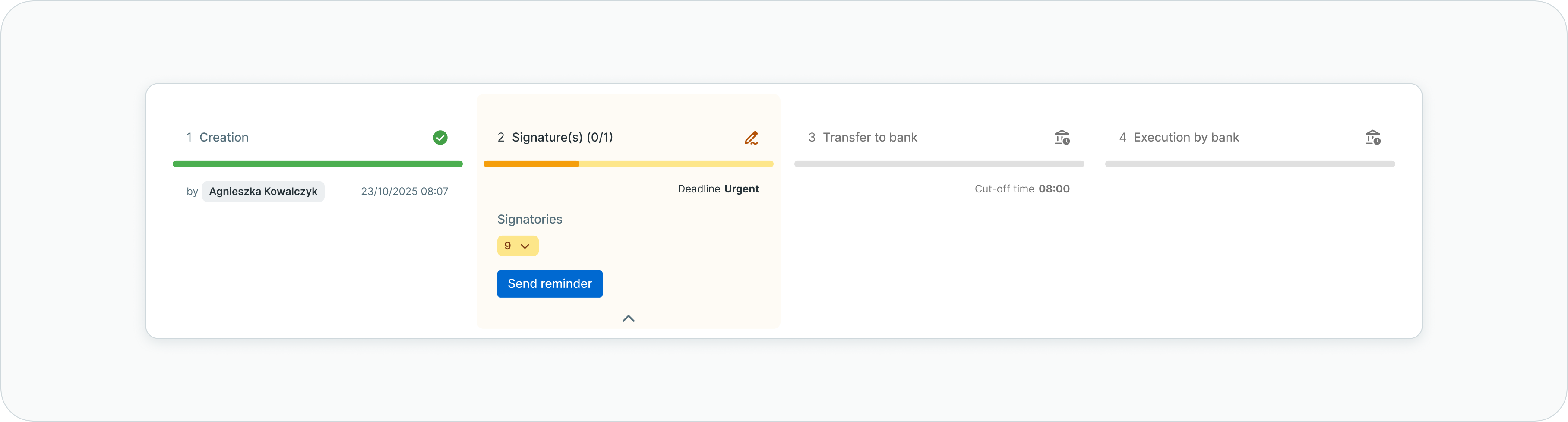

Credit transfer - details - timeline - required signatures

- Second LYNKS provides an overview -depending on the status- of

- the requested signatories eligible to authorize and

- tracks the flow of the incoming signatures for the requested payment.

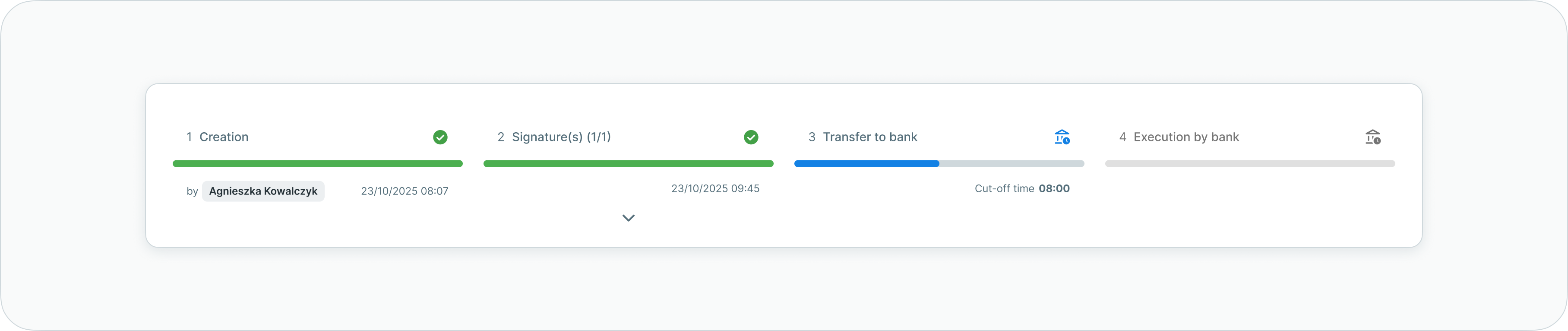

Credit transfer - details - timeline - authorised

- Third the payment will transition to either ‘Waiting for manual transfer to bank’ or ‘Pending delivery to ban’ disclosing the cut-off time that is configured for this payment to be transferred to the bank, or a button to trigger the manual sending to bank.

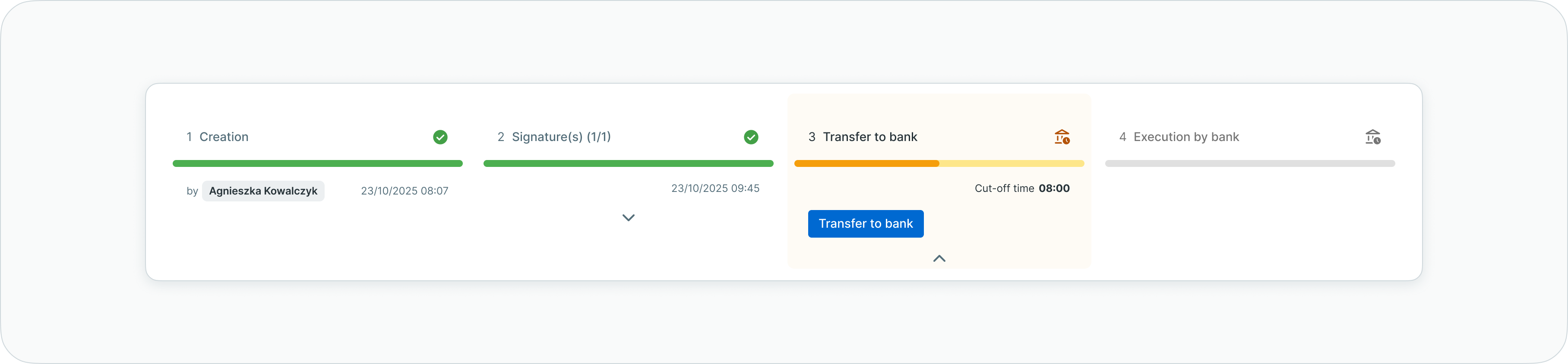

Credit transfer - details - timeline - pending delivery to bank

Credit transfer - details - timeline - manual transfer to bank

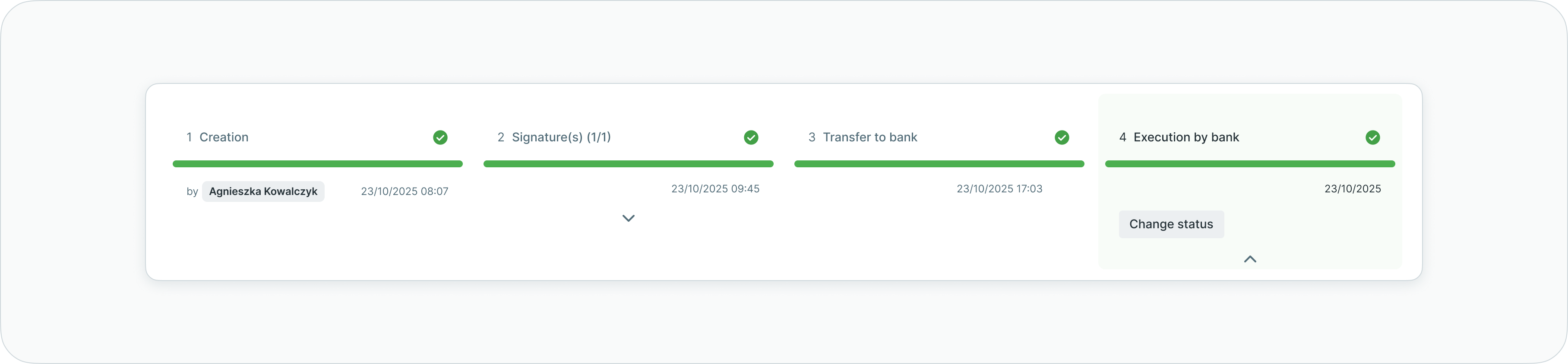

- Last the success of the payment execution is marked with the full timeline changing colour, while also updating the delivery timestamp on Transfer to bank and putting the value date. LYNKS provides the possibility to change the status of the payment in case of need (more on HOW TO section).

Credit transfer - details - timeline - executed

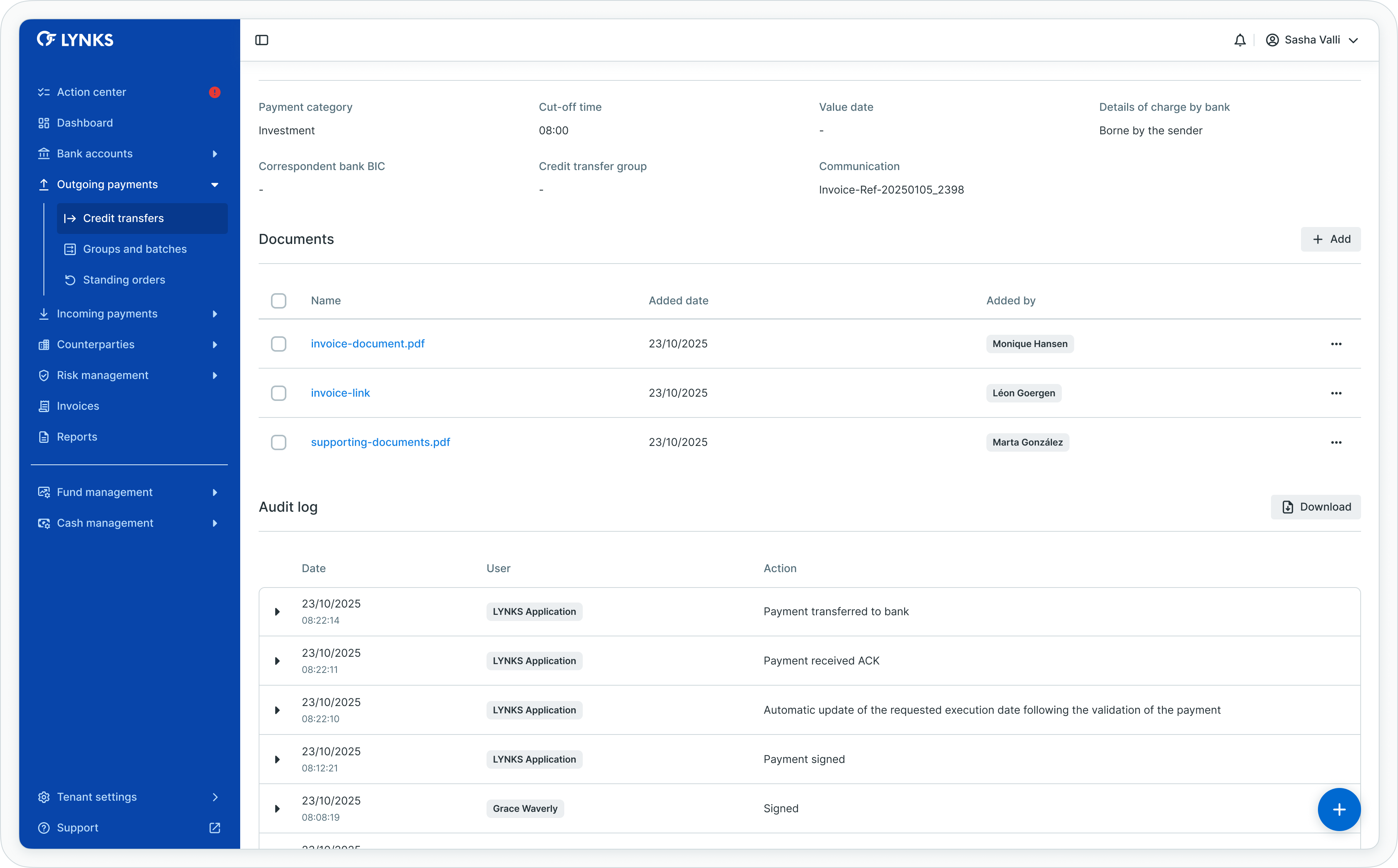

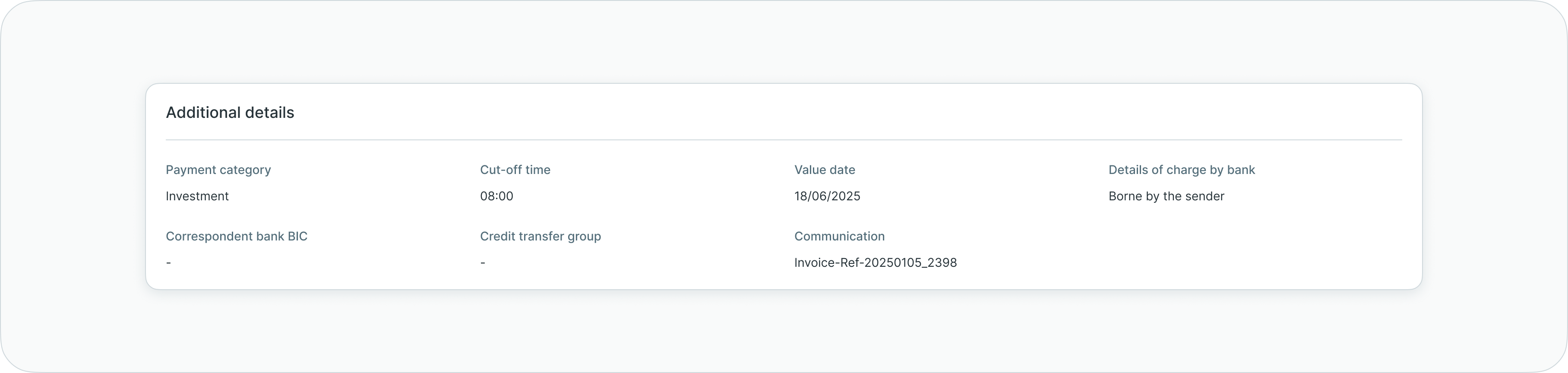

Additional details

More details on the payment can be found right below the timeline. The additional details section provides an overview with more payment specific details like payment category, cut-off time, value date, details of charge by bank, correspondent bank BIC, Credit transfer group, communication, number of credit transfers (in case of a batch booking) and standing order.

Credit transfer - details - additional details

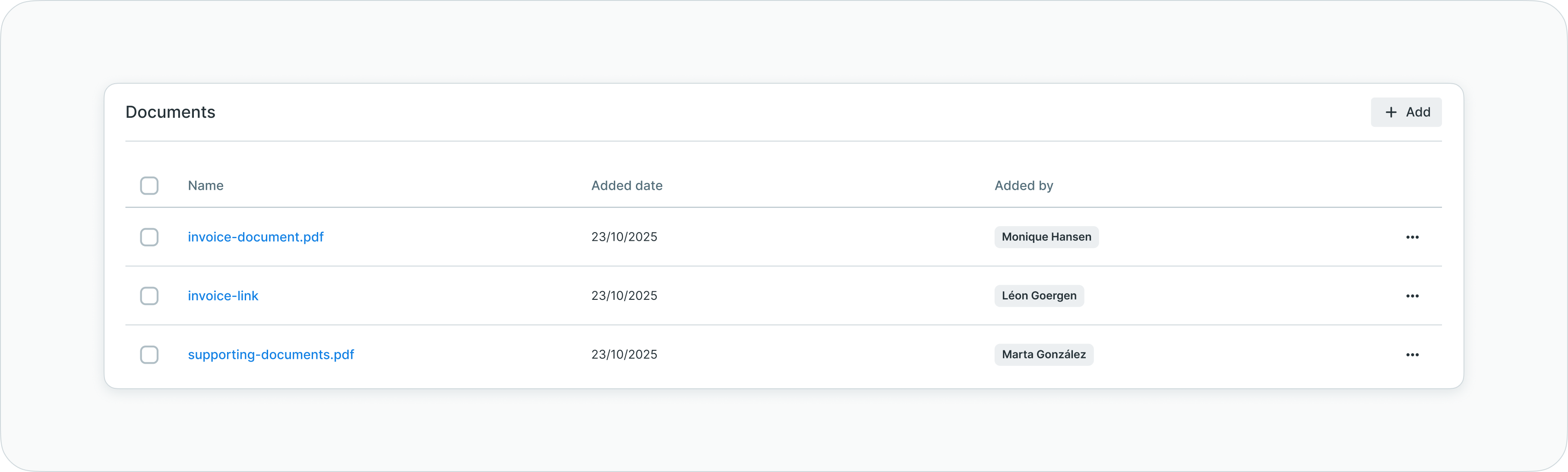

Documents

The documents feature allows the users to attach documents as PDF’s or web-links to a payment.

The attachments are downloadable and can be removed at any time.

Credit transfer - details - documents

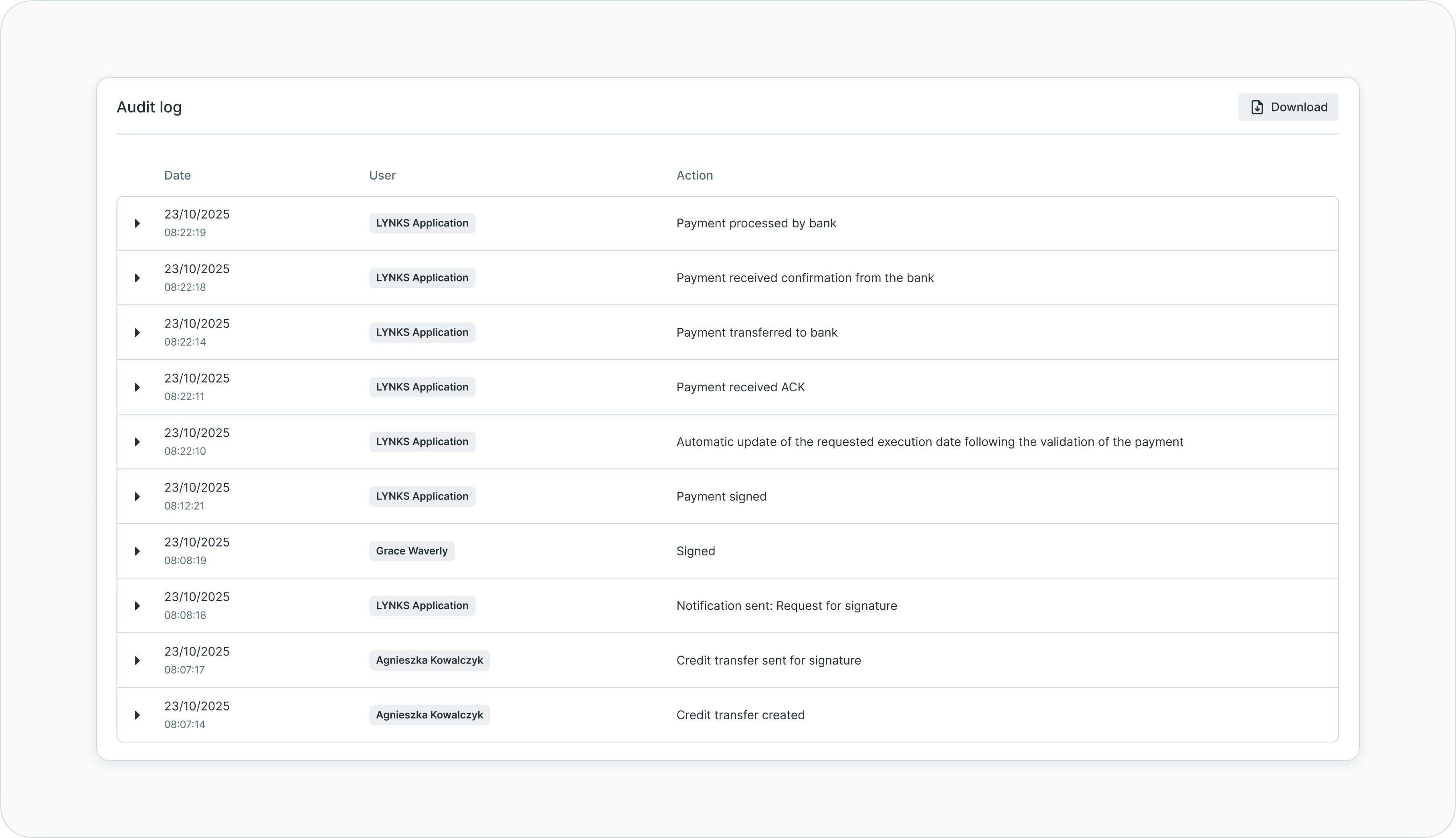

Audit log

Audit log is the place where every action on the payment is logged to keep a good traceability and to have potentially have more details on the latest update of the payment in one sight.

We log any status transition, and actions like notification triggers, received ACK until the end of the flow.

Credit transfer - details - audit log

Updated 5 months ago