Groups and batches

Organize payments with user-defined groups, process multiple payments as batch bookings, and manage bundled transactions with unified approval workflows

Introduction

The Groups and Batches section provides organizational tools for managing related payments, enabling users to group transactions by custom criteria or process multiple payments as consolidated batch bookings. This functionality streamlines payment management by organizing transactions logically and reducing processing overhead through bundled payment submission.

The interface presents both organizational approaches through dedicated views: user-defined groups for flexible transaction organization, and batch bookings for consolidated multi-payment processing with unified approval workflows and reconciliation.

Groups and batches overview

Prerequisites

Users must have the appropriate permissions to view and manage groups and batch bookings. The interface displays only transactions and batch bookings associated with accounts and categories to which you have access rights.

Permissions

| Permission | Description |

|---|---|

PAYMENT_READ | View user-defined groups, batch bookings, and associated transactions |

PAYMENT_CREATE | Create user-defined groups and upload batch booking files; manage payment groups |

PAYMENT_APPROVE | Submit draft payments for authorization |

PAYMENT_AUTHORISE | Sign or reject payments (signatory right) |

BATCH_BOOKING_TRANSACTIONS_READ | View batch booking details and child transactions |

Account and category scopingUsers see only groups and batch bookings associated with ordering party accounts and payment categories they have been granted access to through their permission configuration.

Overview

The Groups and Batches section organizes payment management tools into three primary views, each accessible through dedicated tabs: an aggregated overview showing all groups and batch bookings, a user-defined groups tab for custom payment organization, and a batch bookings tab for consolidated payment processing.

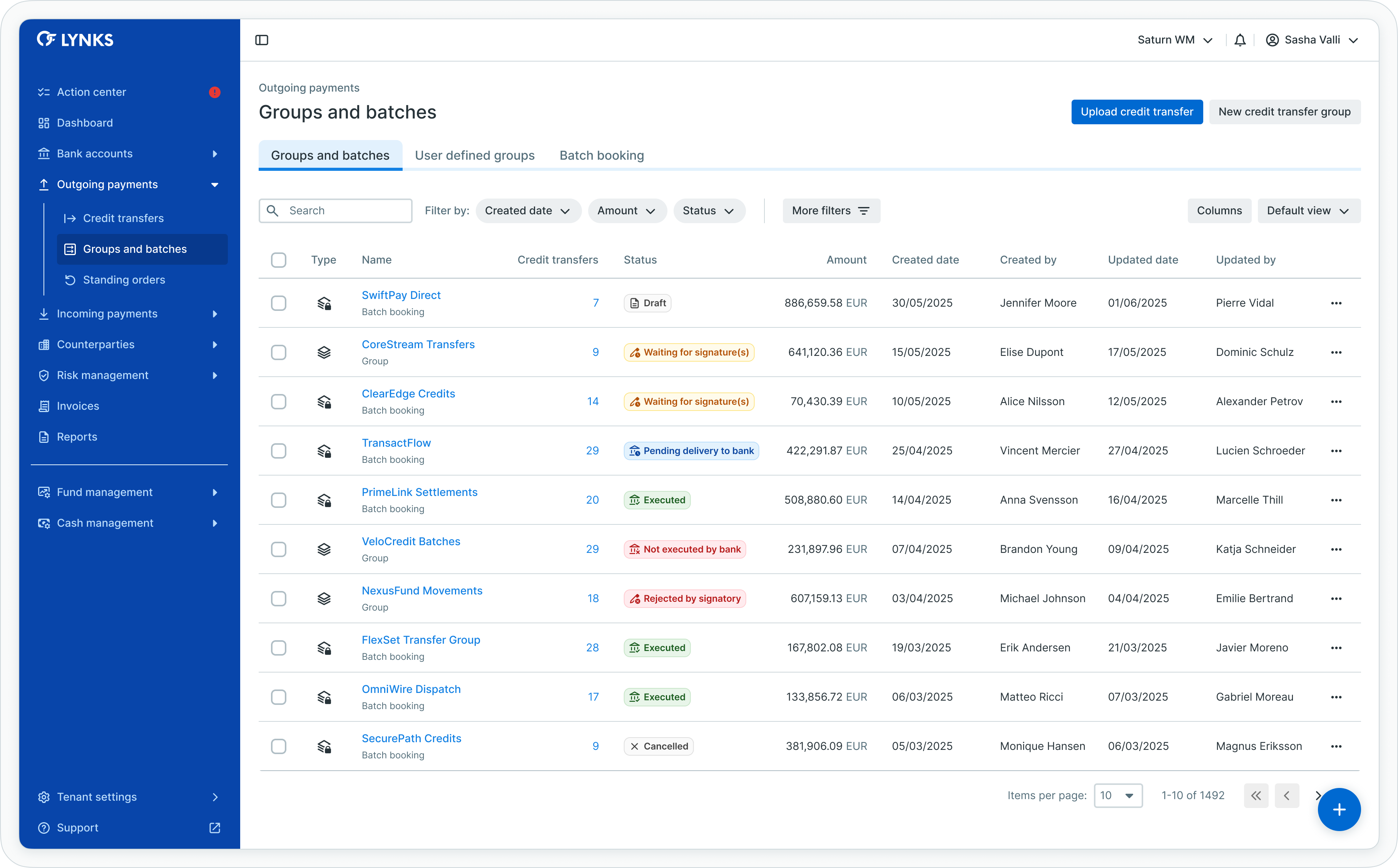

Aggregated view

The main tab displays a combined list of all user-defined credit transfer groups and batch bookings existing in the system, providing quick access to both organizational approaches from a single interface.

Key information displayed:

- Group or batch booking name (clickable for navigation)

- Number of credit transfers within the group or batch

- Status indicators for batch bookings

- Creation date and creator information

- Ordering party account for batch bookings

Clicking a group name redirects to a pre-filtered credit transfers page showing associated transactions, while selecting a batch booking opens the detailed batch booking view.

Creating user-defined groups

User-defined credit transfer groups enable you to organize related payments by custom criteria for efficient monitoring and management.

Creating a new group

To create a credit transfer group:

- Navigate to Groups and Batches from the main menu under Outgoing Payments

- Select the User-defined groups tab

- Click the Create group or (+) button

- Enter a descriptive group name (e.g., "Payroll January 2025", "Vendor Invoices Q1", "Project Alpha Payments")

- Optionally add a description

- Click Save or Create

The empty group appears in the user-defined groups list, ready to receive credit transfers.

Naming conventions

Choose clear, descriptive group names that reflect:

- Business purpose (Payroll, Invoices, Subscriptions)

- Time period (January 2025, Q1 2025)

- Project or cost center (Project Alpha, Marketing Department)

- Any other relevant categorization criteria

Managing group membership

Credit transfers can be added to or removed from groups at any time, providing flexible payment organization.

Adding payments to groups

To associate credit transfers with a group:

From credit transfers list:

- Navigate to Credit Transfers from the main menu

- Select the credit transfers you want to group (use checkboxes for multi-selection)

- Click the bulk actions menu or overflow menu

- Select Add to group

- Choose the target group from the dropdown

- Click Confirm or Add

From individual payment:

- Open a credit transfer details page

- Click the overflow menu (three dots) or Actions button

- Select Add to group

- Choose the target group

- Click Confirm

The payments now appear in the selected group.

Removing payments from groups

To remove credit transfers from a group:

From credit transfers list:

- Navigate to Credit Transfers

- Apply filter to show payments in the specific group

- Select the credit transfers to remove (use checkboxes)

- Click bulk actions menu

- Select Remove from group

- Confirm removal

From individual payment:

- Open the credit transfer details

- Click the overflow menu or Actions button

- Select Remove from group

- Confirm removal

The payment no longer appears in the group but remains in the system.

Editing group details

To modify group information:

- Navigate to Groups and Batches > User-defined groups

- Locate the group in the list

- Click the overflow menu on the group row

- Select Edit

- Modify the group name or description

- Click Save

Deleting groups

To remove a group:

- Navigate to Groups and Batches > User-defined groups

- Locate the group in the list

- Click the overflow menu on the group row

- Select Delete

- Confirm deletion

Deleting a group does not affect the payments within it - payments remain in the system and lose only their group association.

Creating batch bookings

Batch bookings consolidate multiple payments into a single summary transaction, requiring file upload to create.

Uploading batch booking files

To create a batch booking:

- Click the floating action button (+) in the bottom right corner

- Select Upload file for multiple credit transfers

- Choose your payment file:

- Drag and drop the file into the upload area

- Or click to browse and select the file

- Supported file formats:

- PAIN.001 XML (ISO 20022)

- CSV format (according to LYNKS template)

- XLSX format (according to LYNKS template)

- The system validates the file

Multi-currency account supportFor foreign exchange payments from multi-currency accounts, upload files support optional Ordering Party Account Currency and Ordering Party BIC fields to specify which currency line to debit. These fields enable precise identification of ordering accounts when multiple currency lines or BIC codes share the same IBAN.

Batch booking validation

The system checks whether child payments meet batch booking requirements:

- All payments must originate from the same ordering party account

- All payments must use EUR currency

- All payments must have identical requested authorization and execution dates

- All payments must have the same urgency level

- All payments must be assigned to the same payment category

If all child payments meet these criteria, LYNKS creates a batch booking. If requirements are not met, the system creates individual credit transfers instead.

Reviewing validation results

After file upload:

- Review the validation summary showing:

- Number of payments successfully validated

- Any validation errors or warnings

- Batch booking creation confirmation (if applicable)

- Correct any errors in your file if needed

- Re-upload the corrected file

Submitting batch bookings

After successful validation:

- Review the batch booking summary

- Choose to:

- Send for authorization - Submit the batch booking immediately for signatures

- Save as draft - Store the batch booking for later submission

- Click the appropriate button

The batch booking appears in the Batch bookings tab with the selected status.

Related functionalityFor detailed information about creating individual credit transfers through file upload, see Credit Transfers - Review payment details before approval.

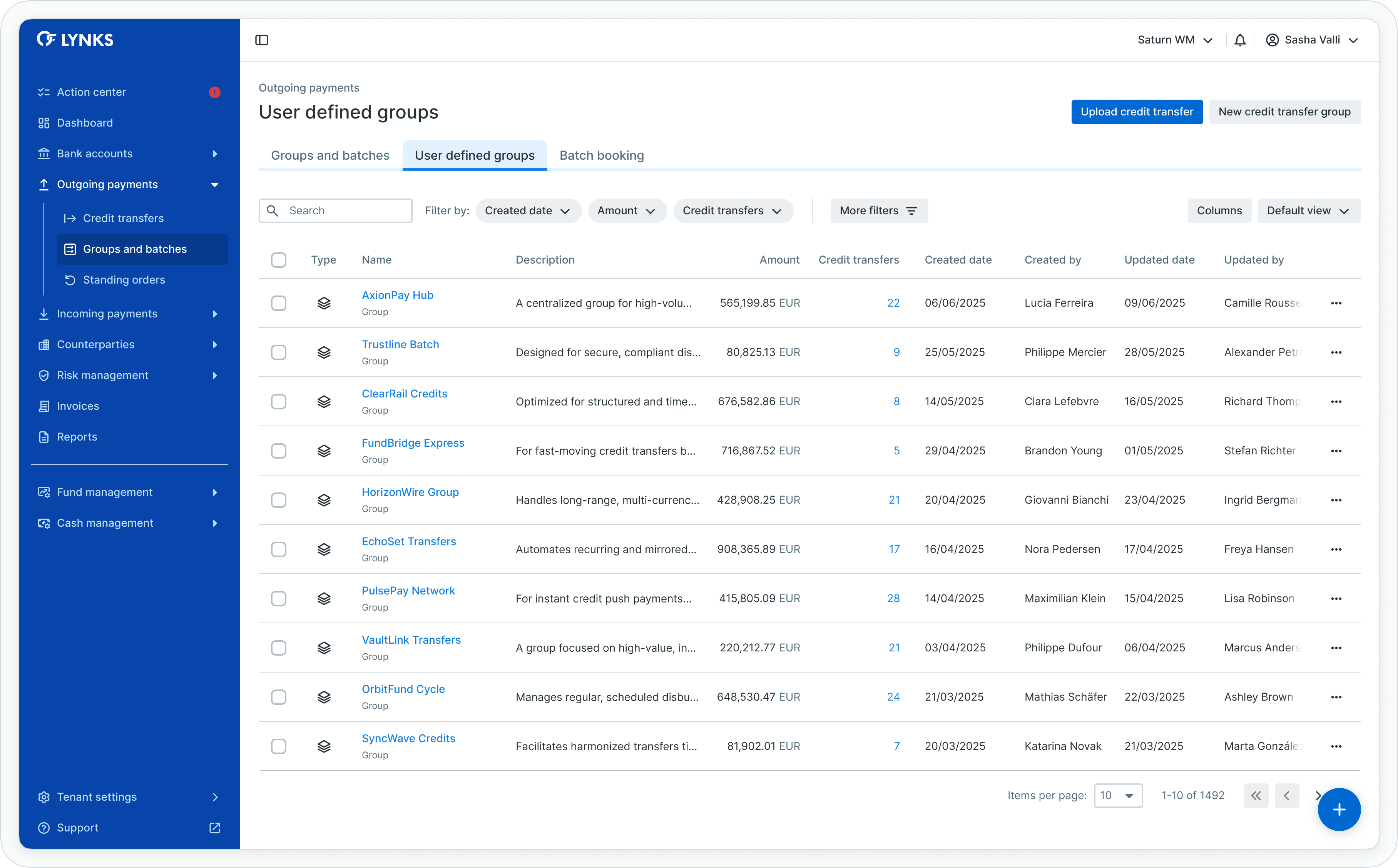

User-defined groups

User-defined credit transfer groups provide flexible organization for related transactions, enabling users to create custom collections of payments organized by project, purpose, business unit, or any criteria relevant to their operational needs.

User-defined groups tab

Group functionality

Credit transfer groups serve as organizational utilities that enable:

- Custom grouping - Create groups with custom names reflecting business logic

- Flexible membership - Add or remove credit transfers from groups at any time

- Group management - Edit group names, delete groups, or dissolve group associations

- Pre-filtered views - Quick navigation to all transactions within a specific group

Managing group membership

Users can associate credit transfers with groups or remove transactions from groups through:

- Bulk actions on the credit transfers page

- Individual payment actions from overflow menus

- Group management interface for modifying membership

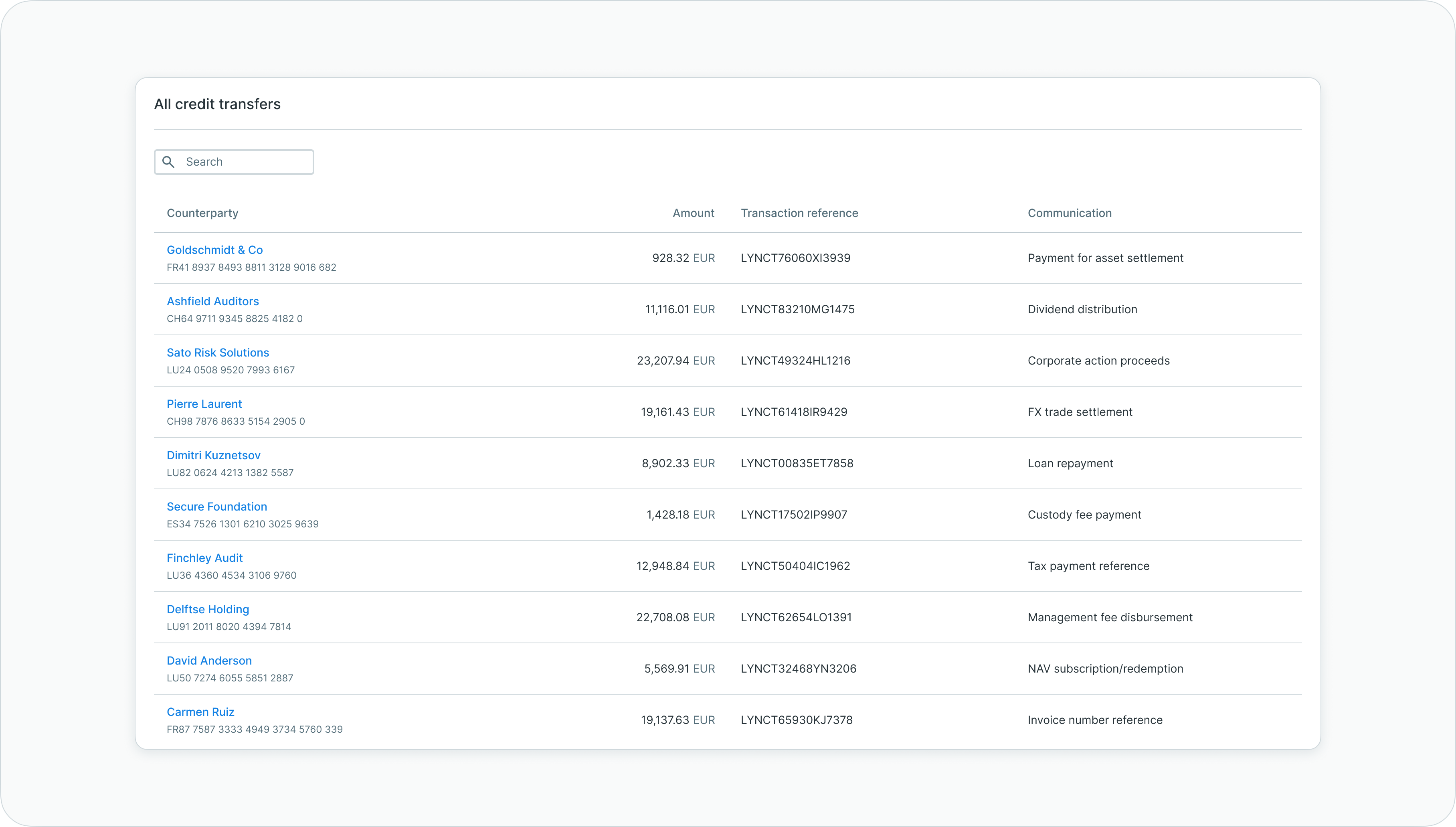

Pre-filtered credit transfers list showing group members

Use cases

User-defined groups support various organizational needs:

- Payroll processing - Group salary payments for monthly payroll batches

- Invoice payments - Organize payments to vendors or suppliers by invoice period

- Project payments - Associate all transactions related to specific projects

- Fund deals - Group payments associated with investment fund operations

- Cascading payments - Organize related sequential payment instructions

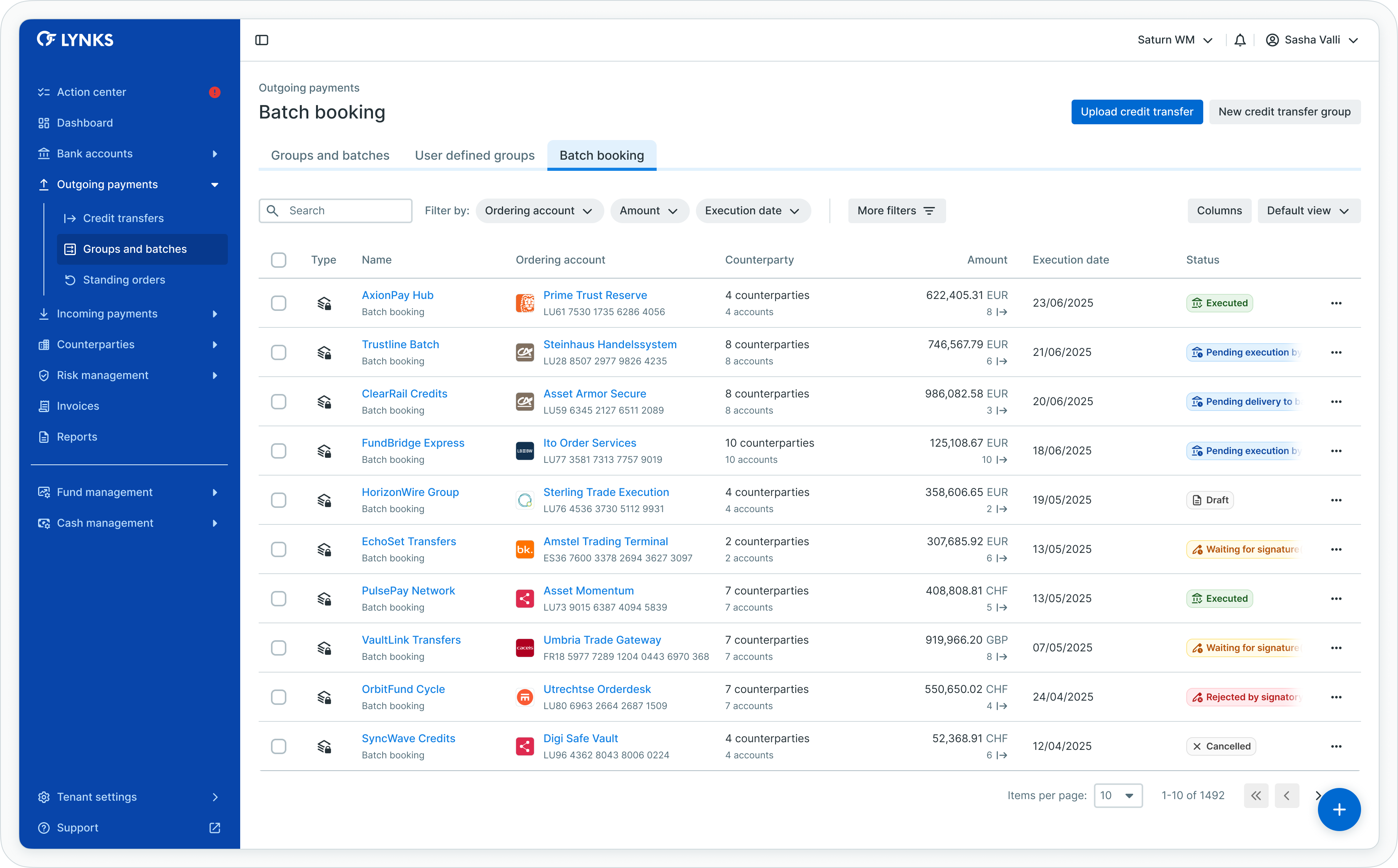

Batch bookings

Batch bookings enable processing multiple payments as a single bundled transaction, reducing overhead and simplifying reconciliation by treating numerous individual payments as one summary transaction from an approval and status tracking perspective.

Batch bookings tab

Batch booking benefits

| Benefit | Description |

|---|---|

| Time savings | Process multiple payments with single authorization workflow |

| Cost efficiency | Reduce transaction fees through bundled payment submission |

| Simplified reconciliation | Single summary transaction simplifies accounting processes |

| Unified management | All actions and status transitions affect entire batch simultaneously |

Batch booking requirements

All child payments within a batch booking must share common attributes:

- Same ordering party account - All payments originate from identical account

- EUR currency - Batch bookings support Euro transactions only

- Common dates - Identical requested authorization and execution dates across all child payments

- Same urgency - Uniform urgency level for all transactions in batch

- Same payment category - All child payments assigned to identical category

Counterparty visibilityLYNKS discloses individual counterparty details only to users with appropriate permissions to read that information. Users without counterparty access see aggregated batch information without individual beneficiary details.

Creating batch bookings

Batch bookings are created by uploading payment files (PAIN.001 XML format, CSV, or XLSX) through the upload functionality. The system validates that all child payments meet batch booking requirements before accepting the submission.

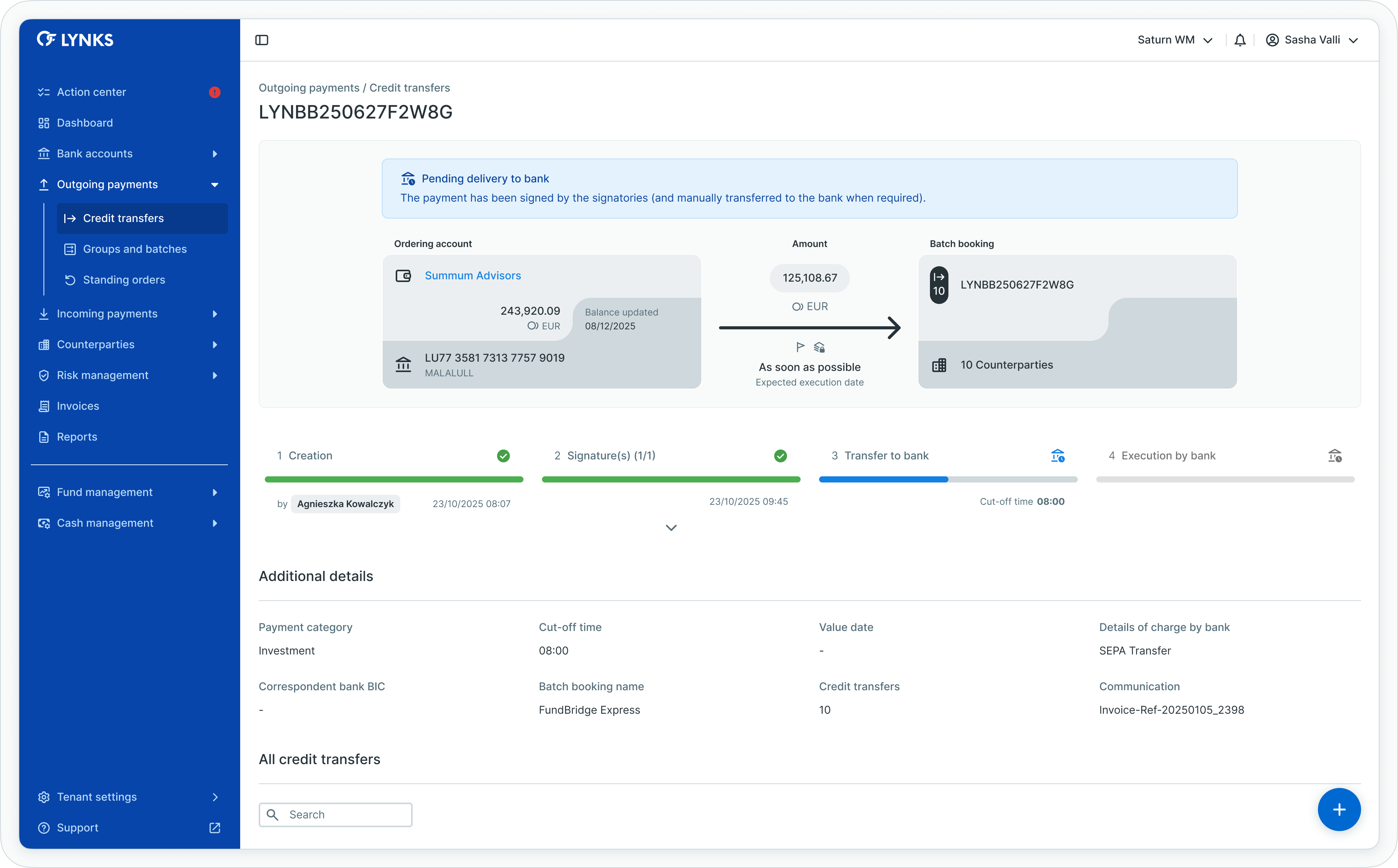

Batch booking details

The batch booking details screen presents comprehensive information about the consolidated payment, organized similarly to credit transfer details but adapted for the batch context with aggregated information and child transaction listing.

Batch booking details view

Summary information

The payment information section displays:

- Batch booking reference and name

- Status indicator with descriptive alert

- Ordering party account details

- Aggregated counterparty count - Total number of beneficiary accounts (not individual names)

- Total batch amount - Sum of all child payment amounts

- Urgency and currency

- Management action buttons

Timeline and progress

The timeline section tracks the batch booking's progress through authorization and execution stages, displaying:

- Creation details

- Authorization status and signature collection

- Bank transfer status

- Execution confirmation

All timeline stages apply to the entire batch booking as a unified transaction.

Additional details

The additional details section provides batch-specific information:

- Payment category

- Cut-off time

- Value date

- Charge details

- Number of credit transfers - Count of individual payments within the batch

- Communication text

- Credit transfer group association (if applicable)

Child transactions listing

A dedicated section displays all individual credit transfers included within the batch booking, visible only to users with permissions to view counterparty details.

Child transactions within batch booking

This section presents:

- Complete list of all child payments

- Individual counterparty information

- Payment amounts per transaction

- Reference information for each child payment

Users without counterparty read permissions see only the summary batch information without access to individual transaction details.

Status definitions

Batch bookings follow the same status progression as credit transfers, with all status transitions affecting the entire batch simultaneously rather than individual child payments.

Batch booking statuses

| Status | Definition |

|---|---|

| Draft | Batch booking created and saved without authorization submission |

| Waiting for signature(s) | Batch booking requires authorization from designated signatories |

| Rejected by signatory | Batch booking rejected during approval process |

| Waiting for manual transfer to bank | Batch booking authorized, awaiting manual submission |

| Pending delivery to bank | Batch booking transmitted to bank, awaiting acknowledgment |

| Delivered to bank | Bank acknowledged batch booking receipt |

| Pending execution by bank | Bank processing batch booking for execution |

| Executed | Bank confirmed successful batch booking execution |

| Failed | Bank rejected batch booking due to validation errors |

| Not executed by bank | Batch booking not executed, status manually updated |

| Cancelled | Batch booking cancelled before execution |

Unified status managementStatus changes apply to the summary batch booking transaction. Individual child payments inherit the batch booking's status and progress through lifecycle stages together as a unified entity.

Best practices

Follow these recommendations to maximize the effectiveness of groups and batch booking management:

- Use groups strategically - Create groups reflecting operational workflows (payroll, projects, invoice batches) for efficient payment monitoring

- Name groups clearly - Use descriptive group names that immediately convey the payment collection's purpose

- Leverage batch bookings for recurring bulk payments - Process regular high-volume payments (salaries, supplier invoices) as batch bookings to reduce overhead

- Validate batch requirements - Ensure all child payments meet batch booking criteria before uploading to avoid validation failures

- Monitor batch booking status - Track batch booking progress to identify authorization delays or processing issues affecting multiple payments

- Document batch purposes - Attach supporting documentation to batch bookings to provide context for authorizers

- Review child transactions - Check individual transactions within batch bookings to verify all payments are correct before authorization

- Clean up unused groups - Remove obsolete groups to maintain organization clarity and reduce clutter

Related documentation

Explore related sections for more information:

- Platform Navigation - Detailed guide to the head-up display, table views, filters, and search functionality - Tables, filters, search, and view customization

- Permissions - Comprehensive explanation of access control and role-based permissions - Understanding access control and account scoping

- Approvals - How approval workflows and signature processes function - Authorization workflows and signatory rules

- Action Center - Centralized task and approval management - Pending batch booking authorizations

- Credit Transfers - Review payment details before approval - Individual payment management

- Counterparties - Investor and beneficiary management - Beneficiary management and permissions

- Signatory Rules - Approval workflow configuration - Configuring authorization requirements

Support

For assistance with groups and batch bookings or questions about payment organization, contact [email protected].

Updated about 1 month ago