Credit transfers creation

Initiation

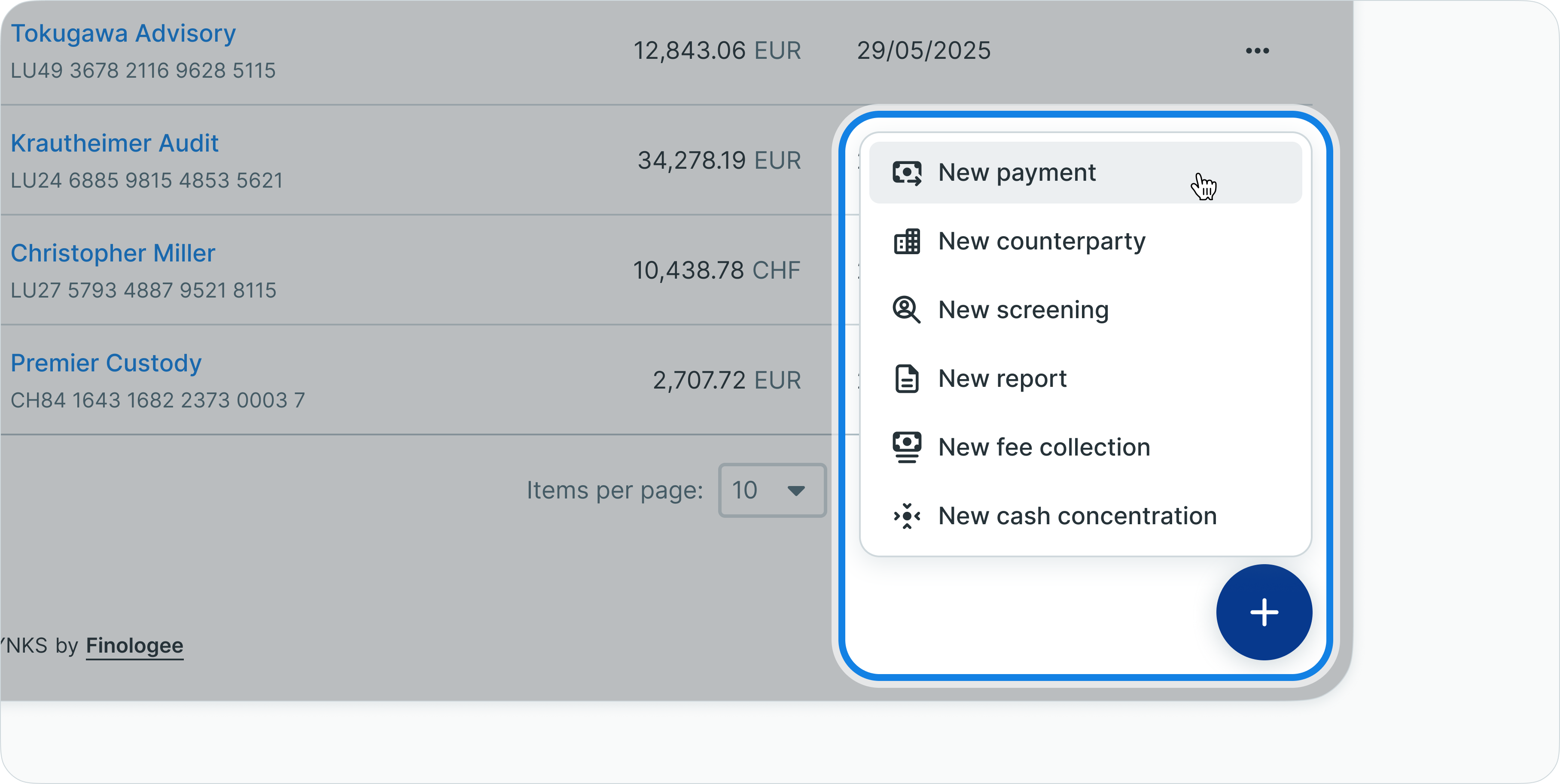

To initiate a new payment, users can conveniently create one by simply clicking on the "+" button located in the bottom right corner of the screen and clicking then on New Payment. This intuitive action allows users to quickly access the payment creation feature and begin the process of setting up a new payment transaction.

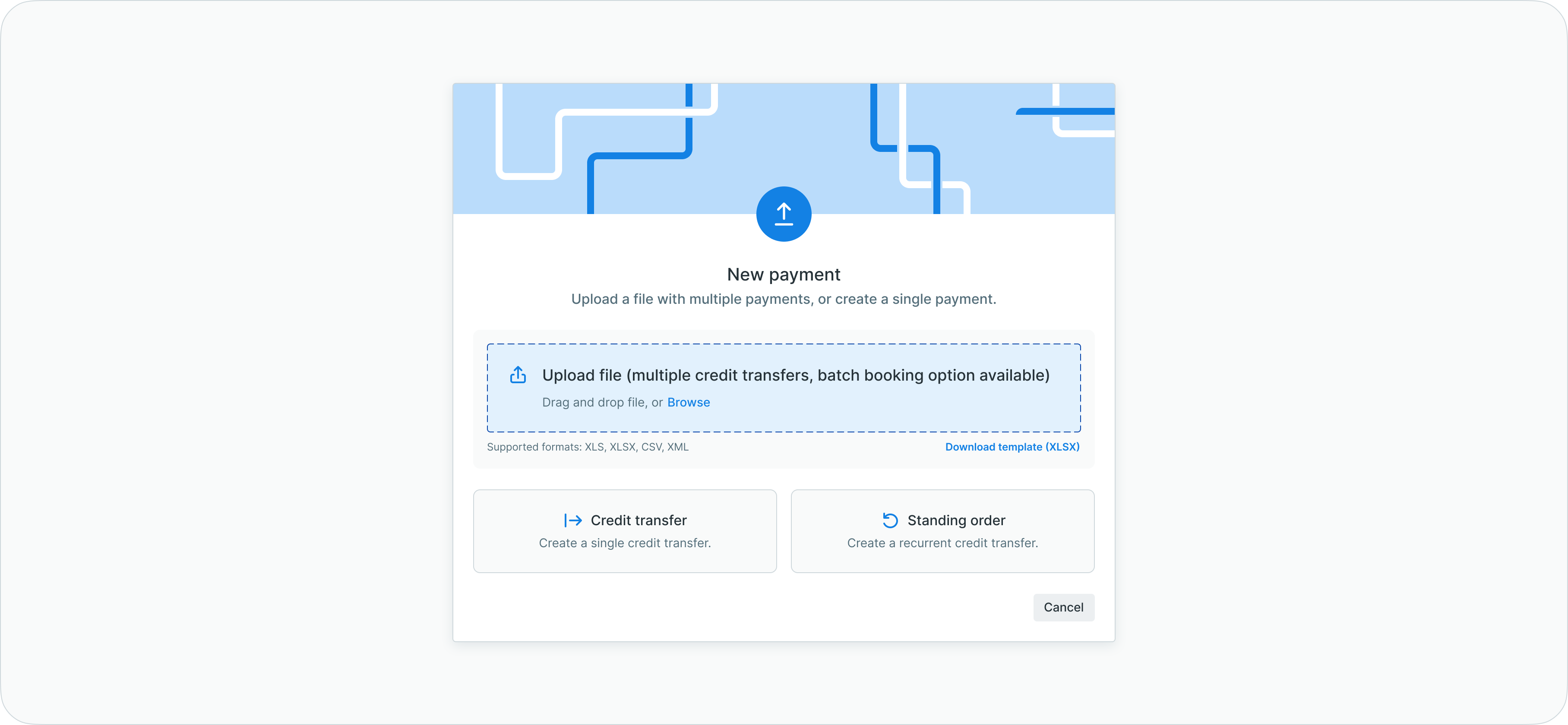

Once users choose "New Payment," they will have the following sub-options available to proceed:

- Upload file for multiple credit transfers: This option enables users to conveniently upload a file containing multiple credit transfer instructions. Users can simply drag and drop the relevant file from their device to initiate the upload.

- Create single credit transfers: Selecting "Credit Transfer" allows users to manually create individual credit transfers. They can input the necessary details, such as beneficiary information and transaction amount, to complete the transfer.

- Create Standing order: Clicking on "Standing Order" permits users to set up a recurrent credit transfer. This option is ideal for scheduling periodic payments, such as monthly subscriptions or regular bill payments.

Single Credit transfer

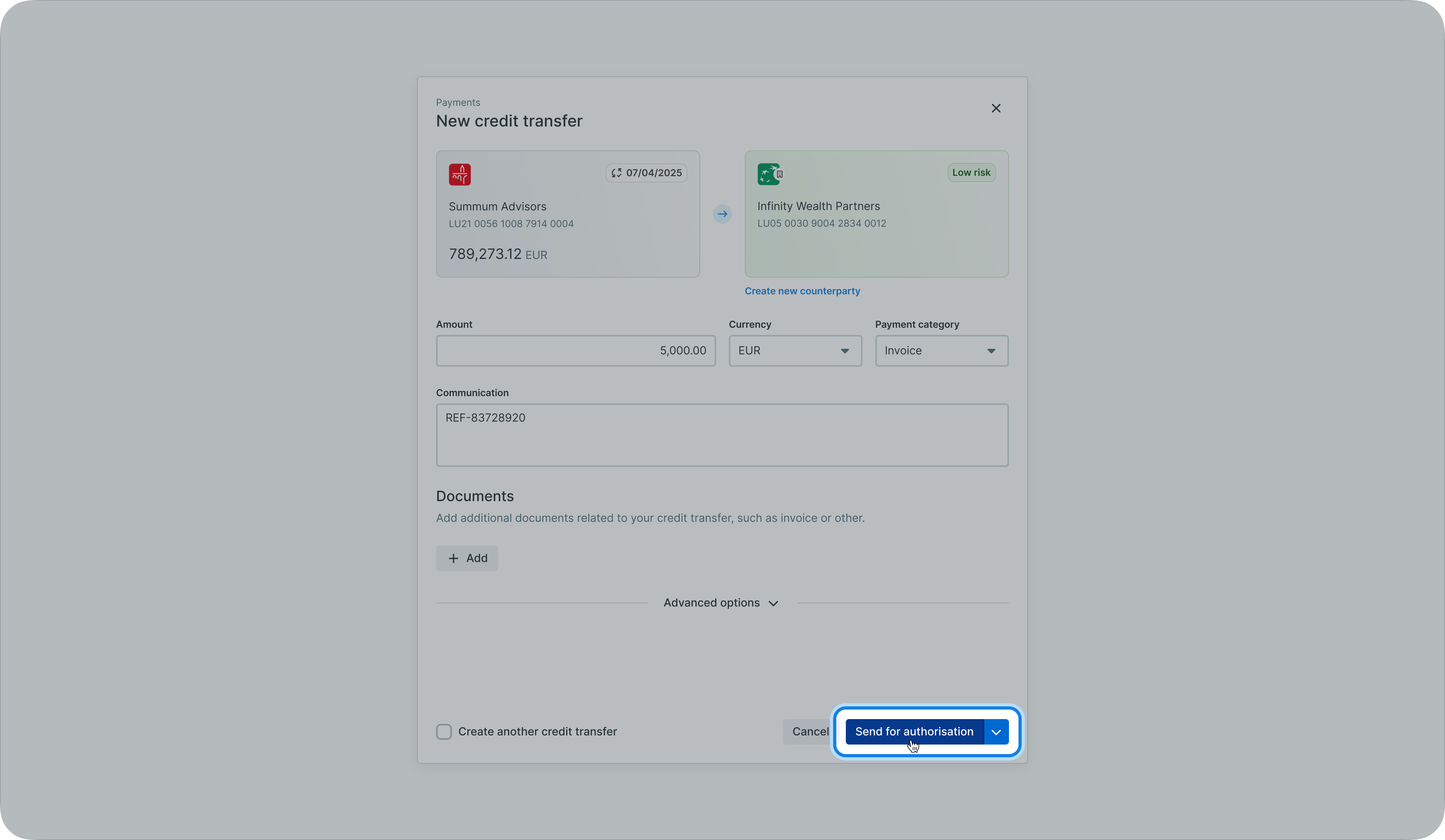

To initiate a single credit transfer in LYNKS, end users can simply click on the "Credit transfers" option, which will direct them to the "New credit transfer" screen. Here, they will be guided through a step-by-step process to complete the transfer:

- Account Selection: Users will be prompted to select the account from which the funds will be debited and the beneficiary's account to which the funds will be transferred.

- Transaction Amount: Users will need to enter the amount of the transaction and select the desired currency for the transfer.

- Payment Categories: Users will have the option to choose from three payment categories: Invoice, Commissions, and Client payment. This selection allows for proper categorization and tracking of the transaction.

- Communication Section: In this section, users can provide additional information or details regarding the transfer in the designated "Communication" field. This could include any relevant reference numbers, descriptions, or instructions.

Once the end users have completed filling in all the necessary details, they have a few options for managing the transaction:

- Cancel: If the users decide not to proceed with the transaction, they can click on the "Cancel" button. This will abort the transaction and return them to the previous screen without any further actions taken.

- Save draft: Users also have the option to save the transaction as a draft by clicking on the "Save draft" button. This allows them to store the progress made so far and come back to it later for further edits or submission.

- Send for authorisation: When the end users are ready to submit the transaction for approval, they can click on the "Send for authorisation" button. This action initiates the authorization process, and the designated signatories will receive a notification regarding the pending transaction.

Inside the advanced options:

Here some information about the flow of a payment via LYNKS:

- Urgency

- Normal

In case a payment is created with normal urgency, the payment will be sent to the bank on the cut-off time (under the condition that the required signatures are received). - Urgent

If a payment is created as URGENT, the payment will be sent to the bank immediately after successful authorisation.

- Normal

- Requested authorisation date

This field defines the deadline for signatories to review and approve payments inside LYNKS.

The date will categories the payments that are due later, due soon or overdue to be authorised. - Requested execution date

This field defines the requested execution date for the bank.

In particular, if a payment is sent to the bank urgently, then the bank will execute it on the set date.

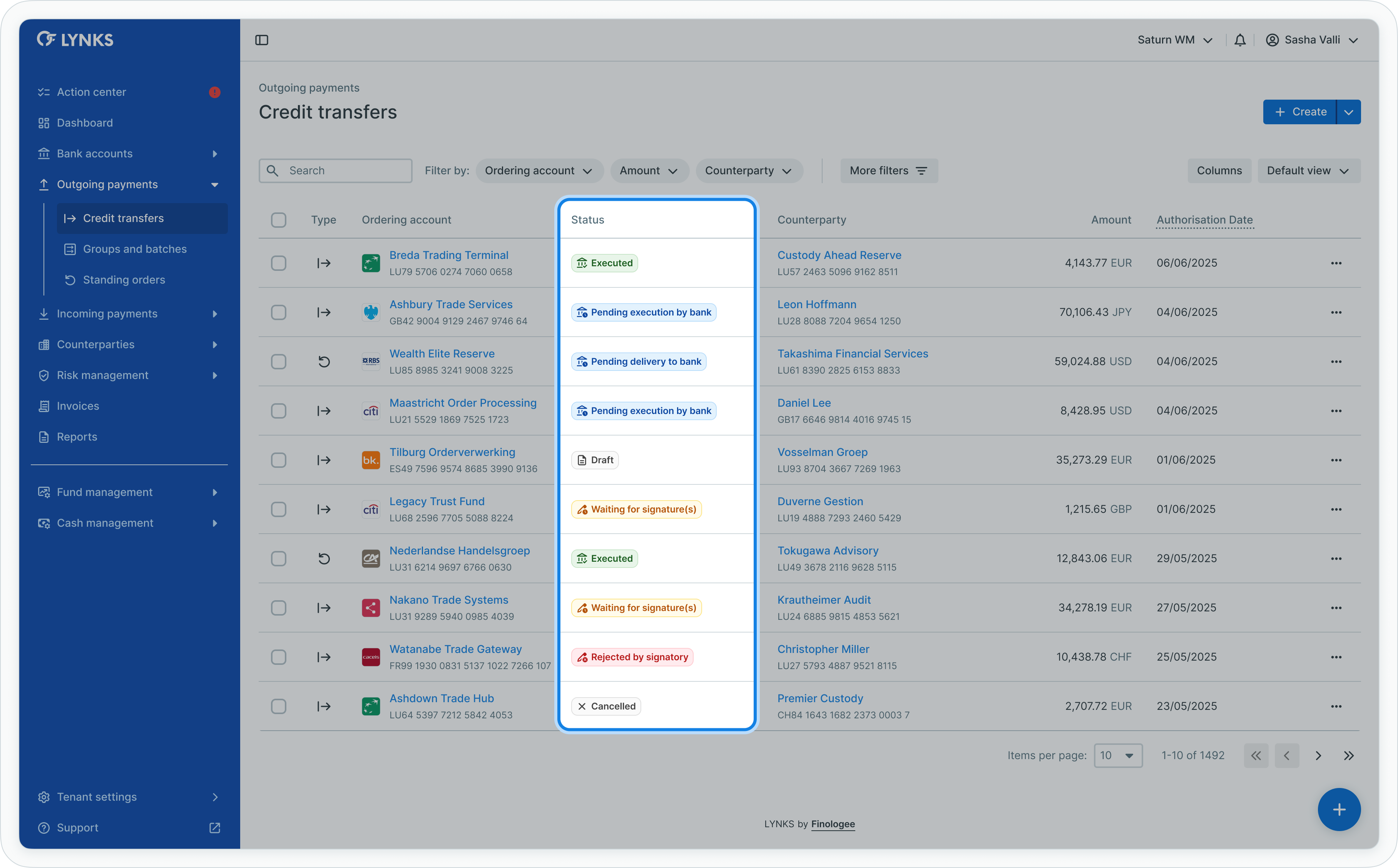

By navigating to the "Credit Transfer" section, users can easily access the relevant transaction details. Within this section, users will find a designated field labelled as 'Status', which provides real-time updates on the progress and current status of each transaction. This feature allows users to effortlessly monitor and track the status of their transactions, ensuring transparency and visibility throughout the process.

Below is the list of available payment statuses:

- Pending Execution by Bank (Blue): The payment has been delivered to the Bank (ACK notification received via the SWIFT network)

- Pending Execution by bank (Yellow): The payment has been delivered to the Bank (ACK notification received via the SWIFT network). However, there was no MT940/942 received from the bank matching this transaction.

- Pending Delivery to Bank: The payment has been signed by the signatories (and manually transferred to the bank when required.)

- Failed: Transaction has failed because of NACK reception from SWIFT network.

- Waiting for signature(s): The payment has been made and has not yet been authorized by the signatories.

- Draft: The credit transfer is a draft, and it was not sent for authorization.

Updated 4 months ago