Standing orders

Configure recurring payment instructions, manage scheduled transfers with automated execution, and monitor associated transactions for ongoing payment orders

Introduction

The Standing Orders feature enables users to configure recurring payment instructions that execute automatically according to defined schedules, eliminating the need to create repetitive payments manually. This functionality supports various recurrence patterns, allowing users to automate regular transfers such as rent payments, subscriptions, recurring invoices, or any periodic payment obligation.

The system presents standing order information through two interfaces: a list view displaying all configured recurring payment instructions with their schedules and statuses, and a detailed view providing comprehensive information about the standing order configuration and all associated transactions generated by the recurrence rule.

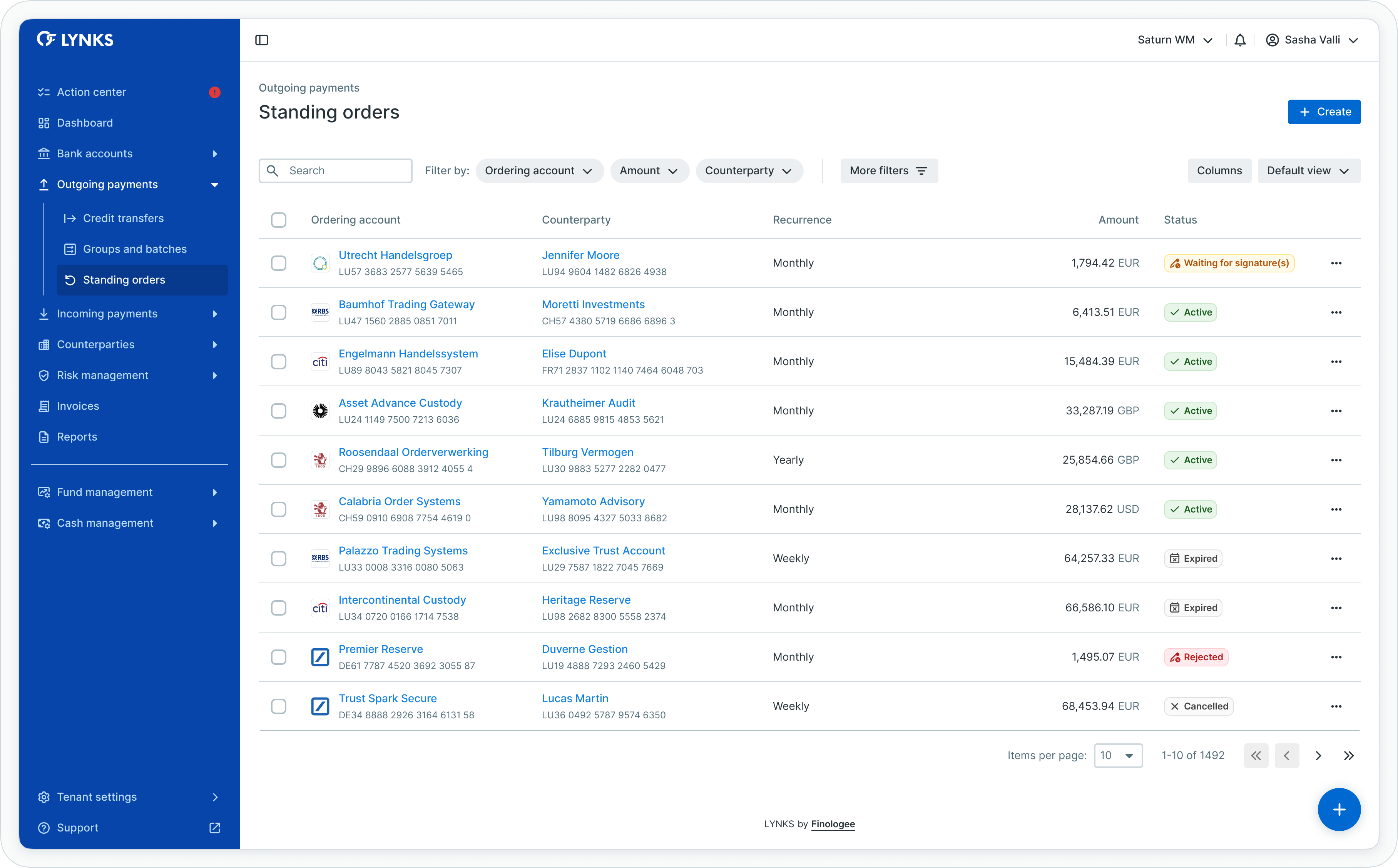

Standing orders list view

Prerequisites

Users must have the appropriate permissions to view and manage standing orders. The interface displays only standing orders associated with ordering party accounts and payment categories to which you have access rights.

Permissions

| Permission | Description |

|---|---|

STANDING_ORDER_READ | View standing orders, recurrence details, and associated transactions |

STANDING_ORDER_WRITE | Create and cancel standing orders |

Account and category scopingUsers see only standing orders associated with ordering party accounts and payment categories they have been granted access to through their permission configuration. Standing order visibility respects both account-level and category-level scoping.

Standing orders overview

Standing orders automate recurring payment execution by generating credit transfers according to configured recurrence rules. Once authorized, the system creates and executes individual payments automatically at scheduled intervals, maintaining the recurring payment instruction until expiration or manual deactivation.

Lifecycle stages

Standing orders progress through defined lifecycle stages:

- Creation and configuration - Standing order defined with recurrence pattern, amount, counterparty, and schedule

- Authorization - Collection of required signatures according to signatory rules

- Active execution - Automatic generation and execution of credit transfers according to schedule

- Expiration - Standing order concludes when all scheduled payments complete

Each stage provides specific information and available actions relevant to the standing order's current state.

Creating standing orders

Standing orders enable automation of recurring payments by configuring a single payment instruction that generates individual credit transfers automatically according to a defined schedule.

Initiating standing order creation

To begin creating a standing order:

- Locate the floating action button (+) in the bottom right corner of the screen

- Click the (+) button to open the payment creation menu

- Select Standing Order from the available options

The "New standing order" screen opens, guiding you through the configuration process.

Configuring payment details

Complete the standing order configuration by providing required information:

Step 1: Account and counterparty

- Select the ordering party account (funds will be debited from this account)

- Select or create the beneficiary counterparty account

- Ensure the counterparty is approved and active

Step 2: Payment amount and currency

- Enter the recurring payment amount

- Select the currency

- The same amount will be paid with each execution

Step 3: Payment category and reference

- Choose the appropriate payment category

- Enter a descriptive payment reference to appear on each generated credit transfer

- Include information identifying the recurring payment purpose

Configuring recurrence pattern

Define when and how often payments should execute:

Recurrence type

Choose the recurrence frequency:

- Daily - Payment executes every N days

- Weekly - Payment executes every N weeks on specified day(s)

- Monthly - Payment executes every N months on specified date

- Yearly - Payment executes every N years on specified date

Recurrence parameters

Configure the schedule:

- Start date - Date of first payment execution

- Frequency interval - Number of periods between executions (e.g., "every 2 weeks", "every 3 months")

- Execution day - Specific day for monthly/yearly or weekday for weekly recurrences

- End condition - Choose one:

- End date - Standing order expires on specific date

- Number of payments - Standing order expires after generating specified number of payments

Advanced options

Configure additional parameters:

- Urgency - Normal or Urgent for each generated payment

- Requested authorization date - Deadline for authorizing the standing order

- Payment category - Category applied to all generated credit transfers

Completing standing order creation

After configuring all parameters:

- Review all settings carefully - standing orders cannot be modified once authorized

- Choose an action:

- Cancel - Abort creation without saving

- Save draft - Store standing order for later submission

- Send for authorization - Submit immediately for signature collection

- Click the appropriate button

Once submitted for authorization, designated signatories receive notifications about the pending standing order.

Authorizing standing orders

Standing orders require authorization according to configured signatory rules before beginning automatic payment generation.

Reviewing pending standing orders

To find standing orders requiring your signature:

Via Action Center:

- Navigate to Action Center from the main menu

- Review the Payments section

- Look for "Standing orders waiting for authorization" entries

- Click the counter to view pending standing orders

Via Standing Orders list:

- Navigate to Outgoing Payments > Standing Orders

- Apply filter: Status = "Waiting for signature(s)"

- Review standing orders requiring authorization

Providing authorization

To authorize a standing order:

- Click the standing order row to open details

- Review all standing order configuration carefully:

- Ordering party and counterparty details

- Recurring payment amount and currency

- Recurrence pattern and schedule

- Start date, end condition, and total payments

- Verify the recurrence configuration matches intended payment schedule

- Check attached supporting documentation

- Click the Authorize or Sign button

- Complete authentication according to your configured method

- Confirm the signature

Once fully authorized, the standing order transitions to Active status and begins generating scheduled credit transfers.

Rejecting standing orders

To reject a standing order during authorization:

- Open the standing order details

- Click the Reject button

- Optionally provide a rejection reason

- Confirm rejection

The standing order status changes to "Rejected by signatory" and no payments will be generated.

Viewing standing order details

The standing order details screen provides comprehensive information about the recurring payment configuration and all associated transactions generated by the standing order.

Opening standing order details

To view detailed information:

- Navigate to Outgoing Payments > Standing Orders

- Locate the desired standing order in the list

- Click anywhere on the standing order row

- The details screen opens, displaying two primary tabs

Standing order tab

The standing order tab displays:

Status tracking section

- Creation details and initiator

- Authorization status and signature collection

- Activation confirmation

- Current operational state

Payment configuration

- Ordering party account information

- Counterparty account details with risk level indicator

- Payment amount and currency

- Payment category assignment

- Payment reference and communication text

- Urgency level

Recurrence configuration

- Recurrence pattern (frequency)

- Frequency interval

- Start date (first payment execution)

- End date or total payment count

- Next scheduled payment date

- Payments completed vs remaining

Additional information

- Authorization information and collected signatures

- Supporting documents attached to the standing order

- Complete audit log of actions performed

Transactions tab

The transactions tab displays all credit transfers generated by the standing order:

- Click the Transactions tab

- View the complete list of associated payments

- Each transaction displays:

- Transaction reference

- Expected execution date

- Actual execution date (when completed)

- Current status

- Payment amount

- Value date

This view enables monitoring of execution history, verification that payments executed as scheduled, and identification of any processing issues.

Managing active standing orders

Active standing orders continue generating scheduled payments until expiration or manual cancellation.

Monitoring standing order execution

To track standing order performance:

- Open the standing order details

- Review the Transactions tab to see all generated payments

- Check execution dates to verify timely processing

- Monitor payment statuses to identify any failed executions

- Compare "Payments completed" vs "Payments remaining" counters

Cancelling standing orders

To stop a standing order before natural expiration:

- Open the standing order details

- Ensure the standing order is in Active status

- Click the Cancel button or overflow menu

- Confirm cancellation

The standing order status changes to "Cancelled" and no further payments will be generated. Already-generated payments in progress continue processing.

Cancellation is permanentCancelled standing orders cannot be reactivated. To resume recurring payments, create a new standing order with the desired configuration.

Modifying standing orders

Standing orders cannot be edited once authorized and active. To change payment details or recurrence configuration:

- Cancel the existing standing order

- Create a new standing order with updated configuration

- Submit for authorization following normal approval workflow

This approach maintains clear audit trails for recurring payment commitments.

Standing orders list

The standing orders list displays all configured recurring payment instructions in a comprehensive table format, showing essential information about each standing order and enabling navigation to detailed views.

Information displayed

The standing orders list includes:

- Counterparty name and account information

- Payment amount and currency

- Ordering party account (IBAN)

- Recurrence pattern (frequency and schedule)

- Current status with visual indicators

- Start and end dates for recurrence period

- Next scheduled payment date

- Total number of payments to generate

- Payments completed count

Table functionality

The standing orders list supports standard table features:

- Column customization - Show, hide, reorder, and resize columns according to preferences

- Filtering - Apply filters by status, account, counterparty, amount ranges, currency, recurrence frequency, and dates

- Search - Quick search across counterparty names, references, and standing order identifiers

- Sorting - Sort by any column to organize standing order information

- Bulk actions - Select multiple standing orders for batch operations

- View persistence - Save customized table configurations for future sessions

Related functionalityFor detailed information about table features, filtering, and view customization, see Platform Navigation - Detailed guide to the head-up display, table views, filters, and search functionality.

Standing order details

Selecting a standing order from the list opens the details screen, presenting comprehensive information organized into two primary tabs: the standing order configuration tab showing recurrence rules and payment details, and the transactions tab displaying all credit transfers generated by the standing order.

Standing order details - standing order tab part 1

Standing order details - standing order tab part 2

Status tracking section

The top section displays status transitions for the standing order, tracking the progression from creation through authorization to active execution. This section functions comparably to the timeline view for credit transfers, providing visibility into:

- Creation details and initiator

- Authorization status and signature collection

- Activation confirmation

- Current operational state

Standing order information

The standing order tab presents configuration details in a comprehensive tile-based layout:

Payment details

- Ordering party account information

- Counterparty account details with risk level indicator

- Payment amount and currency

- Payment category assignment

- Payment reference and communication text

- Urgency level

Recurrence configuration

- Recurrence pattern (daily, weekly, monthly, yearly)

- Frequency interval

- Start date (first payment execution)

- End date or total payment count

- Next scheduled payment date

- Payments completed vs remaining

Additional information

The standing order details also include:

- Authorization information - Signatory requirements and collected signatures

- Documents section - Supporting documentation attached to the standing order

- Audit log - Complete history of actions performed on the standing order

Transactions tab

The transactions tab displays all credit transfers generated by the standing order, providing comprehensive oversight of executed and scheduled payments.

Transactions tab showing associated payments

Transaction information

Each associated transaction displays:

- Transaction reference

- Expected execution date

- Actual execution date (when completed)

- Current status

- Payment amount

- Value date

This view enables users to monitor the execution history of the standing order, verify that payments executed as scheduled, and identify any payments that encountered issues during processing.

Status definitions

Standing orders progress through defined statuses reflecting their position in the authorization and execution lifecycle.

Standing order statuses

| Status | Definition |

|---|---|

| Waiting for signature(s) | Standing order created, requiring authorization from designated signatories before activation |

| Rejected by signatory | Standing order rejected during approval process by one or more signatories |

| Active | Standing order authorized and operational, automatically generating scheduled payments |

| Expired | Standing order completed after all scheduled payments executed or end date reached |

| Cancelled | Standing order cancelled before completion, no further payments will generate |

Authorization requirementStanding orders require authorization according to signatory rules before activation. Once approved, the standing order transitions to Active status and begins automatic payment generation according to the configured recurrence pattern.

Recurrence patterns

Standing orders support flexible recurrence configuration, enabling users to define payment schedules matching various recurring payment needs.

Recurrence types

| Recurrence Type | Description | Example Use Cases |

|---|---|---|

| Daily | Payment executes every N days | Daily operational expenses, short-term recurring obligations |

| Weekly | Payment executes every N weeks on specified day(s) | Weekly service fees, regular supplier payments |

| Monthly | Payment executes every N months on specified date | Monthly rent, subscription payments, recurring invoices |

| Yearly | Payment executes every N years on specified date | Annual membership fees, yearly insurance premiums |

Recurrence parameters

Standing orders define recurrence through configurable parameters:

- Start date - First payment execution date

- End condition - Either specific end date or total payment count

- Frequency interval - Number of periods between executions

- Execution day - Specific day for monthly/yearly recurrences or weekday for weekly recurrences

Weekend and holiday handlingWhen scheduled execution dates fall on weekends or bank holidays, the system adjusts payment execution according to configured rules, typically executing on the next business day.

Best practices

Follow these recommendations to maximize the effectiveness of standing order management:

- Review active standing orders regularly - Periodically audit active standing orders to ensure they still reflect current payment obligations

- Monitor transaction execution - Check the transactions tab to verify payments execute as scheduled and identify execution failures

- Set appropriate end dates - Define clear end dates or payment counts to prevent standing orders from continuing indefinitely

- Use descriptive references - Include clear payment references to facilitate reconciliation and identification of recurring payments

- Deactivate obsolete standing orders - Cancel standing orders that are no longer needed rather than letting them expire naturally

- Verify counterparty details - Ensure counterparty information remains current, especially for long-duration standing orders

- Attach supporting documentation - Include contracts or agreements justifying the recurring payment for audit and approval purposes

- Configure signatory rules appropriately - Ensure standing order authorization requirements match organizational controls for recurring payment commitments

- Plan for amount changes - When payment amounts change, create new standing orders rather than modifying active ones to maintain clear audit trails

Related documentation

Explore related sections for more information:

- Platform Navigation - Detailed guide to the head-up display, table views, filters, and search functionality - Tables, filters, search, and view customization

- Permissions - Comprehensive explanation of access control and role-based permissions - Understanding access control and account scoping

- Approvals - How approval workflows and signature processes function - Authorization workflows and signatory rules

- Action Center - Centralized task and approval management - Pending standing order authorizations

- Credit Transfers - Review payment details before approval - Individual payment details for generated transactions

- Counterparties - Investor and beneficiary management - Beneficiary management and validation

- Cash Management - Automated payment rules and cash concentration - Automated payment rules and cash concentration

- Signatory Rules - Approval workflow configuration - Configuring authorization requirements

Support

For assistance with standing orders or questions about recurring payment automation, contact [email protected].

Updated 2 months ago