Approvals

Understanding approval workflows and governance principles across payments, counterparties, cash concentration rules, and configuration changes

Introduction

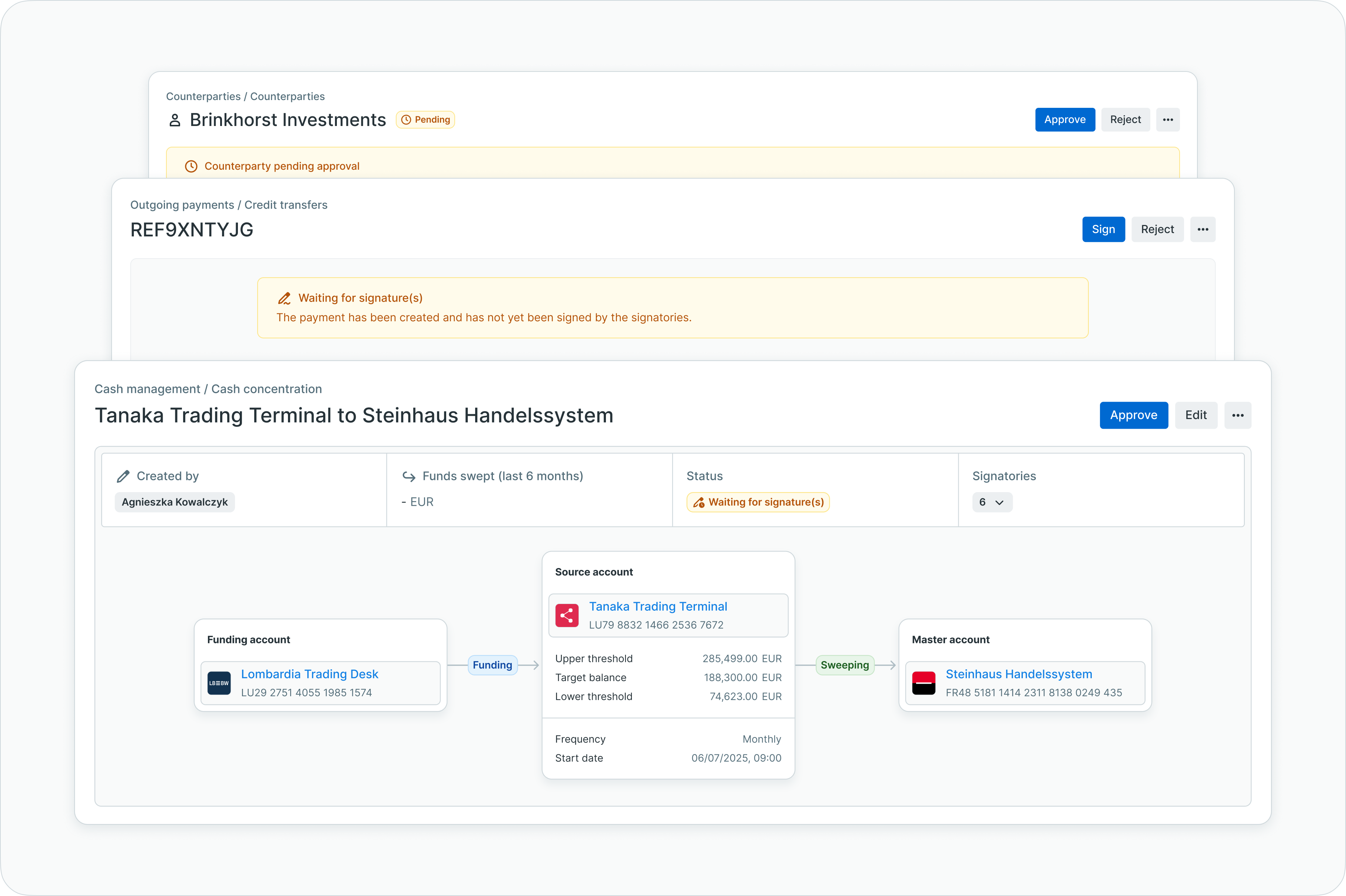

Approvals in LYNKS enforce governance and risk management through controlled review processes across different operational areas. The platform implements distinct approval mechanisms for payments, counterparties, cash concentration rules, and system configuration—each designed for its specific context and risk profile.

These approval workflows embody the four-eyes principle (maker-checker), requiring that different individuals create and authorize actions. This segregation of duties prevents unauthorized changes, reduces operational errors, and maintains clear accountability through comprehensive audit trails. Each approval type operates independently with its own workflow, permissions, and validation rules.

Different approval types in LYNKS

Updated about 2 months ago