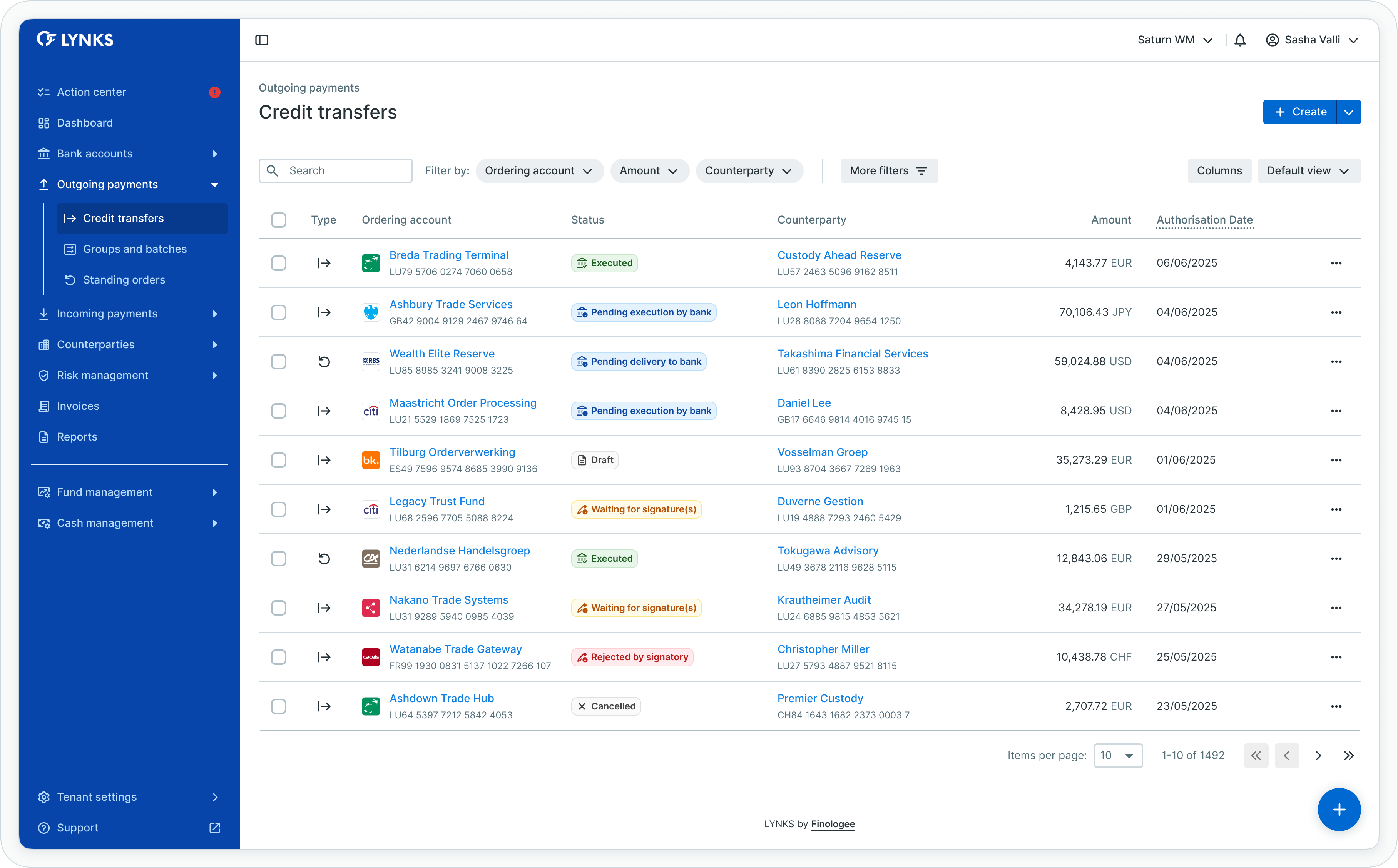

Credit transfers

Create and track individual credit transfers, monitor payment status through approval workflows, and access comprehensive payment details with timeline tracking

Introduction

The Credit Transfers feature provides comprehensive tools for managing all outgoing payment instructions, enabling users to track credit transfers from creation through execution. This interface consolidates payment information, status updates, and approval workflows into an accessible view where users can monitor individual transactions, review payment details, and manage authorizations efficiently.

The system presents payment data through two primary interfaces: a list view showing all credit transfers with customizable columns and filters, and a detailed view displaying complete payment information including timeline tracking, additional details, attached documents, and audit history.

Credit transfers list view

Prerequisites

Users must have the appropriate permissions to view and manage credit transfers. The interface displays only transactions for ordering party accounts and payment categories to which you have access rights.

Permissions

| Permission | Description |

|---|---|

PAYMENT_READ | View credit transfers, payment details, and status information |

PAYMENT_CREATE | Create new credit transfers and save drafts; manage payment groups |

PAYMENT_APPROVE | Submit draft payments for authorization |

PAYMENT_AUTHORISE | Sign or reject payments (signatory right) |

PAYMENT_CANCEL | Cancel payments before bank submission |

PAYMENT_CANCEL_DRAFT | Cancel payments in draft status only |

PAYMENT_SEND_TO_BANK | Manually send authorized payments to the bank |

PAYMENT_DOCUMENT_ATTACH | Attach, edit, or delete documents on payments |

PAYMENT_SEND_REMINDER | Send reminder notifications to signatories |

PAYMENT_MANUAL_CHANGE_STATUS | Manually change payment status between executed and rejected states |

Account and category scopingUsers see only credit transfers associated with ordering party accounts and payment categories they have been granted access to through their permission configuration. Transaction visibility respects both account-level and category-level scoping.

Credit transfers overview

The Credit Transfers section enables users to navigate through all initiated outgoing payments, providing visibility into transaction details, counterparty information, amounts, and current processing status. This comprehensive view supports efficient payment activity monitoring and management.

Transaction lifecycle

Credit transfers progress through multiple states from creation to final execution:

- Creation - Payment initiated as draft or sent for authorization

- Authorization - Collection of required signatures according to signatory rules

- Bank delivery - Immediate transmission of authorized payment to the bank; weekend and holiday execution dates are automatically adjusted to the next banking day

- Execution - Payment processing and settlement by the bank

Each stage provides specific information and actions relevant to the payment's current state, enabling users to understand precisely where each transaction stands in its processing lifecycle.

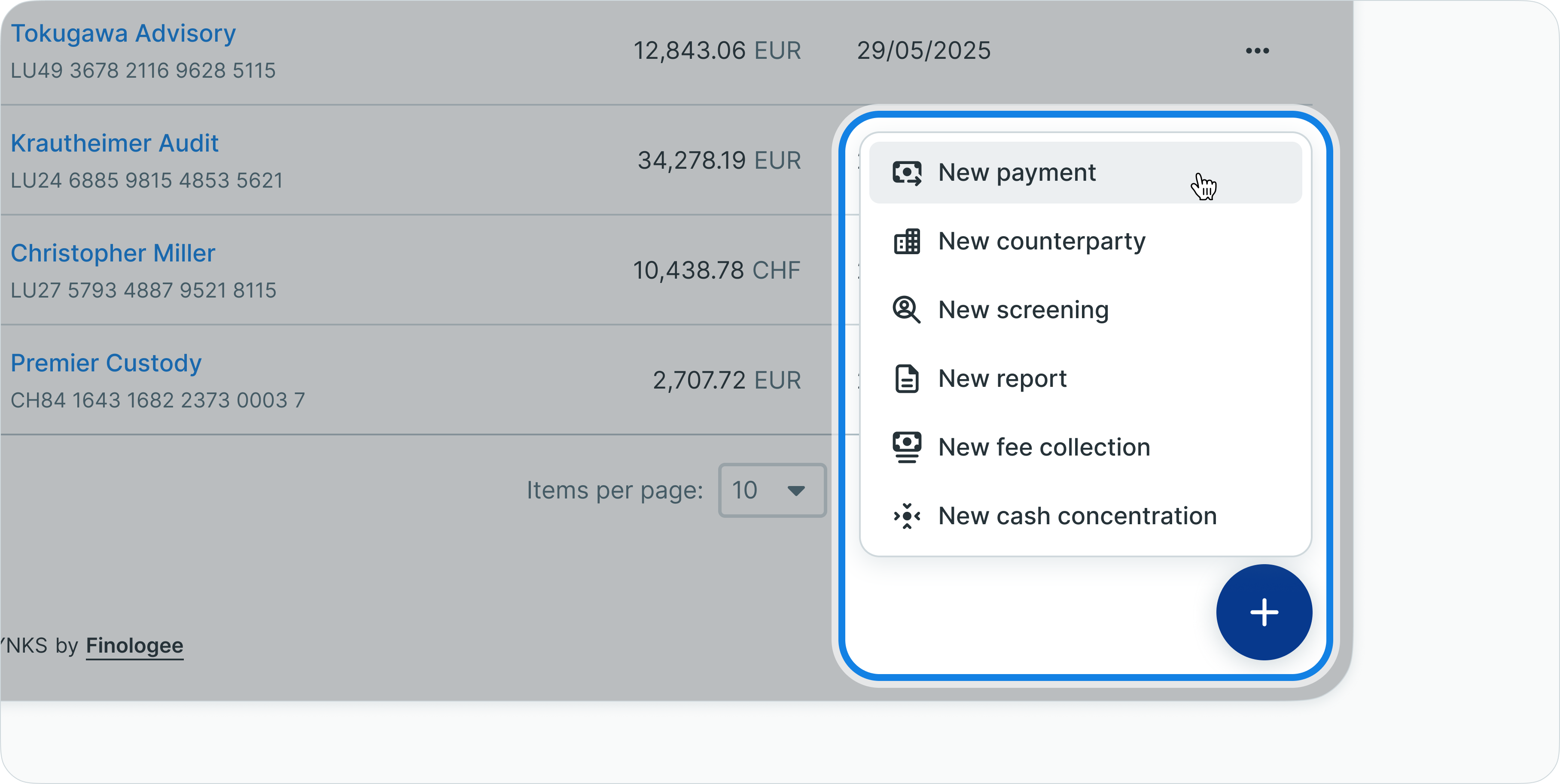

Creating credit transfers

LYNKS provides multiple methods for initiating credit transfers, enabling users to create single payments, upload bulk payment files, or configure recurring payments through standing orders.

Initiating new payments

To begin creating a payment:

- Locate the floating action button (+) in the bottom right corner of the screen

- Click the (+) button to open the payment creation menu

- Select from the available options:

- Upload file for multiple credit transfers - Bulk payment file upload

- Credit Transfer - Create single individual payment

- Standing Order - Configure recurring payment

Payment creation menu

Payment type selection

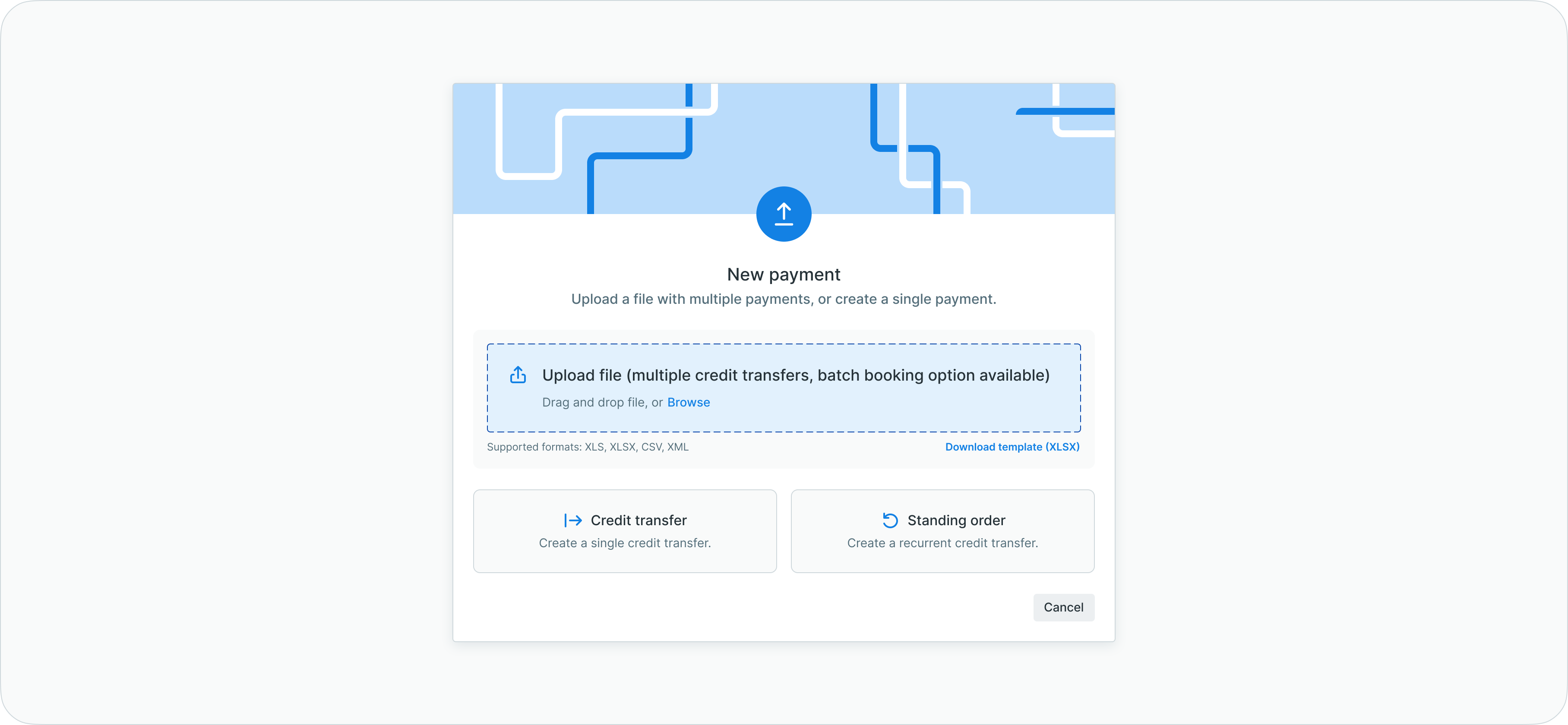

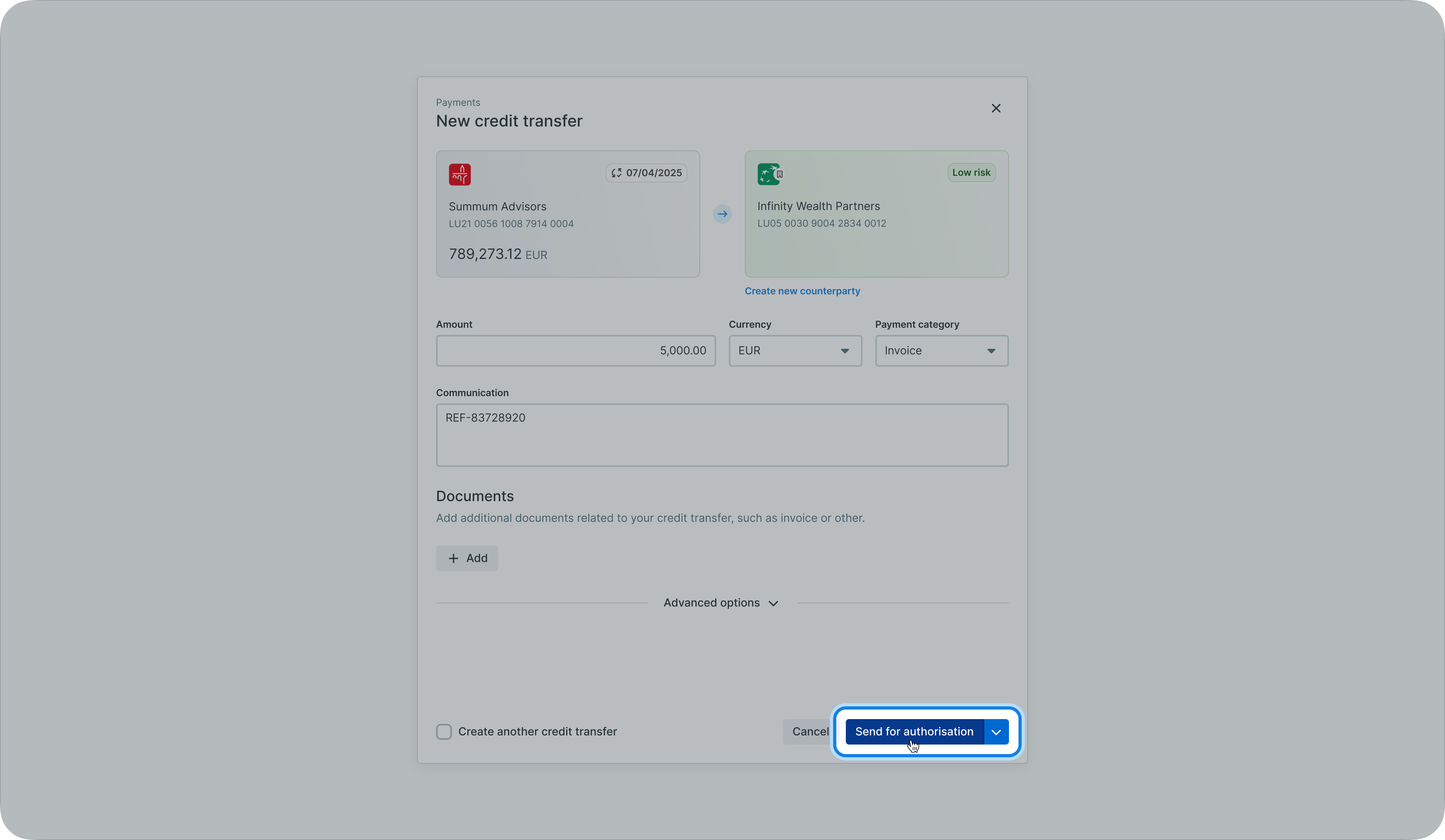

Creating single credit transfers

To create an individual credit transfer:

- Click (+) and select Credit Transfer

- The "New credit transfer" screen opens, guiding you through required fields:

Step 1: Account selection

- Select the ordering party account (funds will be debited from this account)

- Select or create the beneficiary counterparty account (funds will be transferred to this account)

Step 2: Transaction amount

- Enter the payment amount

- Select the currency for the transfer

Step 3: Payment category

- Choose the appropriate payment category from available options

- Payment categories enable transaction categorization and tracking

Payment category selection

Step 4: Communication

- Enter payment reference information in the Communication field

- Include relevant reference numbers, descriptions, or instructions for the beneficiary

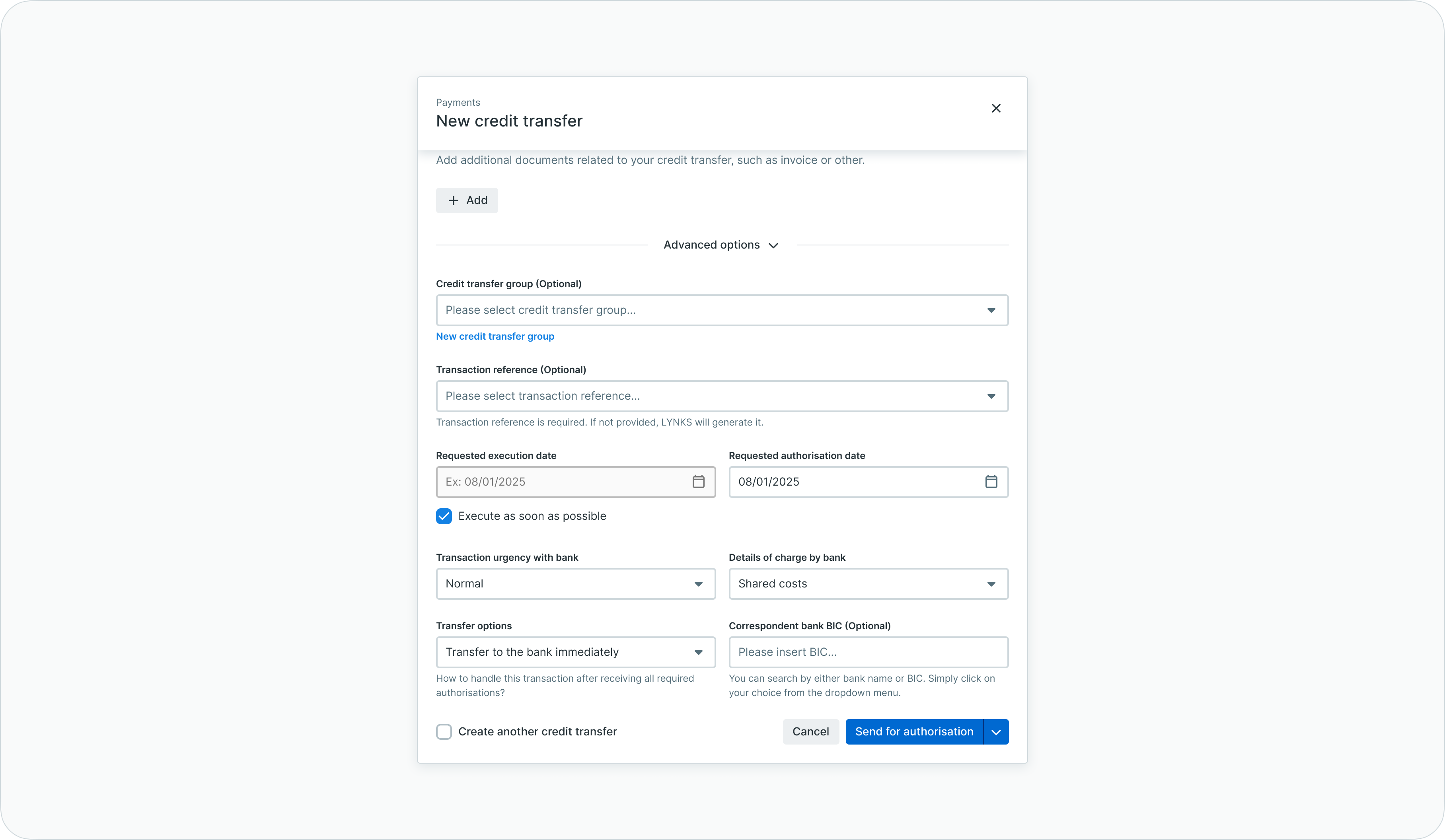

Step 5: Advanced options (optional)

Expand advanced options to configure additional parameters:

- Urgency

- Normal - Standard SEPA credit transfer

- Urgent - SEPA Instant credit transfer for faster settlement at the bank

- Requested authorization date - Deadline for signatories to approve the payment in LYNKS

- Requested execution date - Date when the bank should execute the payment

Advanced payment options

Completing payment creation

After filling all required fields, choose an action:

- Cancel - Abort payment creation and return to previous screen without saving

- Save draft - Store payment as draft for later editing or submission

- Send for authorization - Submit payment immediately for signature collection

Send for authorization button

Once submitted for authorization, designated signatories receive notifications about the pending payment.

Uploading bulk payment files

To create multiple payments simultaneously:

- Click (+) and select Upload file for multiple credit transfers

- Drag and drop your payment file or click to browse

- Supported file formats:

- PAIN.001 XML (ISO 20022)

- CSV format (according to LYNKS template)

- XLSX format (according to LYNKS template)

- The system validates the file and creates individual credit transfers

- Review validation results and correct any errors

- Submit for authorization or save as drafts

Batch booking creationWhen uploading files where all payments share common attributes (same account, currency, dates, category), the system creates a batch booking. For information about batch bookings, see Groups and Batches - Organizing payments and bulk processing.

Multi-currency account support

For foreign exchange payments from multi-currency accounts, bulk upload files support two additional optional fields that enable precise identification of which currency line to use:

- Ordering Party Account Currency - Specifies the currency to debit from the ordering account

- Ordering Party BIC - Identifies the specific BIC when multiple BIC codes share the same IBAN

These fields enable unique identification of ordering accounts when multiple currency lines or BIC codes are associated with the same IBAN. The platform validates ordering accounts using IBAN, BIC, and currency parameters together, ensuring each payment debits the correct account line.

Managing draft payments

Draft payments allow users to save payment information without submitting for authorization, enabling preparation of payments for future submission.

Creating drafts

To save a payment as draft:

- Create a new credit transfer following the creation workflow

- Fill in payment details

- Click Save draft instead of Send for authorization

- The payment saves with status "Draft"

Editing drafts

To modify a draft payment:

- Navigate to the Credit Transfers list

- Apply filter to show only "Draft" status payments

- Click the draft payment row to open payment details

- Click the Edit button (typically in the top right of the details screen)

- Modify payment fields as needed

- Choose to:

- Save draft - Store updated information

- Send for authorization - Submit the modified payment

- Cancel - Discard changes and return to payment details

Deleting drafts

To remove a draft payment:

- Open the draft payment details

- Click the overflow menu (three dots) or find the Delete action

- Confirm deletion when prompted

- The draft payment is permanently removed

Authorizing credit transfers

Credit transfers require authorization according to configured signatory rules before the system can transmit them to the bank.

Reviewing pending authorizations

To find payments requiring your signature:

- Navigate to the Action Center from the main menu

- Review the Payments section showing pending authorizations by urgency:

- Overdue - Requiring immediate attention

- Due soon - Due within next 7 days

- Due later - Due after 7 days

- Click a counter to view pre-filtered list of payments requiring authorization

Alternatively, access pending authorizations directly:

- Navigate to Credit Transfers from the main menu

- Apply filter: Status = "Waiting for signature(s)"

- Review payments requiring authorization

Providing signatures

To authorize a credit transfer:

- Open the payment details by clicking the payment row

- Review all payment information carefully:

- Ordering party and counterparty details

- Amount and currency

- Payment category and reference

- Requested execution date

- Verify counterparty risk level indicator

- Check attached documents for supporting evidence

- Click the Authorize or Sign button

- Complete authentication according to your configured method:

- LYNKS Mobile App approval

- LuxTrust token or signing stick

- SSO authentication

- Confirm the signature

The payment status updates automatically once you provide your signature. If additional signatures are required, the payment remains in "Waiting for signature(s)" status until all required signatories approve.

Rejecting payments

To reject a payment during authorization:

- Open the payment details

- Click the Reject button

- Optionally provide a rejection reason

- Confirm rejection

The payment status changes to "Rejected by signatory" and the creator receives notification.

Authorization workflowsFor detailed information about signatory rules, approval workflows, and authentication methods, see:

- Approvals - How approval workflows and signature processes function - Authorization workflows and signatory requirements

- Signatory Rules - Approval workflow configuration - Configuring authorization rules

- Authentication Methods - Detailed setup and usage of SSO, LuxTrust, and mobile app authentication - Signature methods and security

Attaching documents

Supporting documentation provides context and evidence for payment authorization and audit purposes.

Adding documents to payments

To attach files to a credit transfer:

- Open the payment details

- Scroll to the Documents section

- Click Add document or Upload button

- Choose the document type:

- Upload file - Attach PDF files from your local system

- Add link - Provide URL to web-hosted documents

- Select the file or enter the URL

- Optionally add a description

- Click Save or Add

The document appears in the documents section, visible to all users with access to the payment.

Downloading attached documents

To access attached documentation:

- Open the payment details

- Navigate to the Documents section

- Click the download icon next to the desired document

- The file downloads to your local system

Removing documents

To delete attached documents:

- Open the payment details (payment must be in editable status)

- Navigate to the Documents section

- Click the delete icon or overflow menu on the document

- Confirm deletion

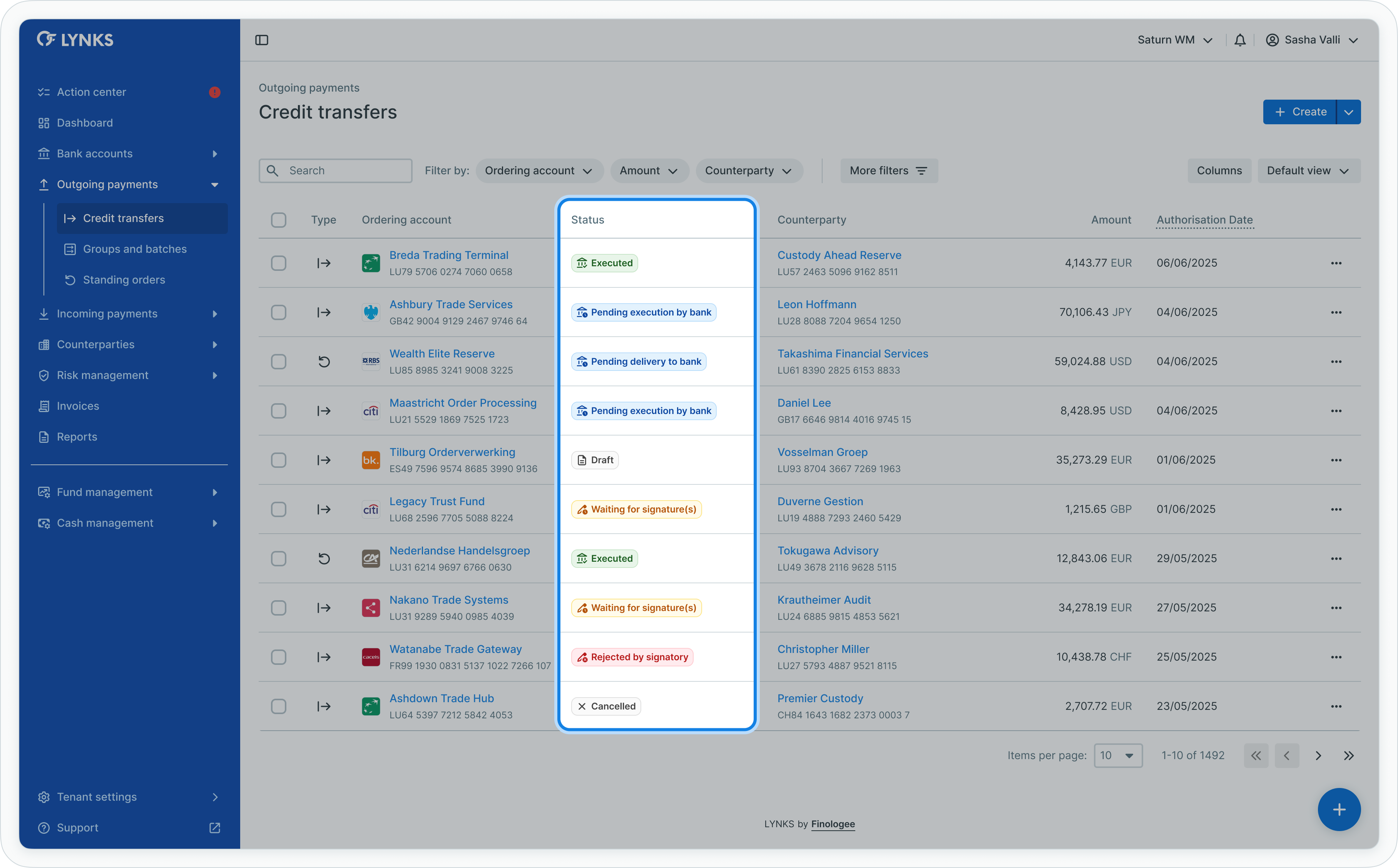

Monitoring payment status

LYNKS provides multiple tools for tracking credit transfer progress through the payment lifecycle.

Viewing status in credit transfers list

To check payment status:

- Navigate to Credit Transfers from the main menu

- Locate the Status column in the table

- Observe the status indicator and text for each payment

Payment status in credit transfers list

Status colors provide quick visual indication:

- Gray - Draft or pending internal actions

- Blue - In authorization or bank processing

- Yellow - Pending execution or attention required

- Green - Successfully executed

- Red - Failed or rejected

Using status filters

To focus on payments in specific statuses:

- Open the Credit Transfers list

- Click the filter controls

- Select Status filter

- Choose one or multiple statuses to display

- The list updates to show only matching payments

Credit transfers list with status filter applied

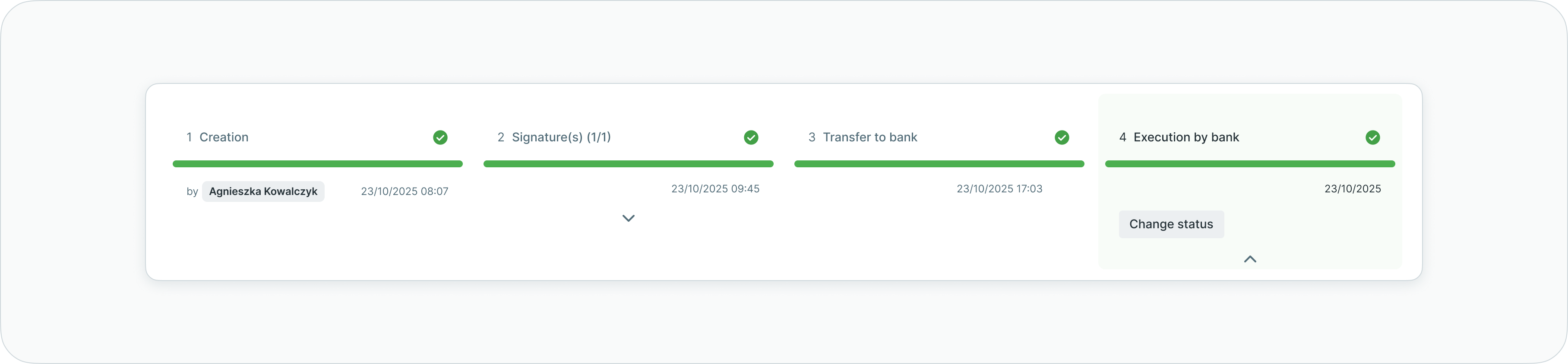

Viewing detailed status progression

To see complete payment lifecycle:

- Open payment details by clicking a payment row

- Review the Timeline section showing all four stages:

- Creation

- Authorization

- Bank transfer

- Execution

- Each stage displays relevant information and timestamps

- The timeline provides complete visibility into payment progress

For detailed status definitions and meanings, see the Status definitions section below.

Credit transfers list

The credit transfers list displays all outgoing payments in a comprehensive table format, enabling users to view essential payment information and access detailed views for individual transactions.

Information displayed

The credit transfers list includes:

- Transaction reference number

- Ordering party account (IBAN)

- Counterparty name and account information

- Payment amount and currency

- Requested execution date

- Payment urgency (normal, urgent, ASAP)

- Current status with visual indicators

- Payment category

- Value date

- Creation date and creator

Table functionality

The credit transfers list supports standard table features:

- Column customization - Show, hide, reorder, and resize columns to display all relevant details

- Filtering - Apply filters by status, account, counterparty, date ranges, amount ranges, currency, urgency, and category

- Search - Quick search across transaction references, counterparty names, and communication fields

- Sorting - Sort by any column to organize payment information

- Bulk actions - Select multiple transactions for batch operations

- View persistence - Save customized table configurations for future sessions

Related functionalityFor detailed information about table features, filtering, and view customization, see Platform Navigation - Detailed guide to the head-up display, table views, filters, and search functionality.

Credit transfer details

Selecting a credit transfer from the list opens the payment details screen, presenting comprehensive information organized into dedicated sections. This single-page view consolidates all payment-related data, enabling users to understand the complete payment context and history.

Credit transfer details view - part 1

Credit transfer details view - part 2

Payment information and status

The top section displays critical payment information with status-specific details:

- Transaction reference displayed prominently

- Current status with descriptive alert and status color

- Ordering party account details (IBAN, BIC, balance)

- Payment amount, urgency indicator, and currency

- Counterparty account information (name, IBAN, BIC, risk level)

- Management action buttons positioned for quick access

Payment information and status section

Status-specific displayThe information displayed varies according to the payment's current status, showing relevant data and available actions appropriate to each processing stage.

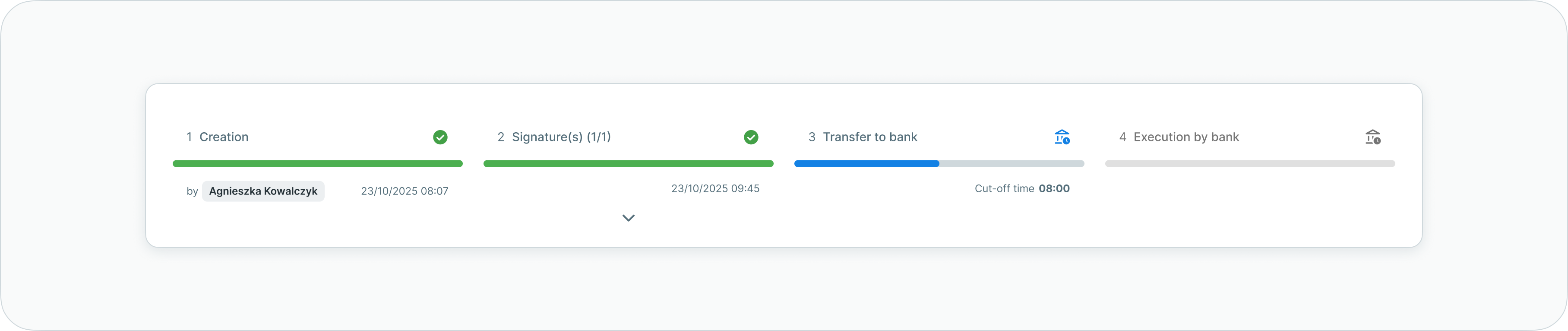

Timeline visualization

The timeline section presents a visual representation of the payment's progress through four major stages, capturing the evolution of status transitions with relevant metadata.

Timeline - authorization stage

Timeline stages

| Stage | Description |

|---|---|

| 1. Creation | Initial payment creation noted with creator details and timestamp, showing either draft status or immediate authorization submission |

| 2. Authorization | Overview of requested signatories eligible to authorize and tracking of received signatures for the payment |

| 3. Bank transfer | Status update showing immediate submission to the bank after authorization; weekend and holiday execution dates are automatically adjusted to the next banking day |

| 4. Execution | Final stage marked with full timeline color change, delivery timestamp, and value date confirmation |

Timeline - signatures collected

Timeline - pending delivery to bank

Timeline - manual transfer to bank

Timeline - executed successfully

Negative status tracking

For payments encountering issues (failed, cancelled, rejected), the timeline indicates where processing stopped and displays the latest performed action, providing clear visibility into workflow interruptions.

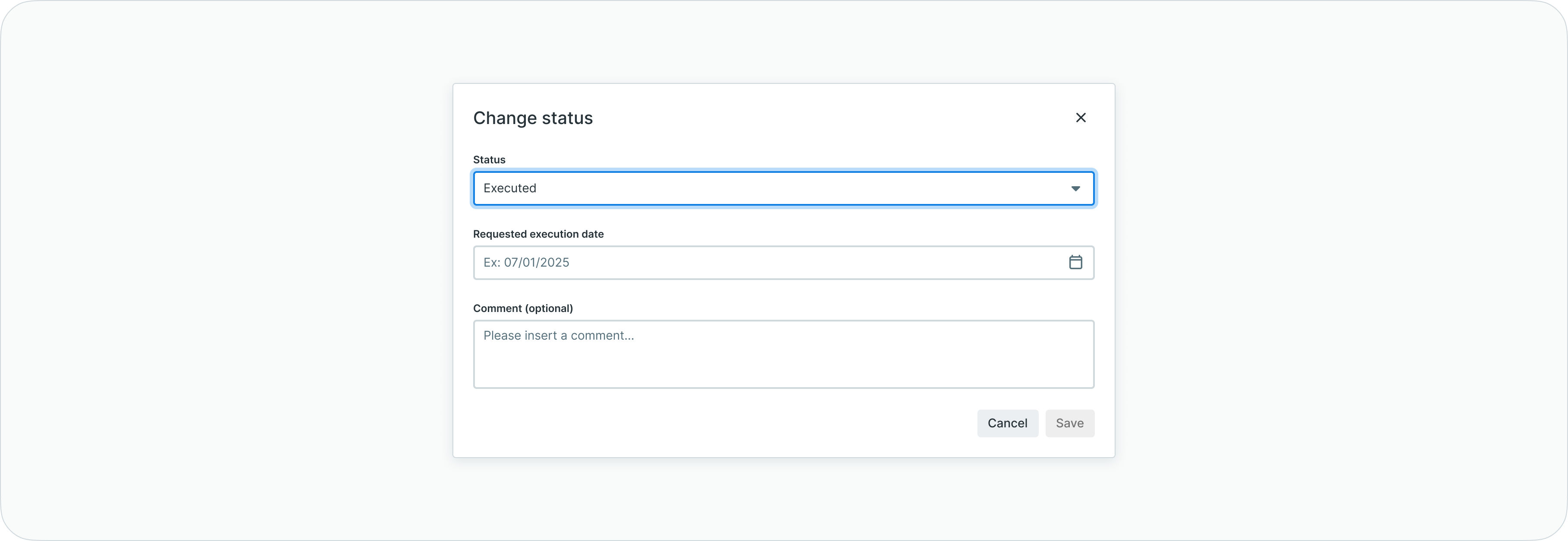

Manual status changes

In certain situations, you may need to manually adjust a payment's status after bank processing. This capability allows you to correct the payment status when bank feedback indicates a different outcome than what LYNKS recorded automatically.

When manual status changes are available

Manual status changes become available when:

- Payment status is Pending delivery to bank, Executed, or Not executed by bank

- You have the

PAYMENT_MANUAL_CHANGE_STATUSpermission for the payment's account and category - Payment was not created through depositary oversight

The Change status button appears in the execution stage (stage 4) of the timeline when these conditions are met.

Available status transitions

You can manually change payment status between:

- Executed → Not executed by bank - When bank confirms a payment marked as executed was actually rejected

- Not executed by bank → Executed - When bank confirms a payment marked as rejected was actually executed

- Pending delivery to bank → Executed - When bank confirms execution without providing automated feedback

- Pending delivery to bank → Not executed by bank - When bank confirms rejection without providing automated feedback

Changing payment status manually

To manually change a payment's status:

- Open the payment details page

- Scroll to the Timeline section

- Locate the execution stage (stage 4)

- Click Change status button

- In the status change dialog:

- Select the new status from available options

- Enter a comment explaining the reason for the manual change (optional, max 255 characters)

- If changing to Executed, provide the Value date for the payment

- Click Save to apply the status change

The payment status updates immediately and the change is recorded in the audit log with your comment and timestamp

Status change dialog

Status change restrictionsOnce you manually change a payment's status, automatic bank feedback updates will no longer modify that payment's status. This prevents LYNKS from overwriting your manual correction with potentially incorrect automated data.

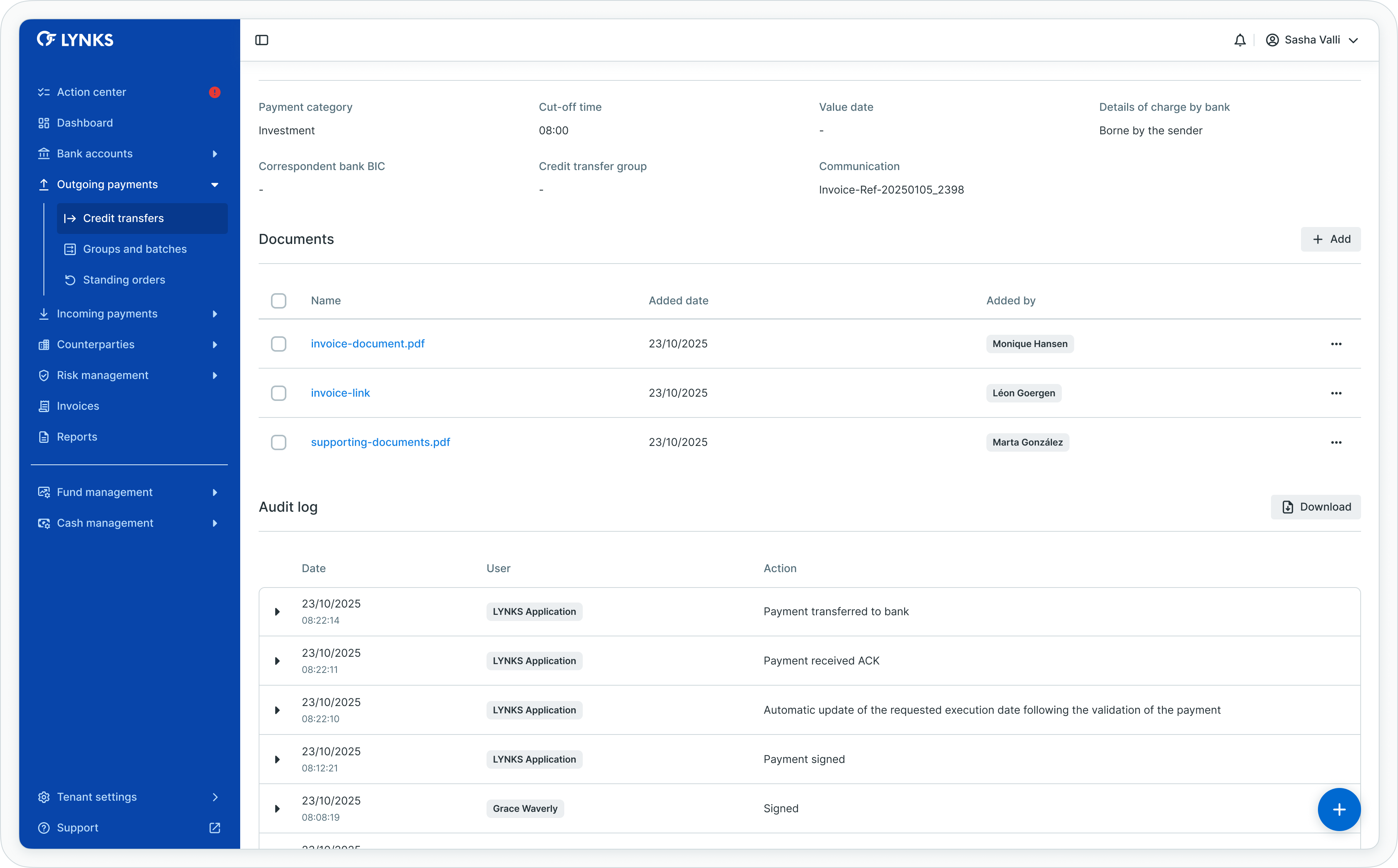

Additional details

The additional details section provides comprehensive payment-specific information:

- Payment category assignment

- Value date

- Charge details (who bears bank charges)

- Correspondent bank BIC (when applicable)

- Credit transfer group association

- Payment communication text

- Number of credit transfers (for batch bookings)

- Standing order association (for recurring payments)

Additional details section

Documents

The documents section enables users to attach supporting documentation to payments, providing context and evidence for payment authorization and audit purposes.

Documents section

Document management

- Attach PDF files or web links to payments

- Download attached documents at any time

- Remove attachments when no longer needed

- Provide supporting evidence for compliance and authorization workflows

Audit log

The audit log maintains comprehensive traceability of all actions performed on the payment, creating a complete history for compliance and operational transparency.

Audit log section

Logged events

The audit log captures:

- All status transitions with timestamps

- Signature actions and authorizations

- Notification triggers

- Bank acknowledgments (ACK/NACK)

- Manual status changes with user comments

- Edit actions and modifications

- Complete end-to-end payment lifecycle

This detailed logging ensures users can access complete information about the latest updates and actions affecting the payment. Manual status changes include the user who made the change, timestamp, new status, and any comment provided explaining the reason for the change.

Status definitions

Credit transfers progress through defined statuses reflecting their position in the payment workflow. Understanding these statuses helps users monitor payment progress and take appropriate actions.

Payment statuses

| Status | Definition |

|---|---|

| Draft | Payment created and saved without authorization submission |

| Waiting for signature(s) | Payment requires authorization from designated signatories according to signatory rules |

| Rejected by signatory | Payment rejected by one or more authorized signatories during the approval process |

| Waiting for manual transfer to bank | Payment fully authorized, awaiting manual submission action to transfer to bank |

| Pending delivery to bank | Payment transmitted to bank, awaiting acknowledgment (ACK) receipt |

| Pending execution by bank | Bank acknowledged payment receipt (ACK), payment pending processing and execution |

| Executed | Bank confirmed successful payment execution and settlement (can also be set manually) |

| Failed | Bank rejected payment (NACK) due to validation errors or processing issues |

| Not executed by bank | Payment not executed by bank; status set manually after bank confirmation |

| Cancelled | Payment cancelled by user before execution |

Status transitionsSome statuses apply only to specific workflow scenarios. For example, "Waiting for manual transfer to bank" appears only when users select manual submission rather than automatic delivery.

Best practices

Follow these recommendations to maximize the effectiveness of credit transfer management:

- Customize list views - Configure column visibility and filters to match your monitoring priorities and save views for recurring analysis needs

- Monitor timeline regularly - Check payment timelines to identify authorization bottlenecks or delivery delays requiring attention

- Use search effectively - Leverage search functionality to quickly locate specific payments by reference, counterparty, or communication text

- Attach supporting documents - Add invoices, contracts, or approval emails to payments to provide context for signatories and audit trails

- Review audit logs - Check audit logs when investigating payment issues or verifying action history for compliance purposes

- Filter by status - Use status filters to focus on payments requiring action (drafts, waiting for signatures, failed payments)

- Track urgency - Monitor urgent and ASAP payments separately to ensure time-sensitive transfers receive priority handling

- Check counterparty risk - Review counterparty risk levels displayed in payment details to identify high-risk transactions requiring additional scrutiny

Related documentation

Explore related sections for more information:

- Platform Navigation - Detailed guide to the head-up display, table views, filters, and search functionality - Tables, filters, search, and view customization

- Permissions - Comprehensive explanation of access control and role-based permissions - Understanding access control and account scoping

- Approvals - How approval workflows and signature processes function - Authorization workflows and signatory rules

- Action Center - Centralized task and approval management - Pending authorizations and payment prioritization

- Dashboard - Financial overview widgets, charts, and real-time monitoring - Payment overview widgets and analytics

- Transaction History - Review incoming payment details - Complete transaction records across accounts

- Groups and Batches - Organizing payments and bulk processing - Organizing payments and bulk processing

- Standing Orders - Configure recurring payments - Recurring payment automation

- Counterparties - Investor and beneficiary management - Beneficiary management and approval

- Signatory Rules - Approval workflow configuration - Configuring authorization requirements

- Authentication Methods - Detailed setup and usage of SSO, LuxTrust, and mobile app authentication - Signature methods and security

Support

For assistance with credit transfers or questions about payment processing, contact [email protected].

Updated about 2 months ago